By Ketki Saxena

Investing.com -- Dividend Channel's proprietary formula ranks thousands of dividend stocks based on their strong fundamentals and undervaluation. Western Union (WU) currently holds a rank that places it in the top 50% of the coverage universe, making it one of the most interesting ideas for investors to explore further.

However, what makes WU even more attractive as a stock investment is its recent entry into oversold territory. On Tuesday, shares of WU changed hands at $10.765 per share, hitting an RSI reading of 29.2 - lower than the average RSI reading of 46.0 among dividend stocks covered by Dividend Channel.

When a stock enters oversold territory like this, it creates an opportunity for investors to capture higher yields from dividends due to falling stock prices. In fact, WU's annualized dividend payout currently stands at $0.94/share (paid quarterly), which translates to an impressive annual yield of 8.50%, based on its current share price.

Investors looking to capitalize on this situation may see the low RSI reading as a sign that heavy selling pressure has been exhausted, making it an attractive time to seek entry points on the buy side.

In summary, Western Union presents itself as an attractive stock investment opportunity due to its high dividend yield coupled with low valuation metrics such as P/E ratios and entry into oversold territory indicated by RSI readings below average levels among Dividend Channel-covered stocks. Its consistent history of paying dividends over time adds credibility to investors looking for long-term investments with reliable returns.

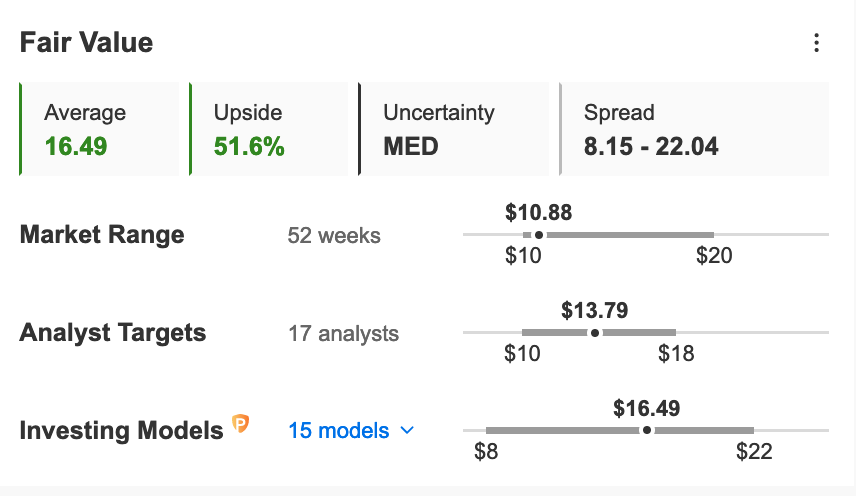

At market close, Western Union shares changed hands at $10.88 USD. Investing Pro models suggest a Fair Price Target (NYSE:TGT) of US $16.49%, representing a 51.6% financial upside.