Kalkine Media -

After being bruised throughout the year in 2022, the global stock markets are anticipating a turnaround in 2023. However, nothing can be predicted as of now because the conditions that propelled volatility last year persist.Highlights:

- Lundin posted an income of C$ 83.9 million from mining operations in Q3 2022.

- OceanaGold’s adjusted earnings were reported at US$ 0.01 per share in Q3 2022.

- OceanaGold has a dividend yield of 3.641 per cent.

The fastest inflation in decades, the central bank’s tight monetary policies, and a slowing economy adversely impacted the stock markets. Be it large-cap, mid-cap, or penny stocks, every sector and the stock was affected in 2022.

Here, we look at two TSX mid-cap stocks and their performances in the latest quarters:

Lundin Gold Inc. (TSX: LUG) Lundin Gold Inc. is a gold operation and developing company based in Canada. Its main portfolio includes Fruta del Norte gold exploration. The company has a dividend yield of 3.641 per cent and paid a semi-annual dividend of C$ 0.258.

Lundin posted an income of C$ 83.9 million from mining operations in the third quarter of 2022. In Q3 2022, the company reported a cash flow of C$ 105 million from operations.

Meanwhile, the net income was C$ 62.67 million compared to C$ 56.67 million in Q3 2021.

The total cash balance at the end of the reported quarter was C$ 304 million. The free cash flow for the quarter came to C$ 65.2 million or C$ 0.28 per share.

The EBITDA and adjusted EBITDA of the company in Q3 2022 were C$ 159 million and C$ 117 million, respectively.

Lundin’s gold production in the third quarter of 2022 was 121,635 oz. The LUG stock returned over 50 per cent YoY.

OceanaGold Corporation (TSX: TSX:OGC) OceanaGold Corp explores, curates, and operates gold mines and other minerals in the Philippines, New Zealand, and the US. In the third quarter of fiscal 2022, OceanaGold produced 104,953 ounces of gold and 3,581 tons of copper.

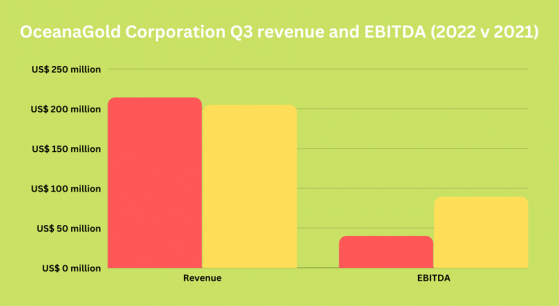

In Q3 2022, OceanaGold registered a revenue of US$ 213.9 million compared to US$ 204.6 million in the same quarter a year ago. The EBITDA in the third quarter of 2022 was US$ 40.1 million versus US$ 89.2 million in Q3 2021.

The net debt of the company at the end of the third quarter of the reported fiscal was US$ 174 million, at a leverage ratio of 0.48 times.

OceanaGold said it is on track to fulfill the 2022 consolidated production and cost guidance.

The adjusted earnings were reported at US$ 0.01 per share, and the operating cash flow was at US$ 0.08 per share in Q3. The OGC stock gained 42 per cent YoY.

Source: ©Kalkine Media®; © Canva via Canva.com

Bottom line: As an investor, if you want to protect your portfolio, analyze the company’s performances thoroughly and only then take any decision. During this time of market volatility, remember that past performances cannot be a criterion to gauge future gains.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.