By Jonathan Stempel and Akriti Sharma

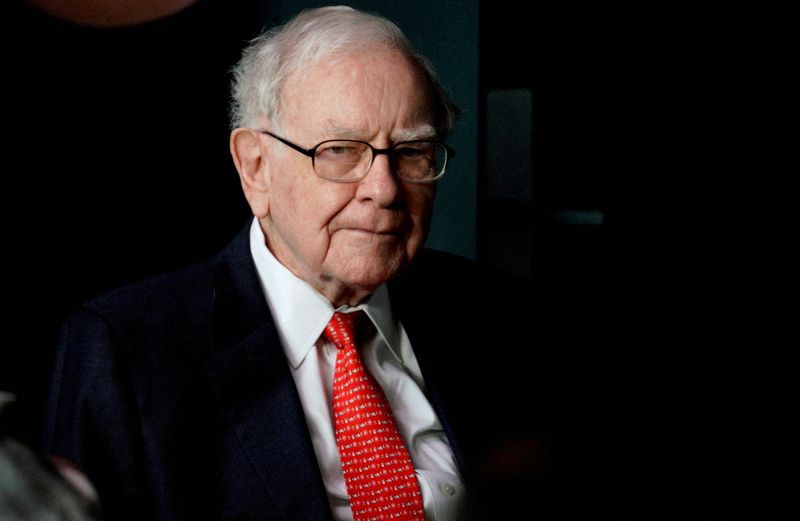

(Reuters) - Warren Buffett's Berkshire Hathaway (NYSE:BRKa) Inc said it has bought another 9.9 million shares of Occidental Petroleum Corp (NYSE:OXY), giving it a 17.4% stake in the oil company.

Berkshire paid about $582 million for the shares, which it bought between Wednesday and Friday, according to a Friday night filing with the U.S. Securities and Exchange Commission.

Buffett's company is Occidental's largest shareholder, now owning 163.4 million shares worth about $9.9 billion.

Its stake is about 60% larger than that of Vanguard, the next largest shareholder, according to Refinitiv data.

Berkshire also owns warrants to buy another 83.9 million Occidental shares for $5 billion.

Occidental's share price has more than doubled this year, benefiting from Berkshire's purchases as well as rising oil prices following Russia's invasion of Ukraine.

The Berkshire investment has prompted market speculation that Buffett's Omaha, Nebraska-based conglomerate might eventually buy all of Occidental.

In a June 23 research report, Truist Securities analyst Neal Dingmann saw a "good chance" of a Berkshire takeover once Occidental became an investment-grade credit, saying a purchase would help diversify Berkshire's energy portfolio.

Occidental has been reducing debt, which swelled when it bought Anadarko Petroleum Corp (NYSE:APC) for $35.7 billion in 2019.

Berkshire bought $10 billion of Occidental preferred stock to help finance that purchase, and obtained the warrants at that time.

It also had a $25.9 billion stake in oil company Chevron Corp (NYSE:CVX) at the end of March.

Berkshire's share price has fallen 8% this year, compared with a 20% decline in the Standard & Poor's 500.

Buffett's company owns dozens of businesses, including the BNSF railroad, Geico car insurer and its namesake energy business, as well as stocks including Apple Inc (NASDAQ:AAPL) and Bank of America Corp (NYSE:BAC).