By Daniel Leussink

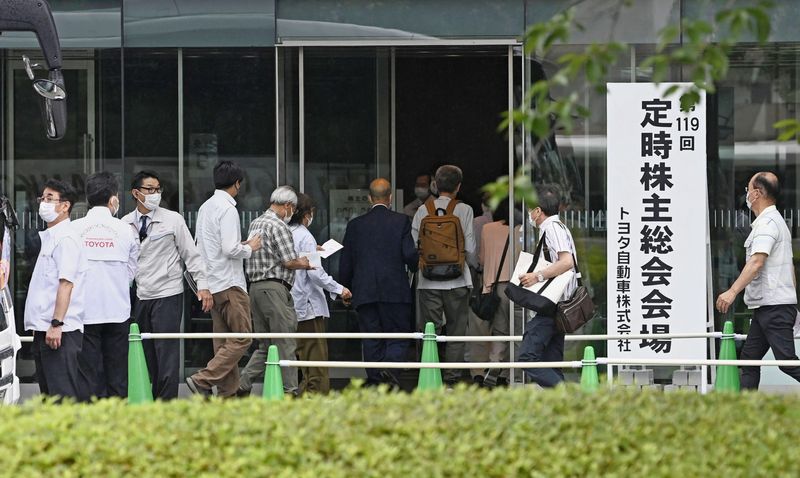

TOYOTA CITY, Japan (Reuters) - Toyota shareholders backed the board and voted down the first resolution proposed in 18 years at an annual general meeting (AGM) on Wednesday, an endorsement of the automaker a day after it laid out an extensive electric vehicle strategy.

The resolution from three European asset managers called for greater disclosure on climate lobbying activity, but was widely expected to fail given the strength of support for management.

Investors also backed all 10 board members in a vote given weight by major U.S. pension funds arguing the re-election of Chairman Akio Toyoda could blunt board independence. Toyota has said its board meets Tokyo Stock Exchange governance standards.

A voting breakdown will be issued on Thursday, Toyota said.

The meeting came a day after the world's biggest automaker by sales volume announced a roadmap for electric vehicles (EV) involving solid-state batteries and radical production changes, in the strongest signal of its intention to grow its battery EV market share and boost its share price.

"Japanese people like Toyota and I think they support Akio," said 61-year-old Tadashi Imai, an individual shareholder who said he has held stock in the company for around a decade.

"Toyota's announcement yesterday about the solid-state batteries roll-out by 2027 sent the shares up 5%. That's really impressive, 5%."

Solid-state batteries can hold more energy than current liquid electrolyte batteries, thereby promising longer driving ranges - addressing a consumer concern widely considered a potential roadblock in the broader transition to battery EVs.

Toyota shares rose 6.3% to 2,310 yen, logging their best two-day performance in a little over three years.

DIFFERENT APPROACH

Toyota had become a target for activists and green investors who considered it slow to roll out EVs. Still, EVs are just one element in Toyota's multi-pathway approach to carbon neutrality that includes petrol-electric hybrids and hydrogen fuel cells.

The Japanese firm has said its approach is more effective to reduce carbon emission and more practical because consumer need, EV infrastructure and clean energy supply differ by country.

Its top scientist, Gill Pratt, told shareholders the best way to reduce carbon as much as possible and as soon as possible is to have diverse solutions.

The roadmap showed that under new CEO Koji Sato, who succeeded Toyoda - the founder's grandson who became chair in April - Toyota has adopted much of a revamp that engineers and planners have been developing for months.

It said it was developing an EV platform to reduce costs including an assembly line that would do away with the conveyor belt system that has defined auto production for over 100 years.

It also said it would use Giga casting pioneered by EV rival Tesla (NASDAQ:TSLA), in which massive, aluminium casting machines eliminate welding to reduce vehicle complexity and cost.

Toyota aims to sell 3.5 million EVs annually by 2030. In April it sold 8,584 EVs, including under its Lexus brand, making up over 1% of global sales in a single month for the first time.