(Bloomberg) -- Japanese stocks’ record rally is so powerful that one of their most prominent buyers is sitting on the sidelines.

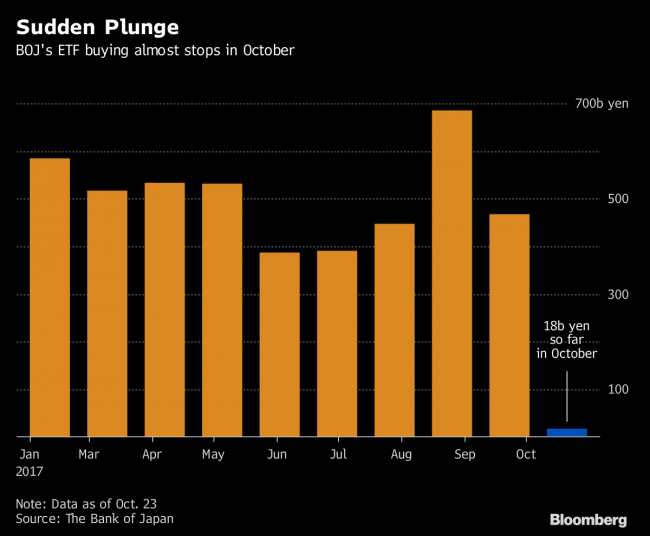

The Bank of Japan, which props up the equity market by investing in exchange-traded funds, has dramatically reduced its buying in October. That comes as the Nikkei 225 Stock Average boasts a 15-day winning streak, the longest run in history. The BOJ has spent 18 billion yen ($158 million) on ETFs so far this month, compared with an average monthly purchase of 505 billion yen in 2017.

The Nikkei 225 closed Monday at its highest since 1996, buoyed by Prime Minister Shinzo Abe’s landslide election win, U.S. shares at an all-time high, and the prospect for better-than-expected corporate earnings at home. As foreign investors return to a market they’ve previously shunned, the BOJ has slid into the background.

“The Bank of Japan doesn’t need to buy,” Norihiro Fujito, a senior strategist at Mitsubishi UFJ Morgan Stanley (NYSE:MS) Securities Co. in Tokyo, said in a phone interview. “You better get ready for things to get stronger still.”

The central bank has been buying Japanese equity ETFs since 2010, but had been increasing its purchases as part of a package of unprecedented stimulus under Governor Haruhiko Kuroda, aimed at revitalizing the economy. The BOJ aims to buy so that its holdings of ETFs increase by about 6 trillion yen a year, and has tended to purchase on days stocks fell in the morning session.

But that’s been rare this month.

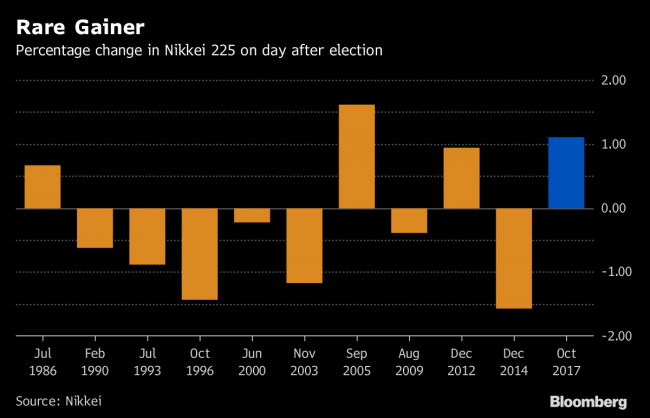

The Nikkei 225 jumped 1.1 percent on Monday after Abe’s ruling coalition retained its two-thirds majority in parliament, boosting the premier’s chances of leading the country through 2021 and becoming the longest-serving leader. The rally bucked a trend of post-election declines, with the Nikkei 225 falling the day after seven of the previous 10 votes, according to Japan Asia Securities Co.

Investors are "far happier" than some commentators expected them to be, according to Andrew Clarke, director of trading at Mirabaud Asia Ltd. in Hong Kong. The Nikkei 225 will climb 15 percent to 25,000 in the next six months, he said.

Others are already looking for the next catalyst. Goldman Sachs Group Inc (NYSE:GS). has turned its attention to earnings, with second-quarter reporting season set to begin in earnest next week. The brokerage now predicts results to be better than previously projected, strategists led by Kathy Matsui wrote in a note dated Oct. 22.

"We think positive surprises will predominate against the backdrop of global economic growth," Matsui and her colleagues wrote.

Foreigners have been rushing back to Japanese equities on speculation Abe’s snap election would cement his power and pave the way for continued monetary easing. Overseas investors bought 1.1 trillion yen of cash equities during the first two weeks of October, on course for the biggest monthly purchases this year, according to the latest data from Japan Exchange Group Inc.

Some strategists are warning that the market optimism is overdone, arguing that nothing will change with Abe’s reelection.

"Our impression is that the election was very similar to that of December 2014 in that it failed to change people’s expectations," Nomura Holdings Inc. economists and strategists led by Takashi Miwa wrote in a note. "If Mr. Abe’s reelection means that BOJ Governor Haruhiko Kuroda is likely to be reappointed, nothing much will have changed.”

Purchase Target

Whatever the case, the BOJ was right on course to achieve its annual purchase target before it slowed down this month. The central bank had bought 4.6 trillion yen in ETFs as of the end of September, according to its data. That meant it needed to purchase an average of 484.6 billion yen a month for the last three months of the year. The central bank has said it takes market conditions into account when making its purchases, while not providing many more details.

For Mitsubishi UFJ Morgan Stanley Securities’ Fujito, the BOJ’s 6 trillion yen goal isn’t set in stone. What matters, says Fujito -- who’s positive about Abe winning another term -- is what the bank’s lack of purchases shows about the strength of the stock rally.

“Even without the BOJ at play, the Nikkei 225 is rising,” he said.