Kalkine Media -

The category of mid-cap stocks is often home to various types of stocks. It includes some of the growing small-cap stocks, which offer a medium level of risk. At the same time, these stocks may offer higher growth potential than some of the other large-cap stocks.Highlights

- Mid-cap stocks include growing small-cap stocks that offer a medium risk level and generally have a growth perspective.

- WilScot Mobile Mini Holdings reported total revenue of US$ 510.28 million for the December 2022 quarter.

- BILL Holdings reported a total revenue of US$ 260 million during the December 2022 quarter.

These stocks may also have high liquidity and high returns as there may be a substantial demand for such stocks in the market. The companies offering these stocks may have a stable business model, so they might appear attractive to investors. Despite all the qualities, one thing that is certain in a stock market is its volatility, and there is no guaranteed return.

Here are two US mid-cap stocks that investors can examine:

WillScot Mobile Mini Holdings Corp. WillScot is a provider of workspace and storage solutions. The company primarily offers furniture rentals, transportation and logistics services. The company is also engaged in other services such as commercial storage, commercial real estate, facility management and job site services.

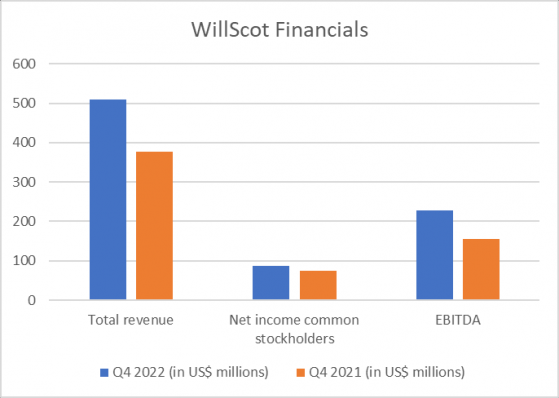

During the Dec 2022 quarter, the company reported a total revenue of US$ 510.28 million, which marked a 28.07% year-on-year change. The net income paid to common stockholders during the December 2022 quarter was US$ 86.40 million, which marked a significant jump of 112.02% over the December 2021 quarter. The basic EPS for the quarter was 0.41, while the diluted EPS was 0.40.

© 2023 Krish Capital Pty. Ltd.

WillScot Mobile Mini Holdings also reported that its Adjusted EBITDA during the fourth quarter of 2022 was US$ 280 million. During this quarter, the company also generated US$ 200 million of cash from operations and US$123 million of free cash flow. The company results also highlighted that it returned US$ 233 million to shareholders by repurchasing 5.3 million shares of Common Stock in the December quarter.

BILL Holdings Inc. BILL Holdings provides cloud-based financial services centered around automating and simplifying operations for small and midsize (SMB) businesses. Some of these services include generating invoices, streamlining approvals and managing the cash.

The company reported total revenue of US$ 260 million during the fourth quarter of 2022, which was 169.4% higher on a year-on-year basis. The company’s EBITDA during the quarter was US$ 233.76 million, which marked a year-on-year change of 133.36%.

© 2023 Krish Capital Pty. Ltd.

BILL Holdings has announced extended support to small and midsize businesses adversely affected by the Silicon Valley Bank events. BILL has offered to complete payments and manage funds of the businesses in need during this time. Additionally, BILL would also provide easy access to credit so that the operations of these SMBs do not suffer.