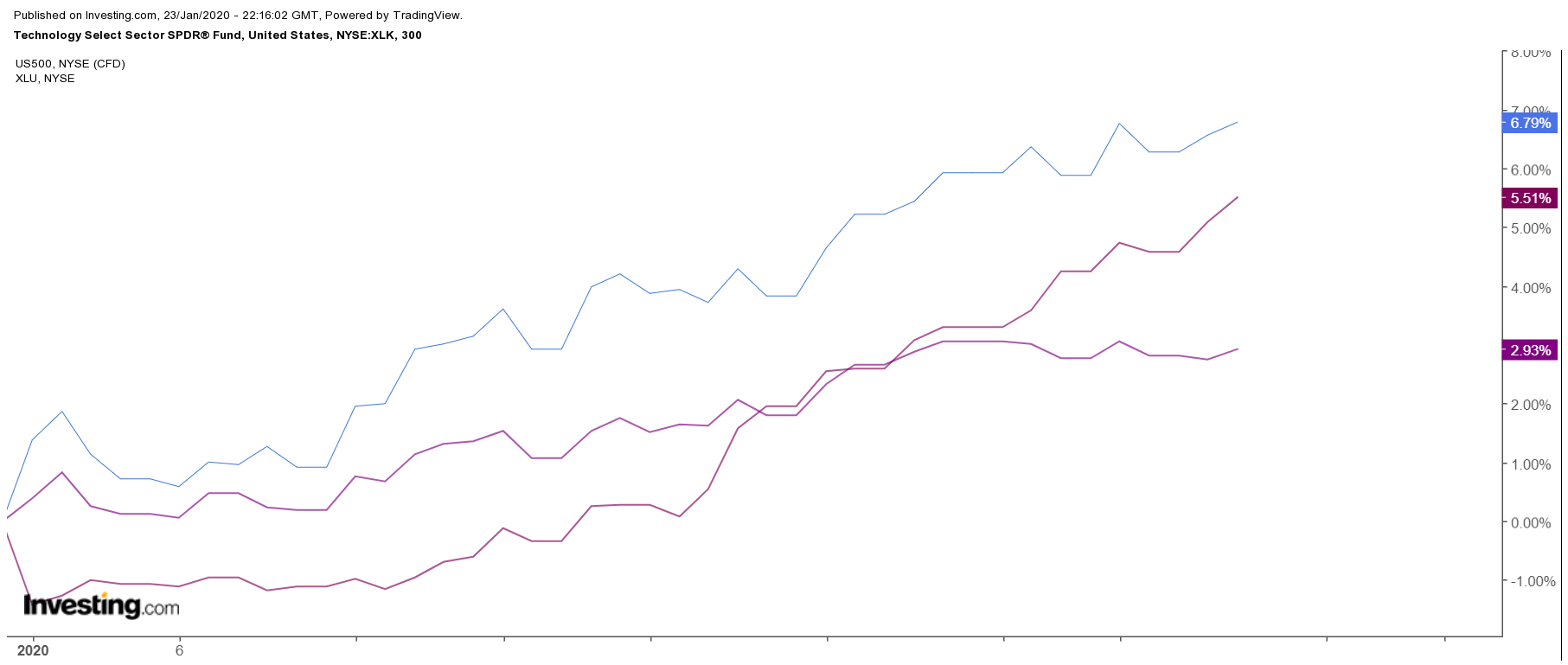

The year is young, but what seems most odd about the stock market rally which has resulted in the S&P 500 rising by around 3%, is that the Utility sector as measured by the Select Sector SPDR Trust ETF (NYSE:XLU) has quietly jumped by over 5.5%.

It joins the Technology sector as measured by the Select Sector Technology ETF (NYSE:XLK), which is up about 6.8% as the top two performing sectors for the month. The recent surge in the Utility sector could be serving as a sign that investors are growing more defensive

More worrisome is the increasing amount of call buying for the CBOE Volatility Index (VIX) options contracts that expire in the middle of February. The betting would suggest that some traders see a surge in volatility in the weeks ahead. It could serve as a strong indication that a pullback in the S&P 500 is quickly approaching over the short-term.

Opposite Side of The Spectrum

It does seem unusual that a sector such as the Utilities is surging alongside the likes of the technology sector. The two sectors seem quite literally to be on polar opposite sides of the risk spectrum, with technology representing the high beta, faster-earnings growth, while utilities deliver stability and slow growth. Even more impressive is that the XLU ETF has risen to its highest levels ever.

Rates have been declining on the longer end of the yield curve to start 2019, with the 10-year Treasury yield declining by 20 bps to 1.73% from 1.93% on Dec. 31. The interest rate environment could be sending some investors to search for higher returns in parts of the equity market, with the Utility sector serving as one haven.

