By Ketki Saxena

Investing.com – Canadian energy infrastructure giant Enbridge Inc (TSX:ENB) (NYSE: ENB) reports its fourth-quarter 2021 earnings tomorrow before the opening bell. One of North America’s largest energy players, the Calgary-based company dominates LNG and {{8849|Crude Oil} pipeline connectivity between Canada and the U.S.

Over the past year, Enbridge has delivered 27.75% returns and currently trades at a P/E multiple of 19.3x. Enbridge also offers a substantial 6.3% dividend to shareholders.

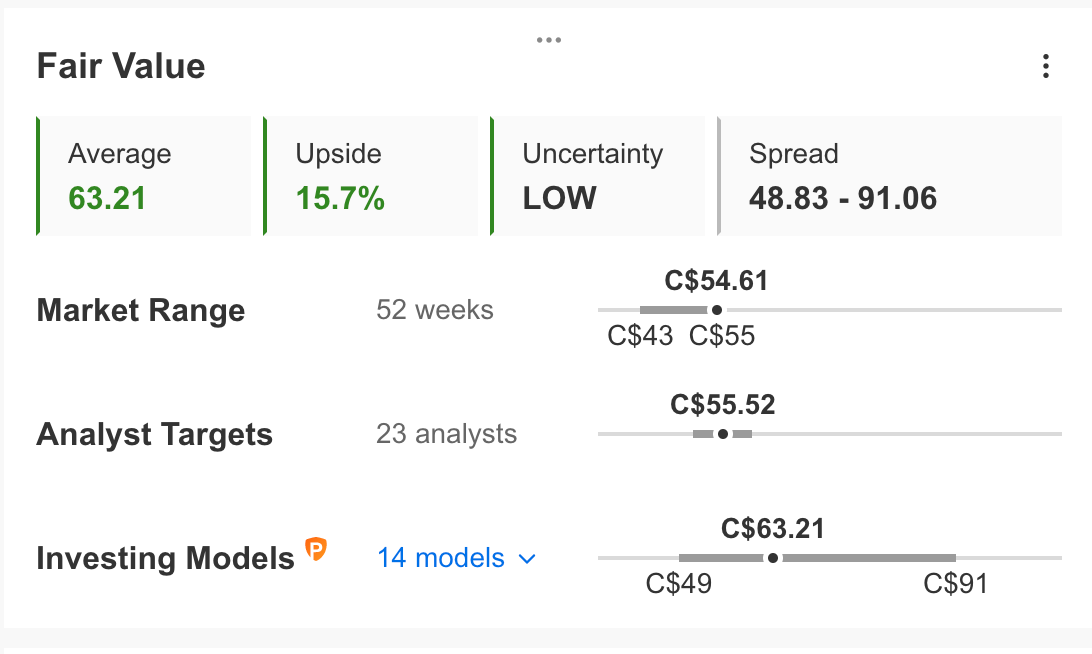

Enbridge Stock Fair Price, Financial Upside

As of 1:00 p.m E.T Thursday, Enbridge stock was trading at C$54.66. Analyst data from 23 brokerages aggregated by Investing.com suggests a fair share price of C$55, representing an upside potential of 0.3%. Investing PRO models are significantly more bullish on $ENB, estimating a fair share price of C$63.21, representing a 12.2% upside.

