Kalkine Media -

The year 2022 was a rough year for the Canadian stocks market as inflation was knocking down doors, and the Bank of Canada (BoC) announced increased interest rate hikes. Most TSX stocks were spotted losing value throughout the year; however, a few small-cap stocks performed positively.Highlights

- Companies with a market cap of between $300 million to $2 billion are called small-cap stocks.

- MTY Group acquired Wetzel’s Pretzels and BBQ Holdings in 2022, increasing its portfolio to 90+ brands.

- Precision Drilling Corp exceeded its debt payment guidance from C$ 75 million to C$ 106 million in 2022.

To keep the volatility of the Canadian stock market in mind, investors need to be patient while investing in small-cap stocks in 2023. Even though small-cap stocks tend to have high-risk tolerances compared to blue-chip stocks; they can provide exposure to investors.

Companies that have a market capitalization of $300 million to $2 billion are known as small-cap stocks.

Let’s look at two TSX-listed small-cap stocks and their financial performances:

MTY Food Group Inc. (TSX: TSX:MTY) MTY Food Group Inc., a quick service and casual food dining company operating in Canada, the US, and internationally. The group engages in activities, such as franchising and operating corporate-owned locations, alongside running retail segments under 90 different brand names.

The company’s market capitalization share is about C$ 1.43 billion, with a dividend yield of 1.429 per cent.

MTY Food Group recently added one more name to its long list of casual dining restaurants by acquiring 100 per cent of COP WP Parent, Inc., commonly known as Wetzel’s Pretzels, from CenterOak Partners and other existing shareholders. The deal was signed for a cash consideration of about US$ 207 million.

The company also acquired BBQ Holdings, Inc. for a cash price of US$ 17.25 per share in September 2022.

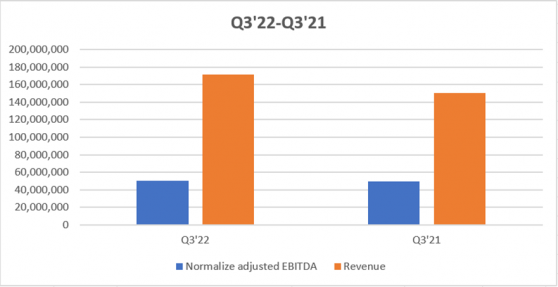

MTY Food Group’s financial highlights for the third quarter of 2022 are showcased below:

Image Source: © 2023 Krish Capital Pty. Ltd.

Precision Drilling Corporation (TSX: PD) Precision Drilling Corporation represents itself as a leading services provider to the global energy industry. The company’s portfolio includes extensive Super Series drilling rigs, well-service rigs, camps, rental equipment, etc.

Precision’s total market cap is around C$ 1.3 billion, with a P/B ratio of 1.13.

The company recently informed that it is on track to meet its 2022 debt reduction goal. Precision exceeded its C$75 million debt reduction objective in 2022 by managing to reduce its overall debt by C$106 million.

The adjusted EBITDA of the company jumped to C$ 119.56 million, representing an increase of 163.3 per cent year-over-year (YoY). Apart from this, Precision mentioned generating C$ 429.33 million of revenue in the third quarter of 2022, a 69.2 per cent increase over Q3’21.

Bottom Line Following the volatile trend of the stock market in 2022, one should conduct thorough market research before deciding to invest in any small-cap stocks.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.