5 big analyst AI moves: Microsoft PT hike; Tesla, Intel could soar on earnings

Introduction

Microsoft Corporation (NASDAQ: NASDAQ:MSFT) is one of the most well-known companies, belonging to the mag-7 and being the biggest company in the world according to market capitalization. While MSFT is definitely a great company, this article will show why it currently is not a buy for me, mainly because there are better deals in other mag-7 companies at lower valuations and better fundamentals.Fundamentals

Performance MetricsFrom a fundamental perspective, Microsoft is a strong company, with a gross profit margin of 69.7% and an EBITDA margin of 55.25%, far above the industry medians of 50.78% and 10.48%, respectively. Furthermore, the ROE is great at 33.61%, while the industry median is only at 4.96%.The same can also be said for growth. While MSFT is not as far ahead of other companies as it was in terms of profitability, a revenue growth rate of 14.13% and an EBITDA growth rate of 19.16% are still great. Furthermore, forward growth rates are even stronger than current ones, suggesting a positive outlook. Only ROE growth is a weak point in this sector, with both current and forward ROE growth expected to be negative.

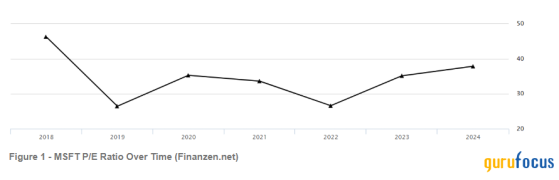

Valuation MetricsAs with all Mag-7 companies, valuation is the biggest problem for Microsoft. Everyone already knows that we are talking about a great company, so the most important thing to get right is to find a good entrance price. Currently, the EV/EBITDA ratio of the stock is relatively high at 22.8, a 31% premium to the industry median. Moreover, the P/S and P/B ratios are even more elevated at 12.51 and 10.49, suggesting a 311% and 214% premium, respectively. The P/E ratio at 35.11 is also very high at the moment. Figure 1 shows the historical P/E ratio of MSFT as can be seen, the company currently trades at 2020 and 2023 levels, leaving it at a higher bound of its average valuation.

Peer Group Comparison

Performance Metrics ComparisonWhen comparing Microsoft’s user base to that of other Mag-7 companies, like Alphabet (NASDAQ:GOOGL) (NASDAQ: GOOG) and Meta (NASDAQ: NASDAQ:META), one can instantly see that the company’s valuation is elevated. At around 1.5 billion users and a market cap of 3.35T, the company has a valuation of $2.233 per user. At the same time, GOOG and META only have valuations of $820 and $494 per user, respectively, making them much cheaper in comparison. Additionally, ROE is a weak point too, with only Tesla Inc. (NASDAQ: NASDAQ:TSLA) and Amazon (NASDAQ: NASDAQ:AMZN) being worse at 8.79% and 25.24%, respectively.From a growth perspective, Microsoft is solid but does not particularly stand out at slightly better revenue growth but significantly less EBITDA growth than Alphabet. Furthermore, the negative ROE growth is the second worst in the peer group, with only Tesla’s ROE falling by almost 70%. In total, Microsoft seems fundamentally somewhere around the average, with profitability being a strength while growth is a comparative weakness.

Valuation ComparisonFigure 2 shows the valuation metrics of Microsoft and its peer group. As can be seen, MSFT is one of the most expensive Mag-7 companies, having a higher EV/EBITDA and P/E ratio than everyone but TSLA and NVDA. In terms of P/S ratio, the company is even more expensive than TSLA, while it is only in the middle of all companies in terms of its P/B ratio. All of this makes a current investment in MSFT look rather bad. Meta, for example, is beating Microsoft in almost every category, with MSFT only slightly exceeding in EBITDA margins, having 4% more. At the same time, META trades at a discount between 15% and 30%, depending on the ratio. This very same example could also be done for GOOG, which has comparable metrics but a discount of almost 50%. Furthermore, GOOG has a far lower P/FCF ratio at 27.1 compared to that of MSFT, which is at 51.2, showing that the premium persists through multiple valuation metrics. This, in total, makes MSFT look very expensive. The only companies in this list looking like a worse deal are TSLA and Apple (NASDAQ: NASDAQ:AAPL), which have worse profitability and growth at comparably high valuations.

Business Concerns and Recent News

AI Risks & CompetitionOne of the major concerns for Microsoft is the company’s big exposure to AI, due to its aggressive investments in this sector. While it could be a long-term growth factor, one should also consider the increased competition in the sector, with almost every company boosting AI investments. In contrast to other companies like Meta, which approaches the AI battle by focusing on a sector, in this case marketing, to gain an edge, Microsoft focuses on large language models, something most companies do. At the same time, the legal battle between Elon Musk and OpenAI, one of Microsoft’s most important AI investments, remains a concern, as Musk wants to stop OpenAI from becoming a for-profit company. Also, it remains questionable if Microsoft can continue charging premium prices for its M365 Copilot, while users have so many other alternatives.Other Business ConcernsThe same argument can also be made for the company’s cloud business, where it faces strong competition from Amazon and Alphabet. Also, many companies are trying to cut costs on cloud spending to increase profit, which could further damage growth in this sector. All of this poses strong questions about whether a forward revenue growth rate of 14.30% and a forward EBITDA growth rate of 19.88% are justified.

Apart from that, Microsoft is also not as immune to geopolitical tensions as one might think. While the trade deal between the US and China has decreased trade tensions for now, a new collapse in foreign relations remains a risk, as it could increase the costs of hardware for the company.

Insider / Institutional TransactionsAnother item of interest could be that MSFT has seen increased insider selling over the past few months $47.9M sold during the last 3 months. Additionally, the famous hedge fund manager and value investor Ken Fisher (Trades, Portfolio) has recently reduced his position in MSFT by 10%. Furthermore, George Soros (Trades, Portfolio) completely cut his position in the company by the end of March.

Technicals

From a technical perspective, MSFT looks fine but not great. Although 6-month and 1-year momentum are positive, they are not extremely high. Figure 3 further shows that the company is trading above its 200-day simple moving average, indicating lower volatility and higher returns. However, it is currently at a resistance at $454 and could bounce back from here. Furthermore, even if it manages to break through this level, we still have to see prices above the resistance of $467 to be able to speak of a new uptrend.Conclusion

In total, MSFT looks like a much worse deal than other Mag-7 stocks like META and GOOG at the moment, which trade at similar multiples, while having similar or even stronger fundamentals. Because of this, I give MSFT a sell rating as it is likely time to shift funds into other Mag-7 companies, especially with the current resistance being a barrier at the moment.This content was originally published on Gurufocus.com

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI