By Steven Scheer

JERUSALEM (Reuters) - Israeli chip manufacturer Tower Semiconductor (TA:TSEM) matched forecasts for unadjusted quarterly earnings, saying a downturn in its medical X-ray and automotive business had been offset by sales of mobile and power management chips.

Tower (O:TSEM), whose shares were down 7.4% in early Nasdaq trade, said earnings per share for April to June was 18 cents, down from 20 cents a year earlier but in line with expectations, according to I/B/E/S data from Refinitiv.

Second quarter diluted earnings per share excluding one-time items was 22 cents, down from 24 cents and missed forecasts by 1 cent.

Chief Executive Russell Ellwanger said manufacturing had not been disrupted by the coronavirus crisis, although the company formerly known as TowerJazz had felt an impact in some of the industries it supplies.

"But we have several markets that are really growing for us. That's a function of entering more and more ... markets and getting market share within those markets," he told Reuters.

Revenue rose to $310 million, up from $306 million.

The company, which specialises in analogue chips used in cars, medical sensors and power management, said it expected third-quarter revenue 5% above or below $320 million. Analysts are forecasting $322 million.

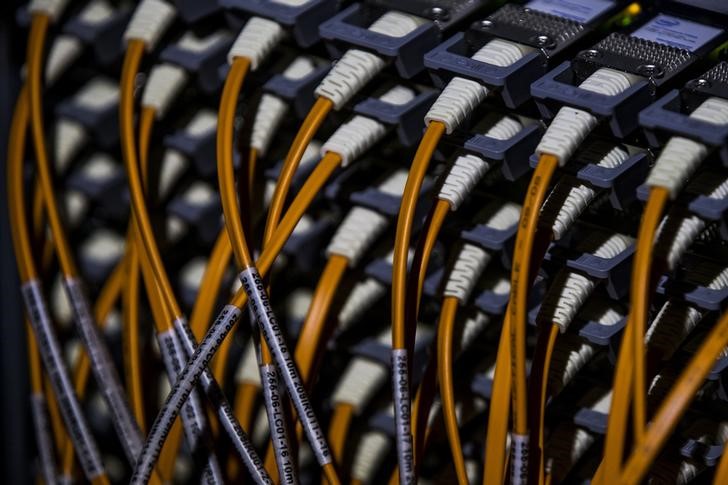

Sales of silicon-germanium chips, used in microchips or integrated circuits, were strong due to robust demand for bandwidth as more people work from home.

Chief Financial Officer Oren Shirazi said July to September orders were strong and that the firm was committed to expanding capacity in its Uozu, Japan factory beyond a planned $100 million investment to meet demand in the mid- and long-term.