- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

GBP Takes A Beating While USD Looks Up

By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

We are supposed to be in the dog days of summer but with the weather just beginning to warm up here in New York, investors are getting chills from the volatility in the British pound this past week. Sterling dropped more than 2% on Thursday evening to its weakest level in 6 weeks and the worst may be yet to come. If there’s one thing we have all learned over the past 12 months it should be that polls could be dangerously inaccurate. We saw it with Brexit, the US election and now in the UK. The “smart strategic move” by Theresa May turned into a nightmare for the Conservative Party and the British pound. When David Cameron rolled the dice by calling a Brexit referendum, he saw a humiliating defeat. Now Theresa May is in the same boat as she struggles to recover from her failed gamble to consolidate power ahead of Brexit negotiations.

Not only is she barely holding onto her job but the strong and stable government that she hoped to create is now in a shambles. May is putting on a brave face by confirming Brexit talks will begin in 10 days but the country is divided and her Brexit strategy is in tatters. Unfortunately the EU is aware of her defeat and is likely to use that to its advantage. She’ll need to be more conciliatory if she hopes to get the approval from those in parliament who preferred to stay in the EU. So while arrogance could find her initially pursuing a hard exit, she’ll have to settle for a soft one.

That's bad news for the British pound. Sterling consolidated its losses on Friday but that was strictly a relief rally on the hope for some sort of compromise solution. The government is weakened and the economy is in flux. Recent data hasn’t been terrible but with inflation at a 3-year high and wages falling, the U.K. is headed for trouble. Foreign investment and net migration will fall in the coming months/years, negatively affecting tax revenues and growth. Brexit is the trickiest divorce ever and May’s plan needs to be completely rethought.

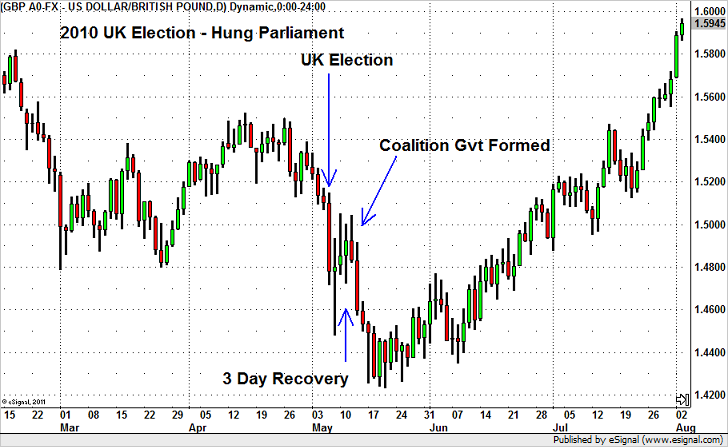

Back in 2010 when the UK last experienced a hung Parliament, there was an initial drop followed by a few days of consolidation and then a sharp slide lower. The same price action appears to be happening now although the relief rally may be shallower given the consequences for Brexit negotiations. Next week is a busy one for the U.K. with inflation, consumer spending and retail sales scheduled for release along with a Bank of England monetary policy announcement. However politics could overshadow economics as no changes are expected from the central bank. Since the last monetary policy meeting, retail sales and inflation increased (though we’ll get a more up-to-date reports before Thursday) but GDP, manufacturing- and service-sector activity slowed. The softness in PMIs was also reinforced by the weaker industrial production report on Friday. One way or the other, we expect to see 1.25 and probably even 1.24 in GBP/USD.

Next week is also an important one for the U.S. dollar with the Federal Reserve expected to raise interest rates for the second time this year. Bloomberg has Fed Fund futures showing a 94.8% chance of a hike and U.S. policymakers have done nothing to cast doubt on those expectations. The dollar, which started the week under pressure recovered strongly by end of day Friday, particularly against the Japanese yen. How it trades in the coming days will depend on whether the Fed signals one and done. At the onset, we think the dollar will struggle because data has been weak and the PPI, CPI, retail sales reports (all due before FOMC) will raise concern about the performance of the U.S. economy. Considering that commodity prices have been falling, gas prices are down, consumer sentiment is lower and earnings growth muted, inflation and spending in April should have softened. In other words, we think pre-FOMC data could hurt the dollar.

