Highlights

- In Q2 2022, the total revenue for WELL Health (TSX:WELL) was C$ 140.3 million.

- On September 30, 2022, the CPG stock price was C$ 8.5.

- In Q2 2022, StorageVault’s net operating income was C$ 44.4 million.

Some stocks may be undervalued despite their good performance and vice versa. This is part and parcel of the stock market, and one must be familiar with such concepts.

For a long-term investor, portfolio diversification is a major step. It can only happen when you consider all types of stocks. For example, several stocks are traded at low prices and are priced below C$ 10.

One should check and carefully analyze different stocks before coming to any decision. Let’s look at five stocks that are priced below C$ 10 and look at their performances in recent quarters:

Payfare Inc. (TSX: PAY) Payfare Inc. is a fintech company that offers loyalty-reward solutions, mobile banking, and instant payment.

Currently, the total market capitalization for Payfare Inc. is C$ 250.56 million. In Q2 2022, Payfare’s total revenue was C$ 33.6 million representing a 285 per cent increase (C$ 24.8 million) over Q2 2021 and a 35 per cent increase (C$ 8.7 million) over Q1 2022.

Further, its Q2 2022 gross profit was C$ 6.4 million, an increase of C$ 5.3 million compared to Q2 2021 and up C$ 2.1 million compared to Q1 2022.

The company’s net loss improved to C$2.3 million in Q2 2022 compared to a net loss of C$ 5.0 million in Q2 2021.

Reportedly, in the second quarter 0f 2022, Payfare Inc. launched a paid App in partnership with new clients to tap into the new opportunities in the market.

WELL Health Technologies Corp. (TSX: WELL) WELL Health Technologies Corp owns and operates primary clinics that deliver healthcare-related services. The company has three segments that include Omni-channel Patient Services Primary (clinical operations and allied health), Omni-channel Patient Services Specialized ( CRH (LON:CRH) and MyHealth), and Virtual Services (cybersecurity, EMR, digital apps, and billing and revenue cycle management solutions).

In Q2 2022, the total revenue of WELL Health was C$ 140.3 million, which witnessed an increase of 127 per cent as compared to revenue of C$ 61.8 million in Q2-2021. Its EBITDA (adjusted) was C$ 26.4 million for Q2 2022 compared to C$ 11.9 million for Q2 2021.

WELL health’s net income (adjusted) was reported at C$ 17.2 million in Q2-2022 compared to a net loss (adjusted) of C$ 1.2 million in Q2-2021.

StorageVault Canada Inc. (TSX: SVI) StorageVault Canada Inc. owns, operates, and leases storage to commercial and individual customers.

With a total market capitalization of C$ 2.109 billion, the company announced a quarterly dividend of C$ 0.003 with a dividend yield of 0.202 per cent. StorageVault Canada Inc. witnessed a five-year dividend growth of 5.62 per cent.

In Q2 2022, StorageVault’s total revenue soared to C$ 66 million compared to C$ 51.7 million in Q2 2021. Moreover, the net operating income grew to C$ 44.4 million from C$ 35 million for the same period.

Crescent Point Energy Corp . (TSX: TSX:CPG) Crescent Point Energy Corp is an exploration and production company headquartered in Calgary, Canada. The company develops and acquires natural gas and petroleum assets and properties.

As on September 30, 2022, the stock price for CPG was C$ 8.5 and witnessed an increase of 45.54 per cent within 12 months.

Crescent Point Energy Corp. announced earnings per share (EPS) of C$ 2.94. The company pays a quarterly dividend of C$ 0.08. Further, the price-to-earnings (P/E) ratio was 2.9.

For the second quarter of 2022, the cash flow from the operating activities of Crescent Point was calculated at C$ 529.6 million compared to C$ 285.5 million at the same time the previous year.

On the contrary, the net income was reported at C$ 331.5 million compared to C$ 2,143.3 million in the same period.

BlackBerry Limited (TSX: TSX:BB) BlackBerry Limited is a software provider that offers end-to-end secure communication for enterprises.

Currently, the total market capitalization of BlackBerry is C$ 3.8 billion. In the second quarter of fiscal 2023, the total revenue for BlackBerry Limited was US$ 168 million. The net loss in Q2 2023 was reported at US$ 54 million compared to US$ 181 million in the year-ago quarter.

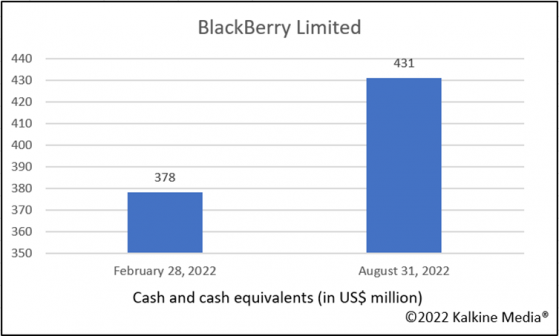

Further, the below graph displays the change in cash and cash equivalents from February 28, 2022- August 31, 2022.

Bottom Line The TSX market is full of options, but you have to choose stocks that align with your goal. As an investor, if you are looking for stocks under $10, you can explore several options.

While choosing your stocks, look at the factors that govern the market and your portfolio. Also, look at the market with a perspective of diversification. Keep track of the smallest changes to stay on top of your portfolio.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.