By Wayne Cole

SYDNEY, (Reuters) - Asian shares followed U.S. stock futures higher on Monday on hopes authorities were working to ring fence stress in the global banking system, even as the cost of insuring against default neared dangerous levels.

Helping nerves were reports First Citizens BancShares Inc was in advanced talks to acquire Silicon Valley Bank from the Federal Deposit Insurance Corp.

S&P 500 futures firmed 0.5% in early trade while Nasdaq futures added 0.4%.

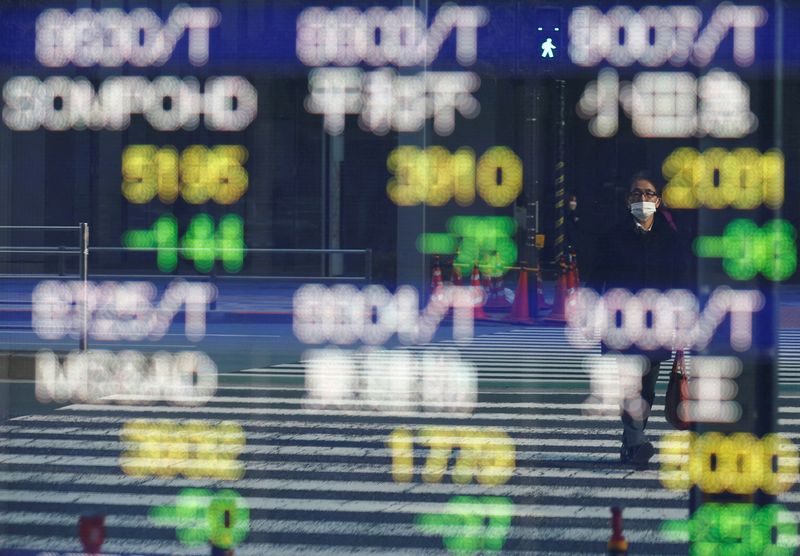

MSCI's broadest index of Asia-Pacific shares outside Japan edged up 0.1%, with trading cautious. Japan's Nikkei gained 0.1% and South Korea 0.2%.

The mood remained jittery after shares in Deutsche Bank (ETR:DBKGn) fell 8.5% on Friday and the cost of insuring its bonds against the risk of default jumped sharply, along with the credit default swaps (CDS) of many other banks.

"The current level of credit default swaps for European banks is just a little lower than it was during the height of the European financial crisis in 2013," noted Naeem Aslam Chief Investment Officer at Zaye Capital Markets.

"If these CDS do not normalise, it is highly likely stock market may continue to suffer for many days."

Over in the United States, depositors have been fleeing smaller banks for their larger cousins or to money market funds. Flows to money market funds have risen by more than $300 billion in the past month to a record atop $5.1 trillion.

Minneapolis Fed President Neel Kashkari on Sunday said officials were watching "very, very closely" to see if the banking stress led to a credit crunch that threatened to tip the economy into recession.

That, in turn, meant the Fed was closer to a peak in rates, he added. Markets are well ahead of the central bank in pricing around an 80% chance rates have already peaked, while a first rate cut is seen as early as July.

Fed Governor Philip Jefferson speaks later on Monday, while Fed Vice Chair for Supervision Michael Barr testifies on "Bank Oversight" before the Senate on Tuesday.

Yields on two-year Treasuries have fallen an astonishing 102 basis points so far this month to stand at 3.77%, while the entire yields curve out to 30 years is below the 4.85% effective funds rate.

That dive has sometimes been a drag on the dollar, at least against the safe-haven Japanese yen where it stands at 130.85 yen, having touched a seven-week low of 129.65 last week.

The euro suffered its own reversal on Friday amid the worries over Deutsche, and it was last at $1.0767 and well off last week's $1.0930 top.

The drop in yields has combined with the run from risk to burnish gold, which was trading at $1,975 an ounce after reaching a high above $2,009 last week. [GOL/]

Oil prices were steadier early Monday, but are still nursing losses of almost 10% for the month as worries about global growth undermine commodities in general. [O/R]

Brent added 43 cents to $75.42 a barrel, while U.S. crude rose 47 cents to $69.73 per barrel.