(Reuters) - Canada's main stock index fell on Monday, tracking global stocks, as U.S. President Donald Trump decided to restore tariffs on steel and aluminum imports from Brazil and Argentina, shrugging off a jump in oil prices following strong data from China.

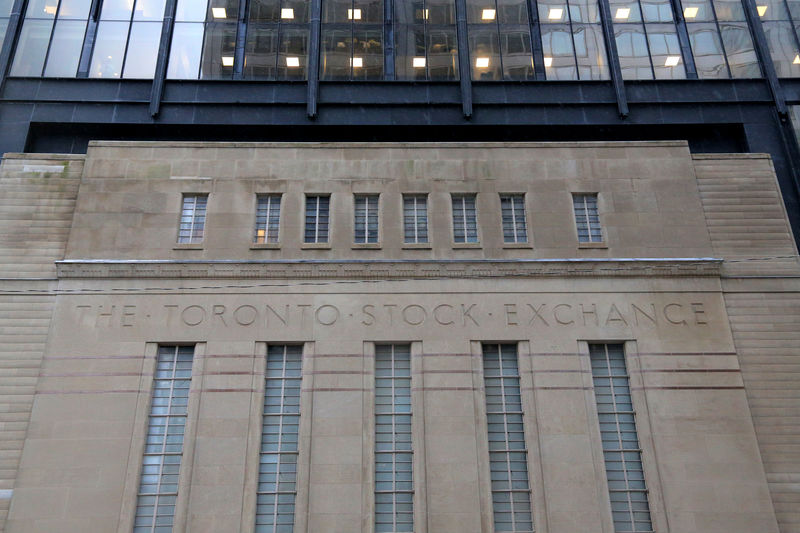

* At 10:37 a.m. ET (15:37 GMT), the Toronto Stock Exchange's S&P/TSX composite index was down 51.91 points, or 0.3%, at 16,988.29.

* Canadian manufacturing activity expanded in November for the third consecutive month as production climbed at a faster pace and new orders continued to grow, but the momentum was subdued compared to historical levels.

* The energy sector dropped 0.2% even as U.S. crude prices were up 1.7% a barrel, while Brent crude added 1.3%. [O/R]

* The financials sector slipped 0.2%, while the industrials sector fell 0.1%.

* The materials sector, which includes precious and base metals miners and fertilizer companies, added 0.3% despite gold futures falling 0.3% to $1,461.2 an ounce. [GOL/] [MET/L]

* On the TSX, 81 issues were higher, while 147 issues declined for a 1.81-to-1 ratio to the downside, with 53 million shares traded.

* The largest percentage gainers on the TSX were Bombardier B and Meg Energy Corp, which jumped 2.5% and 2.2%, respectively.

* Centerra Gold fell 20.8%, the most on the TSX, after open pit mining operations were temporarily halted at its Kumtor gold mine in Kyrgyzstan. The second biggest decliner was Shopify Inc, down 6.7%.

* The most heavily traded shares by volume were Continental Gold Inc, Husky Energy and Harte Gold Corp.

* Eight stocks on the TSX posted new 52-week highs and one fell to a new low.

* Across all Canadian issues there were 42 new 52-week highs and seven new lows, with total volume of 103.45 million shares.