- As my colleague Kelvin Wong noted, there are no clear signs of exhaustion on the S&P500, which sits just off record highs. While last Friday was a bearish close, it warns of a minor pullback at best as there is no evidence of a topping pattern. Moreover, the S&P500 E-mini’s are retesting record highs following strong PMI data from China today.

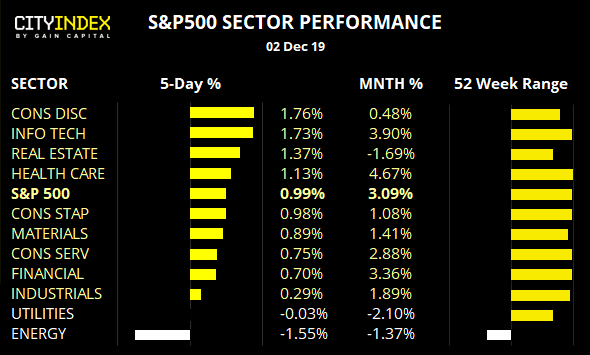

- Info tech remains the dominant sector in 2019, having rallied +41.8% YTD, while Consumer Services and Financial sectors take second and third place as 28.4% and 26%, respectively.

- Energy remains in the doldrums, having gained a mere 1.7% YTD.

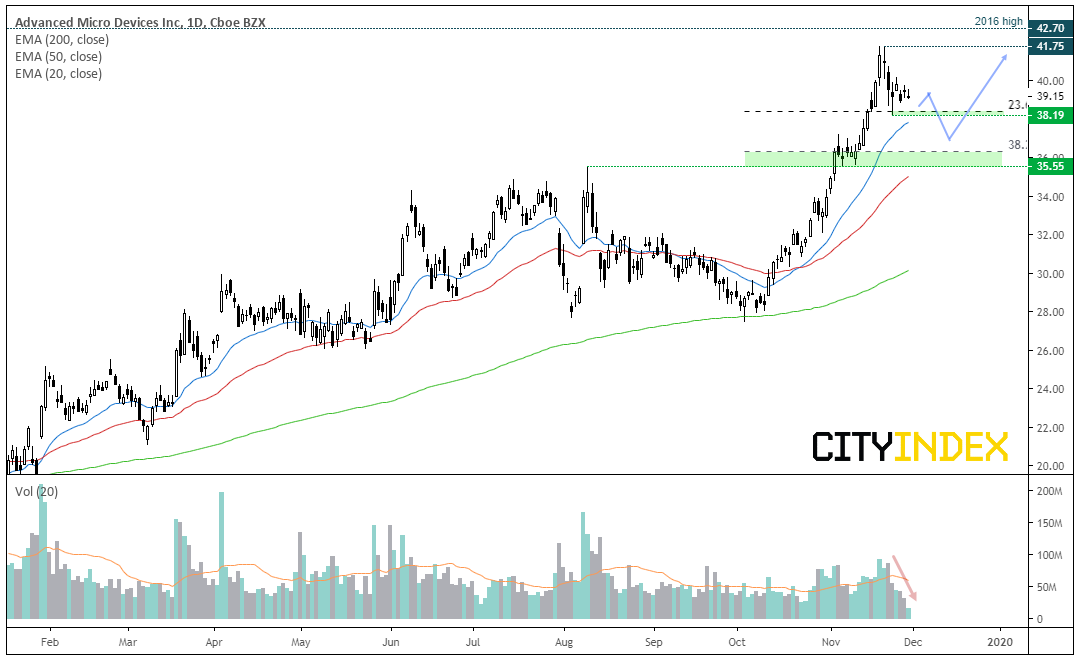

Advanced Micro Device CFD/DFT: A performing stock in a performing sector, Advanced Micro Devices Inc (NASDAQ:AMD) has rallied an impressive 112% year to date. Since touching a record high of 41.75 in November, prices have moved lower but on thinner volumes to suggest the move is corrective, so we’re looking out for new level of support to build before it breaks to fresh highs.

United Technologies Corporation (NYSE:UTX) CFD/DFT: Prices are consolidating just below record high, and the 20-day eMA is providing support. At the beginning of November we saw a break of key resistance around 144, and the bullish trend from the September low appears to be an impulsive wave. Due to strength of momentum leading into the current consolidation, we expect prices to eventually break higher.

Apache Corp (NYSE:APA) CFD/DFT: The S&P500 Energy index is the worst performing sector over the last 12 months (and the only one to trade lower over this period). At -15.1% YTD, Apache is not the weakest is underperforming relative to the sector although no oversold to the point it could not go lower from here.

A series of lower highs below 38 shows bearish momentum is building and last Friday’s bearish candle suggests prices could be headed lower.

NiSource Inc (NYSE:NI) CFD/DFT: Momentum since the 2019 high has been predominantly bearish, with losses coming quite hard and fast. Support was recently found at the February low around 26, and prices have retraced higher although last Friday’s bearish hammer suggests the corrective. That the bearish hammer stalled beneath the 26.38 resistance and 38.2% Fibonacci levels adds further weight to the corrective move nearing its completion.

- Bias remains bearish below 27.

- Bears can either look to ‘pick at the highs’ (fade into minor rallies) below 27 and assumes prices will revisit support around 26.

- Alternatively, wait for a break below 26.38 support before assuming a return to the 26 area.