However the dollar could rally after the Fed hikes as there is very little reason at this time to believe that the Fed will not move forward with 2 rate hikes this year (in June and December). The U.S. economy is recovering, the unemployment rate is falling and December is a long time from now. Although there hasn’t been any progress on tax cuts and fiscal spending, it is too soon for the Fed to alter its tightening bias. At bare minimum, It’ll want to see how the economy performs over the next few months. They can wait until September to drop their plans for a year-end hike. For this reason and the fact that the Fed is the only major central bank raising rates, we think the dollar will struggle pre-FOMC, but rally on the back of it. The Bank of Japan also has a monetary policy meeting and it is widely expected to upgrade its economic outlook, but that could be offset by a downgrade to its inflation forecast.

Meanwhile, this past week’s European Central Bank monetary policy meeting was anticlimatic. Although the ECB upgraded its GDP forecasts, altered its risk assessment and dropped the phrase “lower rates” from its forward guidance, the euro did not rise. Instead, EUR/USD dropped below 1.12 as investors interpreted Draghi’s emphasis on low inflation as a sign that tapering would not begin in September. At the same time, the dollar rallied after former US FBI Director Comey’s testimony exonerated President Trump, keeping EUR/USD under pressure. On a technical basis, 1.13 appears to be a near-term top for the currency. Fundamentally, how the euro trades hinges on the moves in the U.S. dollar next week. The Eurozone economy has been performing well with first-quarter GDP revised up to 0.6% from 0.5%. Tuesday’s German ZEW survey should show an uptick in investor confidence. Aside from the ZEW, the only pieces of data on the Eurozone calendar are the trade balance and consumer price report. One of our strongest views for the coming week is for a rally in EUR/GBP. The U.K.’s political troubles could take the currency back to 90 cents.

All 3 of the commodity currencies saw gains against the greenback over the last week although the Canadian dollar only turned positive on Friday after a surprisingly strong employment report. More than 54K jobs were created in the month of May, the largest increase in 9 months. The unemployment rate ticked up to 6.6% but that was due to an increase in the participation rate. What made the report so strong was the fact that the economy added 77K full-time jobs. Earlier this week investors were concerned about the economy after the drop in housing starts, building permits and the IVEY PMI index but Bank of Canada Governor Poloz expressed confidence in the better dynamics that are now confirmed by the stronger employment report. USD/CAD rejected 1.35 on the back of the news and now appears poised for a move below 1.34 to the 100-day SMA near 1.3387. There are no major Canadian economic reports scheduled for release in the coming week although investors will be carefully watching the oil inventory report, which shot higher unexpectedly last week. If inventories don’t retrace, we could see another leg down in oil and in turn, the Canadian dollar.

The best-performing currencies this past week were the Australian and New Zealand dollars. AUD climbed to a fresh 1-month high versus the greenback while NZD/USD hit a 3-month high. The initial rally was sparked by the decision of Gulf States to cut ties with Qatar. While Qatar is not a major oil producer, it is a major producer of liquefied natural gas. Australia is quickly becoming a major player in this market and should be a big beneficiary of Qatar’s diplomatic crisis. It extended its gains following the Reserve Bank of Australia’s monetary policy announcement and then on the back of stronger first-quarter GDP numbers and an increase in Chinese imports. However the rally in AUD/USD stopped short of the 100-day SMA. Now, lower highs and lower lows signal a potential retracement. Chinese retail sales, inflation and Australia’s employment report are scheduled for release. Weakness in any of these releases could take AUD/USD back below 75 cents. As for NZD, considering that dairy prices barely increased at this past week’s auction, the currency rose primarily in lockstep with AUD. However NZD could see new life on the back of next week’s first-quarter GDP and manufacturing PMI, both of which are expected to be good, supporting the latest move in the currency.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

CAD While the loonie has not fully unwound the recent move lower on the back of Trump’s comments yesterday, it is notable that USDCAD has begun early trading this morning with a...

Welcome to Simply Forex This content was originally published by our partners at Simply Forex.

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.