(Bloomberg) -- Boris Johnson looks poised to clinch a firm victory in next month’s election, but few investors are letting go of their safety blankets.

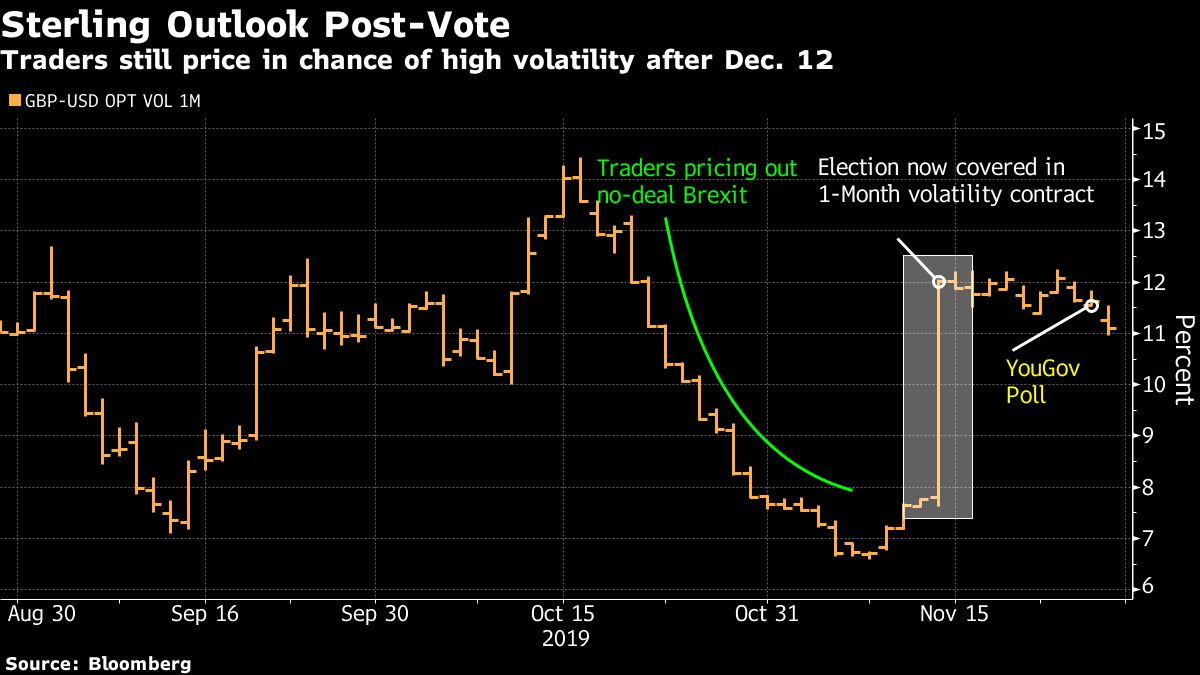

Burnt by pollster prognostications in recent years, traders are holding tight to hedges even as Wednesday’s YouGov poll projected the biggest Tory majority in more than three decades. A win of that magnitude would empower Johnson to deliver on a promise of getting his Brexit deal through Parliament by Jan. 31.

The pound’s initial pop higher versus the dollar after the YouGov survey confirms the market’s base case for a Conservative majority. But volatility measures show traders are in no mood to rule out surprises.

Short-dated volatility in the pound-dollar rate shows caution. A fortnight before the election, the two-week tenor climbed above 8.5% on Thursday, about one percentage point higher than it was at the same point in 2017. The one-month maturity was around 11%, versus 7% two weeks before the 2017 election, according to Bloomberg strategist Richard Jones.

The Tories aren’t taking anything for granted, voicing concerns about the possibility of a hung Parliament. In addition to the YouGov poll, there was also a ComRes/Telegraph poll showing the Conservative lead narrowing to seven points.

U.K. inflation breakevens should climb if Boris fails to muster a firm majority, under the scenario that the pound would weaken -- spurring supply-side price pressures through imports.

Five-year breakevens have tumbled to 2.79%, close to their lowest in three years. That’s below fair value of around 3%, according to Bloomberg strategist Ven Ram. The macro model, based on correlations with nominal yields, the Retail Price Index and the pound, concludes that the market has already priced in a Tory victory.

At the same time, traders are buying up government bonds as a haven given growth and Brexit risks. That’s resulted in them offering the lowest returns in Europe for dollar-based investors. Take a look at currency-hedged returns on five-, 10- and 30-year gilts. They fare worse than those on bonds from Germany, France, Belgium, the Netherlands, Italy, Spain and Portugal. See returns of carry (light blue) versus roll (white):

One piece of good news: U.S. exchange-traded fund investors are tip-toeing back into British small-cap stocks. They added $10.3 million to the iShares MSCI United Kingdom Small-Cap ETF on Tuesday, the most since February. That pushed the fund’s assets to a record. U.K. small-caps are seen as particularly attractive, offering 35% upside if valuations rebound to their 20-year average according to Morgan Stanley (NYSE:MS).

