- Share buybacks have increased in 2018 at a record pace

- Trump's tax overhaul as well as cash repatriation are funding the move

- This has come at the expense of investment in capex and R&D

- The general workforce has also been losing out; corporations aren't funding wage increases or bonuses with the windfall

- Many analysts believe this will hamper growth longer term

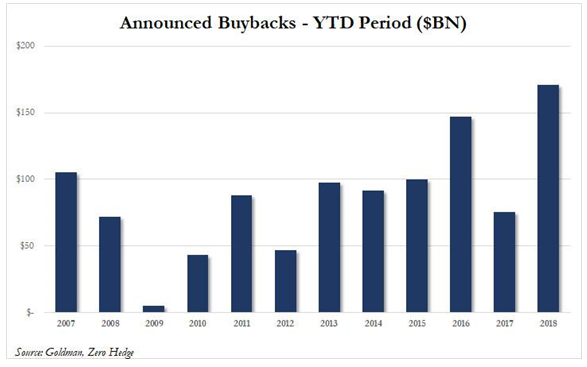

Companies listed on the New York Stock Exchange have been buying back their own shares at a never-seen-before pace so far in 2018, with the notional dollar value of stock repurchases by publicly held corporations reaching its highest level on record for this early in the year.

According to TrimTabs, a California-based firm which tracks corporate buybacks, the value of buyback programs announced in February alone surged to $153.7 billion from $59.9 billion in January, smashing a previous monthly record of $133 billion in April 2015. “Activity has certainly accelerated. Buybacks increased for five consecutive months beginning in July 2017 and have exploded in February,” said TrimTabs analyst Winston Chua. “If the pace keeps up, this year’s volume will smash totals from all other previous years going back more than a decade,” he added.

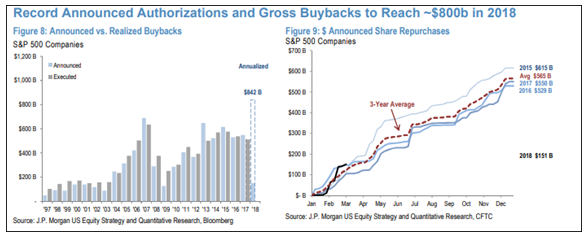

Indeed, a research report from JP Morgan published last week revealed that S&P 500 companies will buy back a record $800 billion of their own shares in 2018, far exceeding the current high of $530 billion that was recorded in 2017. And according to the analysis, this year's number could increase yet more under the right conditions.

“There is room for further upside to our buyback estimates if companies increase gross payout ratios to levels similar to late last cycle when companies returned >100% of profits to shareholders (vs. 83% now),” said the report.

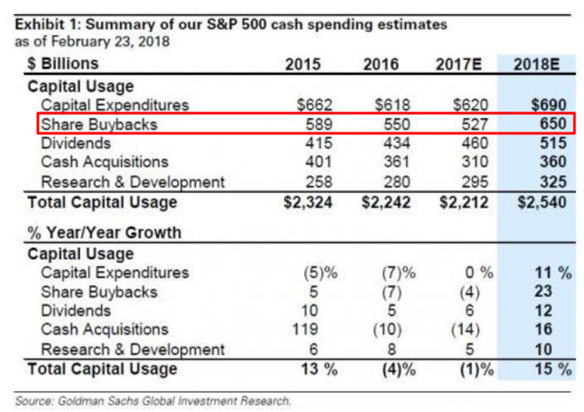

The analysis is somewhat similar to one offered last month by David Kostin, chief U.S. equity strategist at Goldman Sachs, in that it indicates a surge in buybacks. However, Kostin's forecast was less aggressive, coming in at $650 billion.

Why do companies sometimes opt to buy back shares instead of using those funds to make long-term investments in things like capex or research and development? Simply put, it's a time-tested way to bolster the corporate share price.

Buybacks are good for shareholders, including the senior executives who tend to be big owners of their companies’ stock. But the purchases can come at the expense of investments in things like hiring new workers and building new plants.

What's driving this trend?

According to JPM, nearly half the purchases this year will be funded with the windfall from the Trump Administration's tax-reform plan. The legislation, enacted in December, cut the corporate tax rate from 35% to 21% and levied a one-time tax on profits stored overseas that is expected to lead to a high level of repatriation for the $2.5 trillion in offshore cash.

The other half will be financed by strong corporate earnings and the actual repatriation of the cash held overseas. Breaking it down, the research shows that JP Morgan expects companies to dedicate $100 billion to buybacks generated through tax cuts and stronger earnings, while repatriation is expected to contribute about $200 billion, according to the research.

Similarly, the Goldman report also attributed this year's soaring share buybacks mostly to cash saved as a result of the GOP tax-reform plan as well as strong EPS (earnings-per-share) growth. That notion has completely upended the view that the big U.S. corporations would pass along benefits of the Trump tax plan to its workers in the form of increased wages or bonuses.

Instead, what actually happened was that they announced more than $200 billion in share buybacks since the tax law was passed three months ago. That has led to questions in Washington and on Wall Street about the way that the new corporate tax cuts are being used.

