The Federal Reserve is widely expected to lower its benchmark interest rate with the policy statement this afternoon. If the Fed delivers, it would be the second rate cut this year. The first reduction in borrowing costs to be issued since 2008 came at the July policy meeting, where the U.S. central bank announced a 25 basis point cut, which brought the current range between 2.00% to 2.25%.

As the Fed eases borrowing costs, these three stocks have potential to deliver strong returns in the months ahead.

KB Home: Benefiting From Rate Cut Tailwinds

KB Home (NYSE:KBH), one of the nation's largest homebuilders, has made a solid recovery from the selloff the stock suffered in late-2018, with shares rising nearly 64% so far this year. It closed at $31.24 on Tuesday, after touching a fresh 52-week high of $31.36 earlier in the session, giving it a market cap of $3.0 billion.

With interest rates and mortgage rates falling to their lowest levels in years, it makes sense for this homebuilder to be on an investors radar. The yield on the 10-year Treasury note—a benchmark for mortgage rates—recently fell to its lowest level in three years, making it easier for first-time buyers to finance a home purchase. The drop in rates should result in a boost in new home sales, especially in the entry-level market.

The Los Angeles-based homebuilder next reports earnings after the U.S. market closes on Sep. 25. Consensus calls for earnings per share (EPS) of $0.66 for the third quarter, up from EPS of $0.51 in the preceding quarter. Revenue is forecast to rise 15% from the second quarter, to $1.17 billion.

It’s no surprise that this leading name made the cut, as lower borrowing costs tend to spur spending. Americans are likely to have extra disposable income if the cost of their mortgage debt is lower, freeing up more cash to spend on consumable items.

