- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Natural Gas: 2 Reasons To Buy On Dips

Energy has been a volatile sector in 2020. The price of NYMEX crude oil futures fell into negative territory on April 20 when the May contract expired, and longs had nowhere to store the petroleum. In March, the price of nearby NYMEX natural gas futures fell to the lowest level of this century when it reached $1.519 per MMBtu. The last time natural gas traded at a lower price was in 1995. The weakness in energy prices was a function of massive supplies and evaporating demand during the global pandemic.

The fundamental equations for crude oil and natural gas have been adjusting to compensate for the change in the balance between supply and demand. There is an old saying in commodities markets that the cure for low prices is low prices. When a commodity falls to a level where the cost of production is above the market price, output declines. Since natural gas futures began trading on NYMEX in 1990, the price range has been from $1.02 to $15.65 per MMBtu. At below $2, the price is a lot closer to the lows than the highs over the past three decades. Despite technological advances and the discovery of reserves that have lowered the production cost, the price of the energy commodity is at a level where producers are not making significant profits.

Moreover, debt levels in an environment where credit is tightening for companies with weak balance sheets threaten future output viability. Natural gas is in an oversold condition on the long-term chart, and production is falling. The United States Natural Gas Fund (NYSE:UNG) follows the price of nearby NYMEX futures higher and lower.

The Baker Hughes Data Is Not Bearish

The June futures contract in natural gas rolled to July last week. When the continuous contract on NYMEX fell to a 25-year low in mid-March, the low in July futures was at $1.802 per MMBtu.

(Source: CQG)

The daily chart highlights the brief move below the mid-March low in the July contract that took the price to $1.763 on May 29, before it bounced back to settle at $1.849 per MMBtu. Price momentum and relative strength indicators were near oversold conditions. Daily historical volatility at over 48% remains elevated. The total number of open long and short positions in the natural gas futures market at 1.281 million contracts had been edging higher over the recent sessions and rose to the highest level since mid-March.

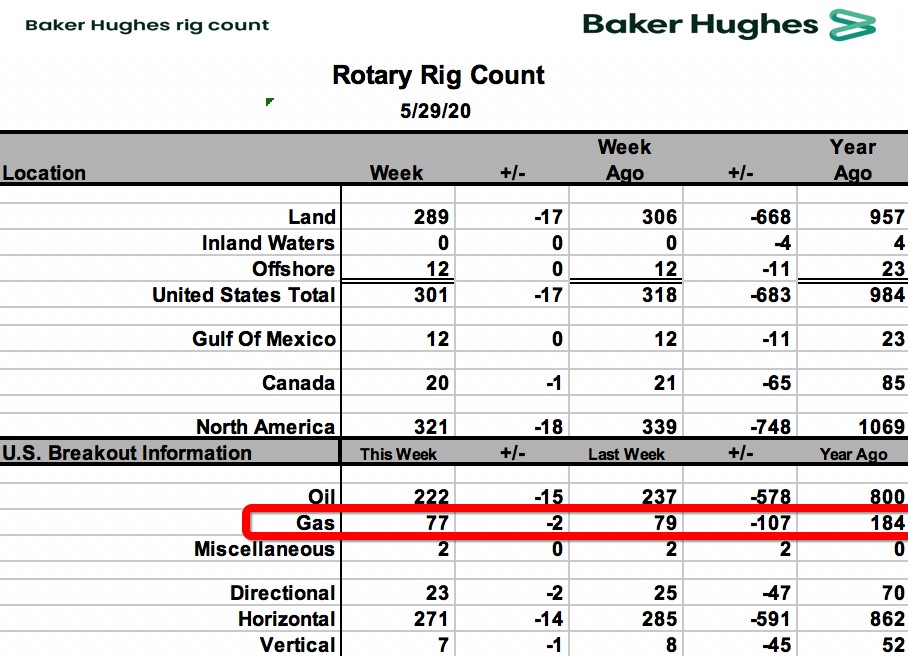

On Friday, May 29, Baker Hughes released its latest data on the number of gas rigs operating in the U.S.

(Source: Baker Hughes)

As the chart shows, as of the end of May, 77 gas rigs were in operation in the U.S., down from 184 at this time in 2019. Falling production is not bearish for the price of natural gas.

The Monthly Chart Could Limit Downside Potential For Price Of Natural Gas

The monthly chart in the NYMEX natural gas futures market shows the recent decline to the lowest price of this century.

(Source: CQG)

Price momentum and relative strength indicators on the monthly chart indicate an oversold condition in the natural gas futures market.

(Source: CQG)

The weekly chart shows a series of higher lows since March and a neutral reading on momentum and price strength indicators.

Electricity Demand During Hot Summer Will Increase Gas Usage At A Time When Production Is Falling

We are coming into the time of the year, where the requirements for cooling increases across the U.S. Natural gas replaced coal as the primary energy commodity in the production of electricity. Therefore, a hot summer would cause the flow of natural gas into storage to decline as demand rises while production is falling. At below $2 per MMBtu, the price of natural gas is at a level that does not incentivize producers to increase output.

The cure for low prices in a commodity is the low price. When demand increases and production falls, significant price bottoms often occur. Buying natural gas during periods of price weakness is likely to be the optimal approach to the energy commodity over the coming weeks. The price action on the final trading session of May could turn out to be a harbinger of future price action. The move below $1.80 proved unsustainable and the price settled at $1.849 per MMBtu. The first level of technical resistance on the July contract stands at $2.027. The May 5 high at $2.364 is the target on the upside.

Related Articles

Oil prices are largely under pressure amid demand concerns, while the European gas market continues to sell off aggressively Energy – TTF Sell-Off Continues Oil prices continued...

Gold prices surged to an all-time high of $2,940 per ounce last Thursday, pushing its market cap above $20 trillion for the first time ever, as trade tensions between the U.S. and...

Gold remains at technically overbought levels across multiple time frames, with RSI showing negative divergence, signaling potential weakness. Gold’s strong correlation with the...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.