Of the companies in the S&P 500, about 44% have said they plan to reinvest some portion of their tax gains into capital expenditures or wages, while 28% said they would use them to increase shareholder returns, Morgan Stanley found in an analysis of recent earnings transcripts. Its own analysts expect companies to spend about 43% of their savings on buybacks and dividends, and 30% on capital expenditures and labor.

Leading Democrats have pointed to the rising stock buybacks as proof the Republican tax plan largely benefits corporations, corporate executives and wealthy shareholders, instead of more employees. “Why is that so significant? Because share buybacks don’t help the average worker,” Senate Minority Leader Charles Schumer (D-N.Y.) said last month.

“They inflate the value of a company’s stock, which primarily benefits shareholders, not workers. It benefits corporate executives who are compensated with corporate stock, not workers who are paid by wages and benefits,” he added.

Proponents of the tax plan, however, point to companies bringing money back from overseas as a positive benefit of the plan. “To the extent that there are share buybacks, that’s capital that’s recycled back into the economy,” Treasury Secretary Steven Mnuchin told the Senate Finance Committee in mid-February.

New Federal Reserve Chairman Jerome Powell also said during Congressional testimony late last month that money returned to shareholders does find its way back into the broader economy. With that being said, the full answer won’t be completely understood for months or years as the new money moves through the economy.

What affect do buybacks have on stock prices and volatility?

The recent surge in share repurchases could give the nearly nine-year bull market a boost at a time when many investors are concerned about how much longer it will last. A company purchasing its own shares is a time-tested way to bolster its stock price.

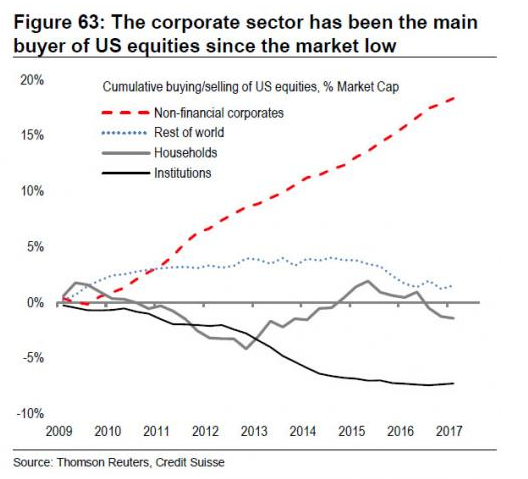

According to the Federal Reserve’s flow of funds data, corporations—via share buybacks—have been the main buyers of U.S.-listed shares on Wall Street since the 2009 market low. Indeed, recent analysis from Credit Suisse revealed that non-financial corporations have repurchased a net $3.3 trillion worth of U.S. equities, equivalent to 18% of market cap, over the past nine years. The research also showed that mutual funds and ETFs have bought a net $1.6 trillion.

By contrast, households and institutions (insurers and pension funds) have sold a net $672 billion and $1.2 trillion respectively over the same period.

What this means is that since the 2008-09 financial crisis, there has been only one buyer of stock in the U.S.: the companies themselves.

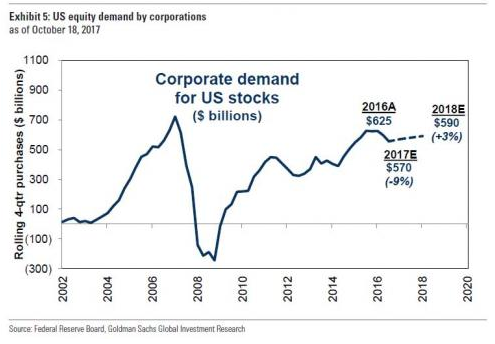

This trend of soaring corporate demand for U.S. stocks is expected to remain strong in 2018, according to analysis from Goldman Sachs.

The tremendous demand for equities from largely price-indiscriminate corporations has had the knock-on effect of crushing equity volatility in recent years.

Christopher Cole, the well-known Artemis hedge fund manager, recently warned that volatility has been artificially and dangerously depressed for years as a result of buybacks. In a report published last October, Cole said:

"Share buybacks are a major contributor to the low volatility regime because a large price insensitive buyer is always ready to purchase the market on weakness. Share buybacks result in a lower volatility, lower liquidity, which in turn incentivizes more share buybacks, further incentivizing passive and systematic strategies that are short volatility in all their forms.

Like a snake eating its own tail, the market cannot rely on share buybacks indefinitely to nourish the illusion of growth. Rising corporate debt levels and higher interest rates are a catalyst for slowing down the $500-$800 billion in annual share buybacks artificially supporting markets and suppressing volatility."

Recently, even Bloomberg hinted at the dangers posed by buybacks, pointing out that:

"Companies over the past decade or so have significantly increased buybacks to the point where they are now collectively the largest single buyer of stocks. Some have called the market self-cannibalizing. Equity shrink is the nicer way to say that."

Though shareholders and corporate insiders, as well as the current U.S. equity bull may be the short term beneficiaries, those pointing the finger at buybacks as a negative say continued corporate stock purchases will make the next downturn far worse than the recent mini-corrections the market has endured.