WeWork, the high-profile unicorn with a staggering $47 billion valuation as of its last private round of funding, is finally going public via an IPO by its parent, The We Company. It's expected to begin trading sometime in September.

The core business, WeWork, leases and renovates office space in 111 cities around the world according to its S-1 filing in mid-August. Its 528 locations are rented for specified periods of time.

The company's 'squishy' mission doesn't inspire confidence: to create co-working spaces that foster and build community. That syncs with company operations, which, based on the S-1 filing should raise a series of red flags for any potential investor. Problems abound, including a slippery narrative based on creative accounting; lack of scalability; a controlling founder with potential conflicts of interest; extensive debt and leasing obligations, no path to profitability, and an absurd valuation.

1. Slippery Narrative, Creative Accounting

Though the We Company is keen to be perceived as a high tech company, it's really just a real estate company. The S-1 frequently refers The We Company as a “Space-as-a-service” business, co-opting the “Saas” acronym, which actually stands for “Software-as-a-service.” Still, though Saas appears 40 times within the S-1, the more accurate term “lease,” appears 939 times.

The parent company currently operates two other businesses as well. It leases apartments under the name WeLive, and runs an elementary school in New York City called WeGrow. Since the We Company doesn't report revenues from individual segments, it's impossible to know how the different businesses are actually doing.

2. Lack of Scalability

For most businesses, the key investment thesis is that the company is growing, albeit losing money now. Nonetheless, economies of scale will allow it to use capital more efficiently in the future, enabling it to turn profit-positive at some point. The We Company's financials don't support that argument.

In June 2017, WeWork brought in $197 million in revenue, on $185 million in location operating expenses (lease, maintenance), and $38 million of depreciation and amortization (D&A). With $197 million of revenue on $223 million in location operating expenses, the company had a negative margin of 13%.

In June of this year, it brought in $720 million in revenue, 3.6 times the 2017 amount, indicating strong revenue growth. But location operating expenses were $695 million and D&A expenses came in at $131 million, for a total of $826 million in expenses, leaving the company with a negative margin of 14.7%, even though the business is 3.6 times bigger.

And that just takes into account operating expenses directly related to office space rental. Additional costs—such as renovation, marketing and business development—can at least be rationalized as investment in the business. These totaled $1.3 billion for the first half of 2019.

As well, The We Company hasn't seen any benefit by growing its real estate operation, nor are there signs it ever will. Since it only leases properties, it doesn't own any real estate assets, just what's called "right of use assets," — a creative way of indicating these leases aren't actually concrete holdings.

3. Costly Lease Obligations

In the S-1, The We Company says one of its main advantages is the flexibility and global mobility it offers tenants. However, the only way it can provide this is by taking on long-term lease obligations itself, in the hope it will eventually pass on the risk burden to tenants or shareholders.

The We Company enters into lease agreements with an average initial term of 15 years. It has already accumulated an astounding $47.2 billion in lease cost obligations to date. With expected 2019 revenues of around $3.5 billion, future leasing obligations are about 13.5 times this year's revenue.

4. Corporate Structural Issues

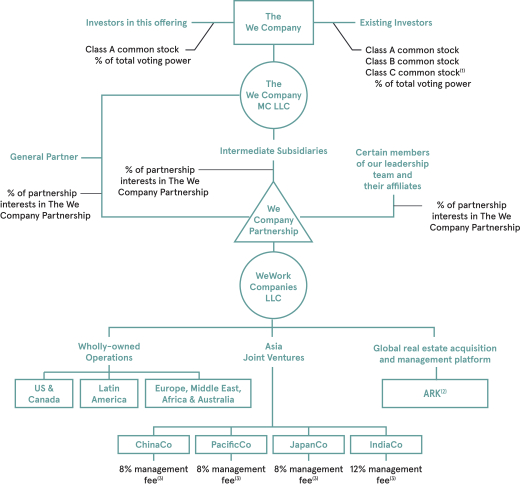

Its up-C structure raises another, significant red flag. By operating as a new holding company which owns an interest in the underlying businesses but not the revenue-generating business itself, the holding company isn't taxed, providing significant advantages to insider executives while passing along a variety of tax obligations to investors.

The WeWork IPO is a multi-class offering as well, with one vote per share on Class A stock, and 20 votes per share on Class B and C stock. This gives founder and CEO Adam Neumann complete control over corporate governance including the company’s board of directors, its acquisitions, and more.

A variety of conflicts of interests are revealed as well: WeWork leases buildings partly owned by Neumann; when the business was rebranded The We Company, the trademark to “We” was bought for $5.9 million—from a holding company in which Neumann has an interest. Finally, it's been reported that Neumann cashed out more than $700 million in stock and debt ahead of the upcoming IPO.

5. Troubling Valuation

In its last fundraising round in January, The We Company's valuation was listed as $47 billion. With revenues of $3.5 billion for the full year of 2019, this would set the company's value at 15 times sales. Compare that to formerly privately-held, growth-play darling Uber Technologies (NYSE:UBER), which is expected to bring in $14 billion in revenue this year. Its market cap is $60 billion, valuing it at 4.2 times sales.

Bottom line: The We Company's S-1 filing indicates the company doesn't intend to achieve positive GAAP income for the foreseeable future, meaning it will need debt financing just to stay in business. With an unproven model and an unclear path to profitability, this high risk play will deliver questionable rewards, at best.