* U.S. stock futures up 0.6 pct, bond futures fall

* Asian stocks tentative, Nikkei ticks up slightly

* Trade war truce seen as positive for risk sentiment

* Oil up after Venezuelan election

By Hideyuki Sano

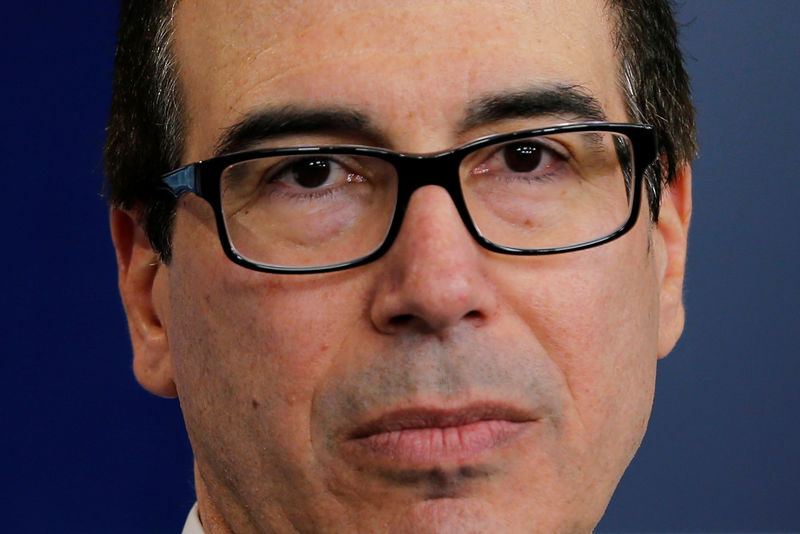

TOKYO, May 21 (Reuters) - Stocks rose on Monday as U.S. Treasury Secretary Steven Mnuchin declared the U.S. trade war with China "on hold" following an agreement to drop their tariff threats that had roiled global markets this year.

U.S. S&P mini futures ESc1 rose 0.60 percent in Asian trade on Monday.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS advanced 0.55 percent in early trade, led by strong gains in greater China. Hong Kong's Hang Seng .HSI was up 1.0 percent, Taiwanese shares .TWII 1.1 percent and mainland shares .CSI300 0.4 percent.

Japan's Nikkei .N225 gained 0.4 percent.

Mnuchin and U.S. President Donald Trump's top economic adviser, Larry Kudlow, said the agreement reached by Chinese and American negotiators on Saturday set up a framework for addressing trade imbalances in the future. weekend talk appears to have made progress. While they still need to work out details of a wider trade deal, it is positive for markets that they struck a truce," said Hirokazu Kabeya, chief global strategist at Daiwa Securities.

As safe-haven demand for debt fell, U.S. bond prices were under pressure, keeping their yields not far from last week's peaks.

The 10-year Treasuries yield stood at 3.065 percent US10YT=RR , near a seven-year high of 3.128 percent hit on Friday.

"Recent data suggests the U.S. economy is very strong, hardly slowing down in Jan-Mar. The world economy slowed in that quarter but it appears to be rebounding. And recent rises in oil prices are likely to lift inflation expectations further," said Tomoaki Shishido, senior fixed income analyst at Nomura Securities.

"We expect more selling until the next Fed's meeting in June," he said.

In the currency market, higher U.S. yields helped to strengthen the dollar against a wide range of currencies.

The euro dipped 0.1 percent to $1.1756 EUR= , hovering above Friday's five-month low of $1.1750.

The common currency was also hit after two anti-establishment parties pledged to increase spending in a deal to form a new coalition government.

The dollar maintained an uptrend against the yen, rising 0.20 percent to fetch 110.97 yen, JPY= , close to Friday's four-month high of 111.085.

Oil prices held firm near 3-1/2-year highs also on easing trade tensions between the world's two biggest economies.

The market is keeping an eye on Venezuela, where President Nicolas Maduro appeared to be set for re-election, an outcome that could trigger additional sanctions from the United States and more censure from the European Union and Latin America. prices have been supported by plummeting Venezuelan production, in addition to a solid global demand and supply concerns stemming from tensions in the Middle East.

U.S. crude futures rose 0.8 percent to CLc1 $71.83 per barrel, near last week's 3 1/2-year high of $72.30 while Brent crude futures LCOc1 notched up 0.8 percent to $79.10 per barrel. It had risen to $80.50 last week, its highest since November 2014.

<^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^ MSCI, Nikkei datastream chart

http://reut.rs/2sSBRiD

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^>