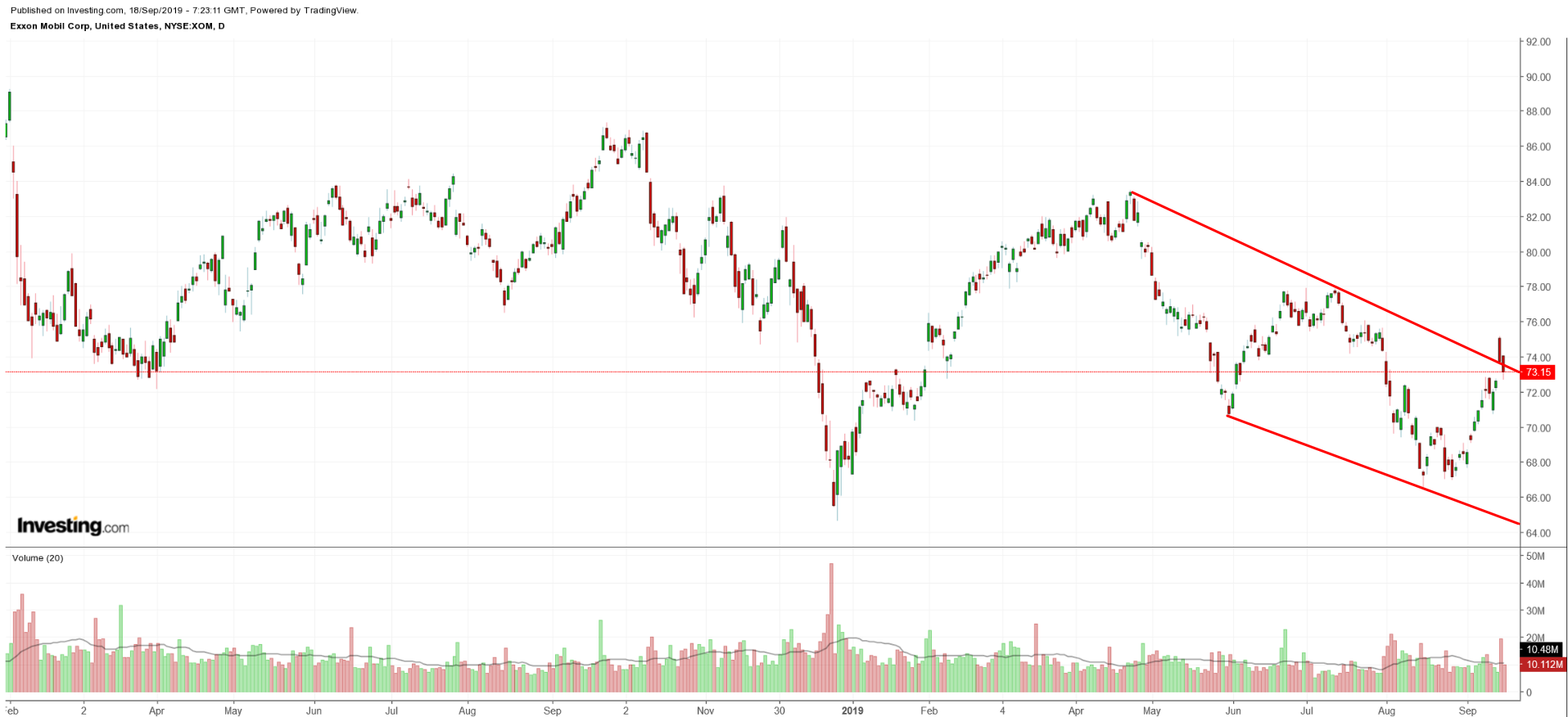

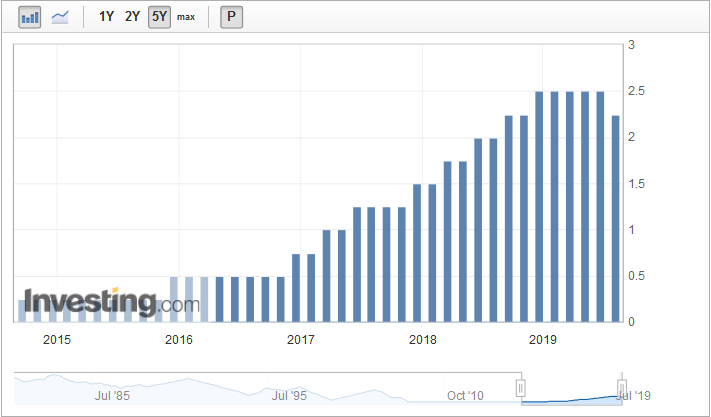

High-dividend stocks tend to perform well in a low-rate environment as the hunt for yield intensifies. The energy provider announced a quarterly dividend of $0.87 per share in April, which implies an annualized dividend of $3.43 per share. Exxon Mobil stock’s dividend yield is currently 4.79%, making it an extremely attractive play in the current environment of declining rates.

In addition, lower rates usually lead to a weaker dollar, which in turn boosts the value of dollar-denominated oil futures contracts, as this makes oil cheaper for buyers in other currencies. This tends to help stocks of commodity producers.

The Irving, Texas-based company is scheduled to release third-quarter earnings on Nov. 1, before the open. Consensus calls for EPS of $0.90, up 47% from earnings of $0.61 per share in the second quarter. Revenue is forecast to come in at $62.9 billion.

Procter & Gamble’s hefty dividend payout and attractive yield make it an even likelier candidate to outperform in the months ahead as the Fed cuts rates. The company raised its quarterly dividend by 4% in April to $0.74 per share. This represents an annualized dividend of $2.96 and a yield of 2.44%.

The consumer behemoth is set to publish earnings for its fiscal first quarter before the markets open on Oct. 29. Consensus calls for EPS of $1.23, which would indicate a year-over-year (YoY) EPS growth rate of 10%. Revenue is expected to rise roughly 5% from the same period a year earlier to $17.5 billion.

Exxon Mobil (NYSE:XOM): Global Oil Giant, Attractive Dividend Yield

Exxon (NYSE:XOM) Mobil (NYSE:XOM) doesn’t need an introduction. Shares of the world's largest publicly traded oil and gas corporation are up almost 8% this year. The stock closed at $73.17 last night with a market cap of $309.5 billion.

Procter & Gamble: Consumer Stock Fit For More Gains

Procter & Gamble (NYSE:PG) is one of the largest consumer goods corporations in the world. The stock is up around 32% in 2019 thanks in large part to its improved underlying sales outlook. During its recently concluded fiscal fourth quarter, the company’s organic sales grew 7%—the most in a decade.

Shares of the Cincinnati-based giant ended at $121.16 last night, not far from their recent record high of $123.43 reached on September 5, giving it a market cap of $303.2 billion.

The strong year-to-date (YTD) performance has been driven by robust demand for its single-family homes, primarily from first-time buyers.