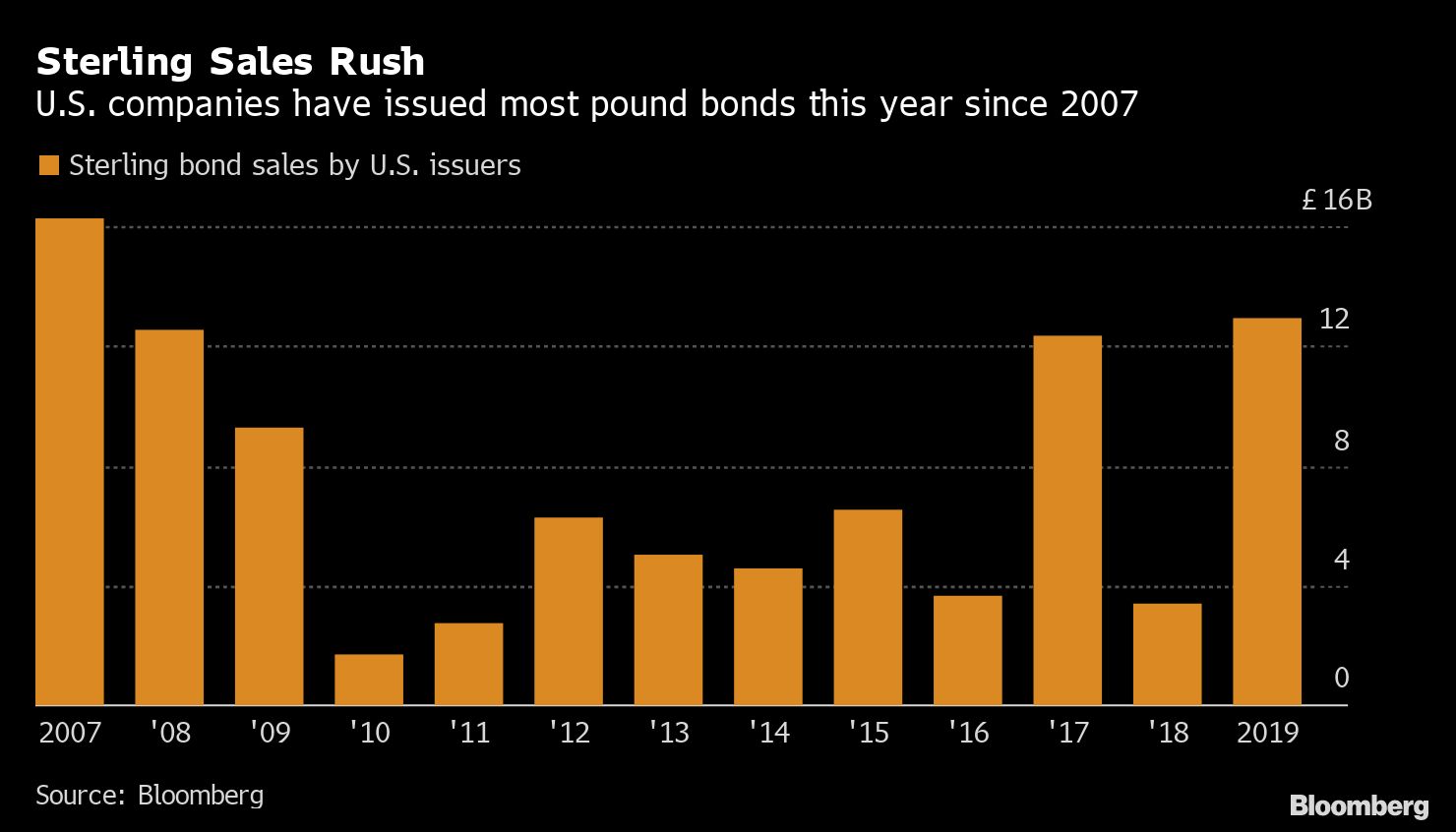

Foreign companies are pouncing to take advantage of cheap borrowing costs. American firms have sold 12.9 billion pounds ($16.7 billion) of sterling bonds this year, the biggest full-year tally since 2007. Warren Buffett’s Berkshire Hathaway Inc . (NYSE:BRKa), Citigroup Inc (NYSE:C). and Verizon Communications Inc (NYSE:VZ). are among borrowers to issue pound debt, partly thanks to strong demand from U.K.-based buyers for overseas companies given feeble domestic growth.