Kalkine Media -

Highlights:

- Fortis (TSX:FTS) has a dividend yield of 4.044 per cent.

- Algonquin Power's adjusted net earnings were US$ 73.5 million in Q3 2022.

- Algonquin paid a quarterly dividend of US$ 0.181 per share.

However, this does not necessarily means that the demand for services might translate well for the stocks. As an investor, thorough research and technical analysis is important before placing your bets in the market.

We are exploring two TSX utility stocks in this article and find out how they have performed:

Fortis Inc . (TSX: FTS) Fortis owns and runs utility distribution and transmission assets, providing their service to more than 3.4 million electricity and gas customers in the US and Canada.

Fortis has a dividend yield of 4.044 per cent and three-year dividend growth of 5.13. The EPS of Fortis is 2.70, and its P/E ratio is 20.70.

In the third quarter of 2022, Fortis posted net earnings of C$ 326 million, or C$ 0.68 per common share, compared to C$ 295 million, or C$ 0.63 in Q3 2021. On the other hand, the adjusted net earnings in the reported quarter of 2022 were C$ 341 million versus C$ 300 million in the year-ago quarter.

Algonquin Power & Utilities Corp. (TSX: AQN) Algonquin Power is Liberty's parent company, a global diversified transmission and distribution utility. The company paid a quarterly dividend of US$ 0.181 with a dividend yield of 10.244 per cent.

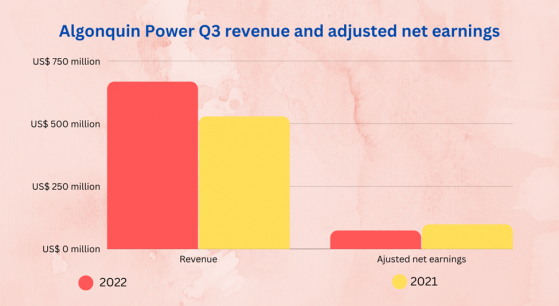

The company reported Q3 2022 revenue of US$ 666.7 million, up 26 per cent from US$ 528.6 million in Q3 2021.

The adjusted net earnings in the third quarter of 2022 were US$ 73.5 million compared to US$ 97.6 million in the year-ago quarter.

Algonquin Power posted Q3 FY22 adjusted EBITDA of 276.1 million compared to US$ 252 million in the same period in 2021.

Source: ©2023 Krish Capital Pty. Ltd; © Canva Creative Studio via Canva.com

Bottom line Investing has indeed become challenging now due to market volatility. However, with a long-term plan and diversifying one’s portfolio, an investor can protect his money until the market settles down. Do in-depth research before making any decision.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.