By David Shepardson, Stephen Nellis and Alexandra Alper

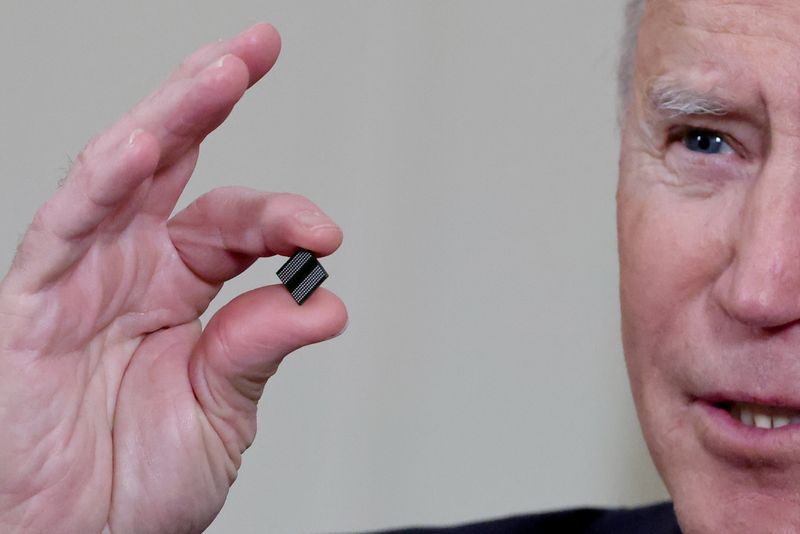

WASHINGTON (Reuters) -The White House pressed automakers, chip companies and others on Thursday to provide information on the ongoing semiconductor crisis that has forced cuts to U.S. auto production, and to take the lead in helping solve it.

Secretary of Commerce Gina Raimondo, who along with Brian Deese, director of the National Economic Council, met on Thursday with semiconductor industry participants, told Reuters that strong action was needed. "It's time to get more aggressive," she said. "The situation is not getting better; in some ways it is getting worse."

Participants in Thursday's meeting, which followed meetings in April and May, included Detroit's Big Three automakers, plus Apple (NASDAQ:AAPL), Daimler, BMW, GlobalFoundries, Micron (NASDAQ:MU), Microsoft (NASDAQ:MSFT), Samsung (KS:005930), TSMC, Intel (NASDAQ:INTC) and Ampere Computing.

The White House said the administration "reaffirmed that industry needs to be in the lead in resolving the supply chain bottlenecks that are occurring due to the global chip shortage."

Raimondo said a voluntary request on Thursday for information within 45 days on the chips crisis would boost supply chain transparency and "get more granular into the bottlenecks and then ultimately predict challenges before they happen."

She warned that if companies did not answer the voluntary request "then we have other tools in our tool box that require them to give us data. I hope we don't get there. But if we have to we will."

Automakers from General Motors Co (NYSE:GM) to Toyota Motor Corp to Chrysler parent Stellantis NV have slashed output and sales forecasts due to scarce chip supplies, made worse by a COVID-19 resurgence in key Asian semiconductor production hubs.

Stellantis Chief Executive Carlos Tavares, who participated in the White House virtual meeting, said the automaker will cooperate with the information request, but added in a statement that "broad participation from the entire semiconductor supply chain will be critical for these efforts to be successful."

TSMC said in a statement after the meeting that the company was supporting and working with all stakeholders to overcome the shortages, and that the it had taken "unprecedented actions to address this challenge".

"We are confident that our capacity expansion plan including the advanced 5nm semiconductor fab in Phoenix, Arizona - one of the largest foreign direct investments in U.S. history - will enable us to support the industry in driving long-term stability in semiconductor supplies," it said.

TSMC has pledged to spend $100 billion over the next three years to expand chip capacity amid the global shortage.

Some attendees told Reuters privately they were concerned the transparency measures could require disclosing pricing information that many companies regard as corporate secrets.

Raimondo also delivered the message to the companies privately that the government would mandate information sharing if necessary.

The White House also said several U.S. agencies would manage a new early alert system "to proactively manage potential semiconductor supply chain disruptions linked to public health developments in key trading partners."

Participants were concerned about how to disclose such information while still complying with reporting requirements of publicly traded companies, a participant said.