However, other high yield sectors which are also defensive in nature such as consumer staples and health care have not seen the same type of outperformance, with the XLV health care ETF up about 2.3% and the XLP Staples ETF up just 1.7%, both underperforming the S&P 500.

Rising Volatility?

It could also be a result of sentiment in the market shifting from a momentum, risk-on sentiment to something more defensive. Recently, there has been some betting in the VIX options for expiration on February 21 at the $21 and $22 strike price. Additionally, open interest levels have been on the rise at the $24 and $25 strike price for the same expiration date. That would require the VIX index to almost double from its current levels of around 13.

The open interest for the $22 calls has jumped by around 265,000 contracts over the past 2 weeks to approximately 305,000 open contracts. It isn’t a small bet either, with the calls trading for roughly $0.45 per contract, it gives the open calls a dollar value of about $13.7 million.

Additionally, the $25 calls have seen their open interest levels rise by over 110,000 contracts, to a total open position of around 160,000 contracts. These contracts trade for about $0.30, with a dollar value of approximately $4.8 million.

Protection from A Downturn?

Some traders appear to be betting on a sudden spike in the VIX index, potentially hoping to exit the contracts before the expiration date. Or they could be buying these contracts as a form of protection should the S&P 500 and the equity market start to move lower.

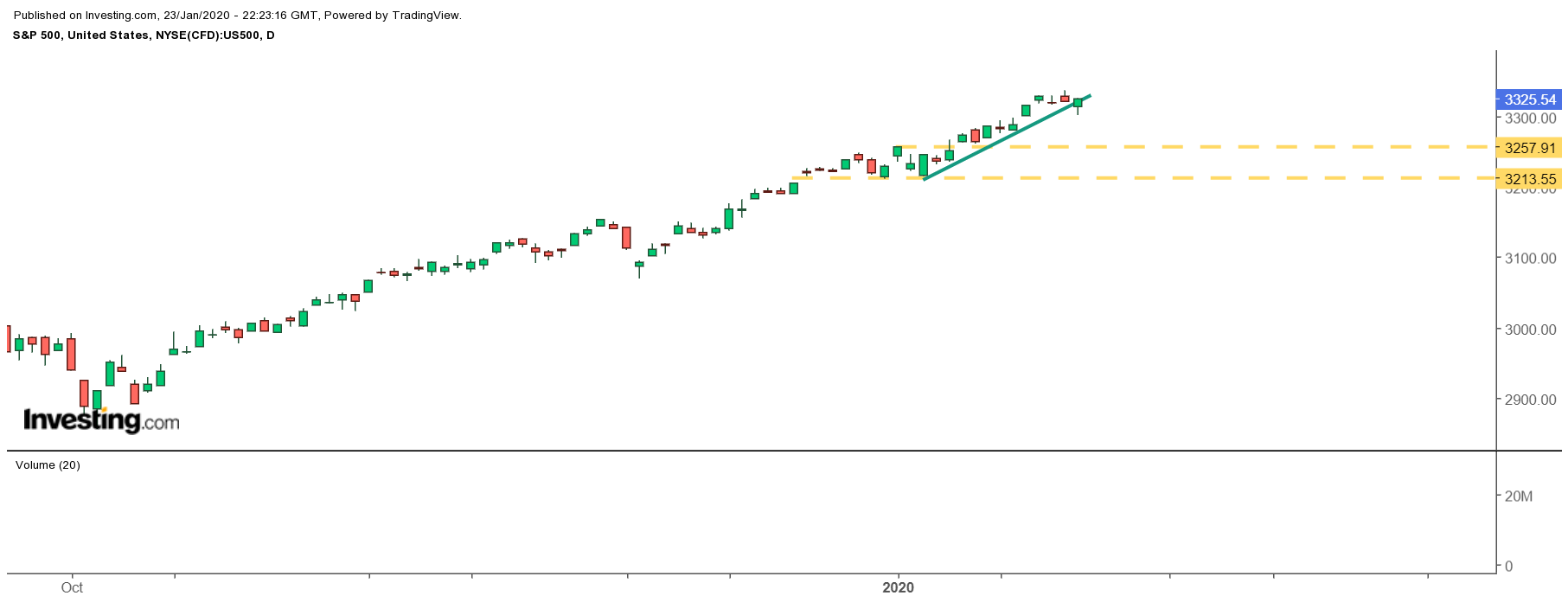

With the S&P 500 up nearly 17% just since the beginning of October, a minor pullback over the short term doesn’t feel like a stretch. Should a pullback occur, a vast region of support for the S&P 500 would come at a level of between 3,200 to 3,250, a decline in the range of 2.5% to 4%. Indeed, not a disaster by any stretch of the imagination.

While there is the potential for a short-term pullback in the markets, the overall technical trends and the outlook for earnings growth should maintain the bullish momentum over the balance of 2020.