July 19 (Reuters) - The following bids, mergers, acquisitions and disposals were reported by 2000 GMT on Friday:

** United States-based diesel engines maker Cummins (NYSE:CMI) CMI.N has made an indicative offer for Volkswagen's VOWG_p.DE MAN Energy Solutions unit, people close to the matter said, as the carmaker seeks to slim down its portfolio of disparate assets.

Buyout firm Apollo Global Management LLC APO.N has approached Coface SA COFA.PA , the credit insurance company partly owned by French bank Natixis SA CNAT.PA , with an acquisition offer, people familiar with the matter said.

Brazilian oil company Petroleo Brasileiro SA PETR4.SA has chosen a bid from Warburg Pincus-backed Trident Energy as the winner in a final "re-bid" for two oilfields, three sources with knowledge of the matter said.

Barrick Gold Corp ABX.TO GOLD.N has struck a deal to buy out its fellow shareholders in Acacia Mining ACAA.L with a higher bid than originally proposed, raising expectations Acacia's long-running tax dispute with the Tanzanian government will finally be resolved.

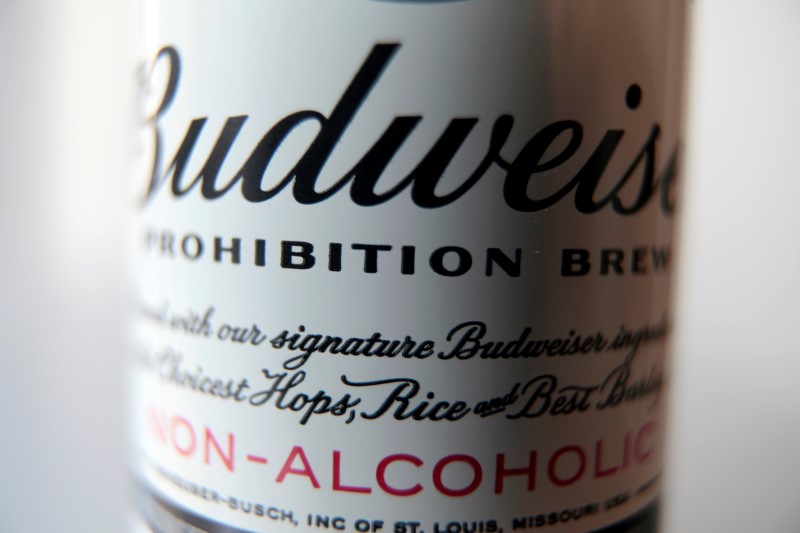

Anheuser-Busch InBev ABI.BR , the world's largest brewer, is selling its Australian operations to Japan's Asahi 2502.T for $11 billion and could revive the stalled flotation of its Asian business as it looks to cut debt.

PepsiCo Inc PEP.O has struck a deal to buy South Africa's Pioneer Food Group Ltd PFGJ.J for $1.7 billion, the companies said, lifting Pioneer's shares and boosting a sector that has been hit by drought and tough trading conditions.

The biggest investor in Aston Martin AML.L offered to buy another 3% stake in the luxury carmaker, whose shares have slumped since listing last year. UK oil and gas company Amerisur Resources Plc AMER.L said it had received a non-binding proposal as well as other indicative offers for some assets as the company reviews strategic options, including a potential sale.