What to expect for Enbridge Earnings

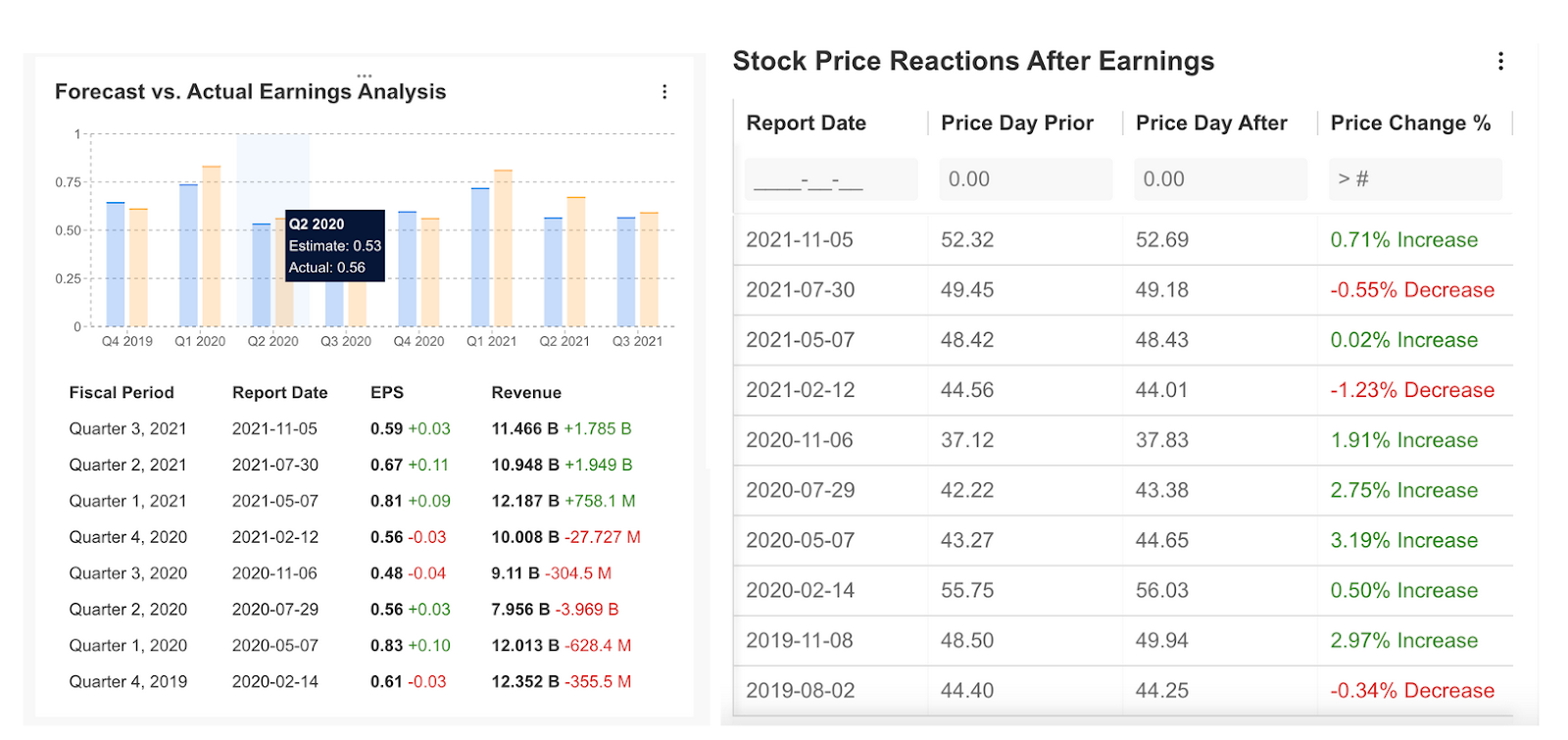

Analysts expect EPS at C$0.76, up 28.8% from 0.59 in the last quarter and up 35.7% from C$0.56 this time last year. Analysts are forecasting fourth-quarter revenue between C$8.065 billion - C$10.79 billion, compared to C$11.466 billion in Q3.

In the last quarter, ENB beat analyst estimates, posting a 4.6% surprise on forecasted EPS and revenue forecasts by a whopping 18%. For the full fiscal year 2021, analysts expect Enbridge to report EPS of C$2.84 on revenue of C$43.955 billion, up from EPS C$2.42 on revenue of C$38,877 for the full year 2020.

With oil's recent break past $90 and with a fair expectation it could soon surge past $100/barrel, upstream producers will likely be ramping up activity, which should benefit Enbridge’s extensive midstream operations in the next quarter. Investors can well expect to be bullish for tomorrow’s earnings, and the market volatile for what is already one of the most highly traded stocks on the TSX.

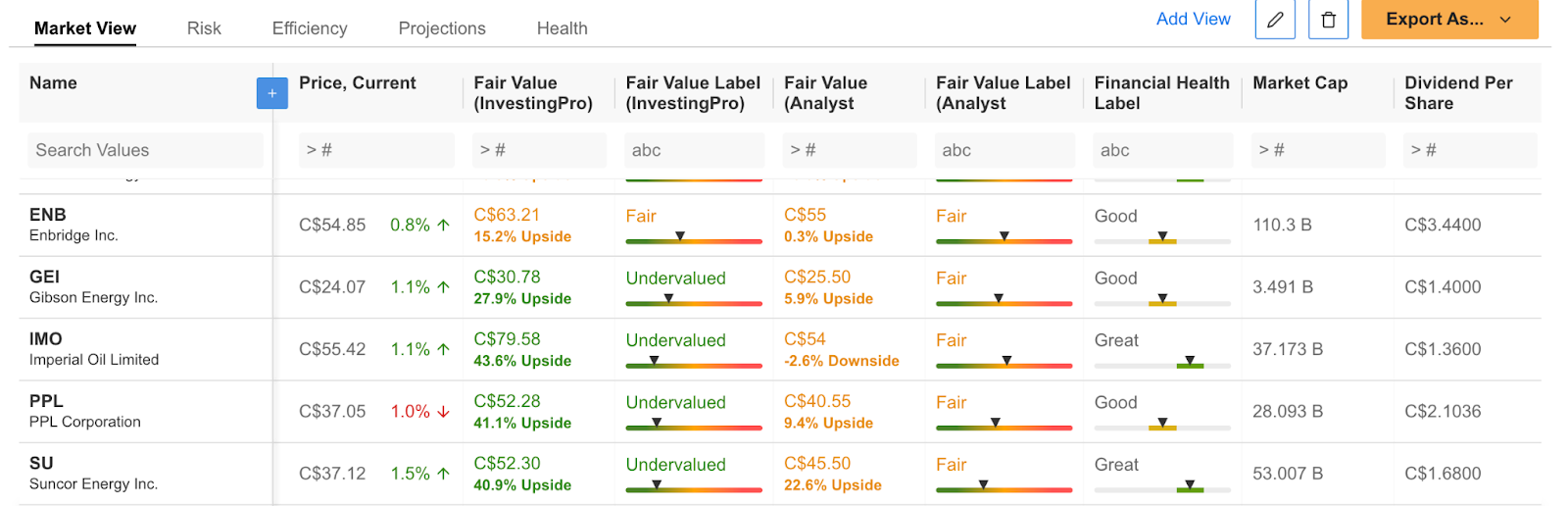

Undervalued Canadian Energy Stocks to Explore

Energy investors seeking stocks with equal or greater potential for financial upside may also want to explore: Gibson Energy (TSX:GEI), Imperial Oil Ltd (TSX:IMO), Pembina Pipeline Corp (TSX:PPL), and Suncor Energy (TSX:SU).

All data and visuals are from Investing.Pro

All data and visuals are from Investing.Pro

All Data is as of 1:00 PM ET