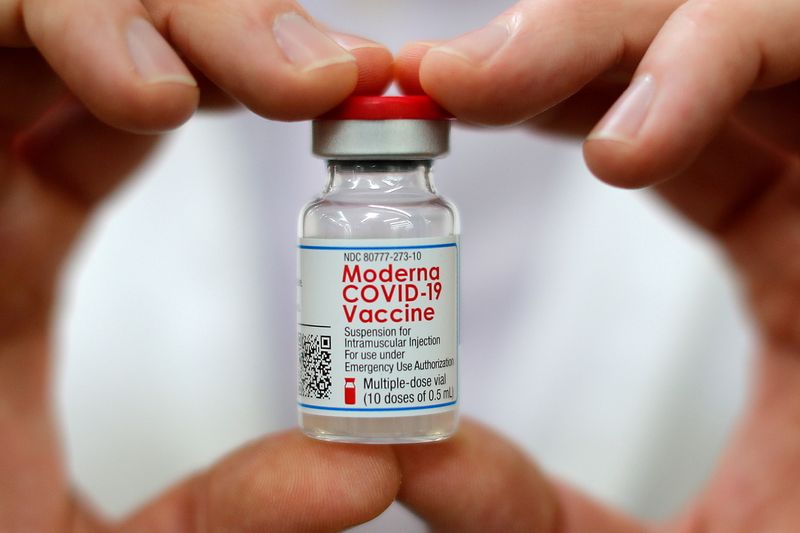

On Thursday, TD (TSX:TD) Cowen revised its price target for Moderna (NASDAQ:MRNA), lowering it to $55 from the previous $60, while keeping a Hold rating on the stock. The adjustment follows Moderna's recent financial performance, where the company's COVID-19 vaccine, Spikevax, saw a significant revenue beat. The vaccine's sales outperformed consensus estimates by 50%, overshadowing the absence of sales from another vaccine candidate, mRESVIA.

The analyst from TD Cowen believes that Moderna is on track to reach the higher end of its fourth-quarter sales guidance, which ranges between $800 million and $1.3 billion. This projection is buoyed by the strong performance of Spikevax.

Moreover, the company is anticipated to announce top-line data for its cytomegalovirus (CMV) vaccine candidate by the end of the year, provided the interim data meets the required benchmarks. This data release is eagerly awaited as it could have significant implications for the company's vaccine pipeline.

Additionally, Moderna is expected to submit its next-generation COVID-19 vaccine, mRNA-1283, and its combination flu/COVID vaccine, mRNA-1083, for regulatory approval by the end of this year. The approval of these vaccines could potentially contribute to the company's revenue stream during the fall and winter seasons of 2025 and 2026.

The TD Cowen analyst's comments highlight key developments at Moderna, including the expected submission of new vaccine candidates that may bolster the company's future earnings. Despite the reduced price target, the maintained Hold rating suggests a cautious but steady outlook for the biotechnology company's stock.

In other recent news, Moderna Inc (BMV:MRNA). reported a robust financial performance for the third quarter of 2024, with revenues reaching $1.9 billion and net income standing at $13 million. Despite challenges and lower-than-expected sales with its RSV vaccine, the company maintains its annual product sales estimate between $3 billion to $3.5 billion. Operating expenses saw a reduction, contributing to the company's strong financial standing.

Moderna's Spikevax vaccine gained a significant market share in retail vaccinations, thanks to early U.S. regulatory approval. On the other hand, RSV vaccine sales were not as high as anticipated, due to missed contracting opportunities and competition, generating only $10 million.

Recent developments include strategic plans for vaccine development and market expansion, as well as executive team changes. Moderna is set to buy its Norwood campus for $400 million, with the deal expected to close in December 2023. The company plans to file for multiple vaccine approvals in 2024 and aims for 10 product approvals in the next three years.

InvestingPro Insights

Moderna's financial landscape presents a mixed picture, as revealed by recent InvestingPro data. The company's market capitalization stands at $19.34 billion, reflecting its significant presence in the biotech sector. However, Moderna faces challenges, with a negative P/E ratio of -3.28 and a substantial revenue decline of 52.6% over the last twelve months as of Q2 2024, aligning with the analyst's focus on the company's financial performance.

InvestingPro Tips highlight that Moderna is "quickly burning through cash" and "suffers from weak gross profit margins," which corroborates the cautious Hold rating maintained by TD Cowen. The gross profit margin of -62.99% underscores these concerns. On a positive note, Moderna "holds more cash than debt on its balance sheet," potentially providing some financial flexibility as it navigates the development and approval processes for its new vaccine candidates.

The company's stock price movements are described as "quite volatile," with the stock "trading near 52-week low" and having "taken a big hit over the last six months." This volatility is evident in the 57.21% price decline over the past six months, which may explain TD Cowen's decision to lower the price target.

Investors seeking a more comprehensive analysis can access 12 additional InvestingPro Tips for Moderna, offering deeper insights into the company's financial health and market position.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.