The banking industry had a turbulent year in 2023. Against the backdrop of a rising interest rate environment, the closure of Silicon Valley Bank, Signature Bank, and First Republic Bank kicked off a regional banking crisis in the US that saw JP Morgan (NYSE:JPM) acquire First Republic Bank after a consortium of the 11 largest American banks made uninsured deposits totalling $30 Billion into the bank. In Europe, the failure of Credit Suisse (SIX:CSGN) resulted in an unprecedented and expedited acquisition by UBS Group AG (SIX:UBSG), a competing Swiss banking conglomerate, to avoid growing trepidation in global financial markets.

As we enter a new year with the global economic landscape poised to shift once more, understanding the current and potential future state of both global banking sectors is important. In this article, we will examine this through the Evolve European Banks Enhanced Yield ETF (Ticker: EBNK) Evolve US Banks Enhanced Yield Fund (Ticker: CALL).

A look at each banking locale, through ETFs

Though both EBNK and CALL are bank-focused ETFs, they each have a distinct geographic focus. EBNK invests in equity securities of the largest European banks on an equally weighted basis, with the added value of a covered call strategy applied to up to 33% of the portfolio. The fund will track the performance of the Solactive European Bank Top 20 Equal Weight Index Canadian Dollar Hedged. Conversely, CALL provides exposure to US banks by replicating the performance of the Solactive Equal Weight US Bank Index Canadian Dollar Hedged, while writing covered call options on up to 33% of the portfolio securities.

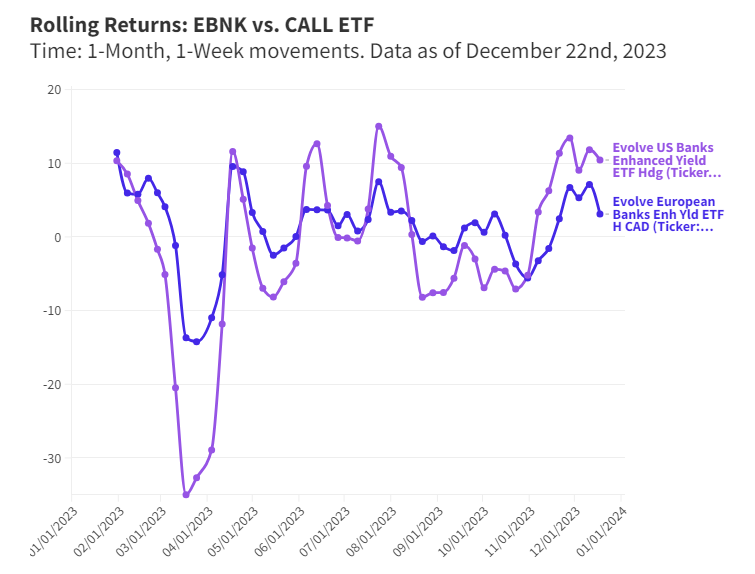

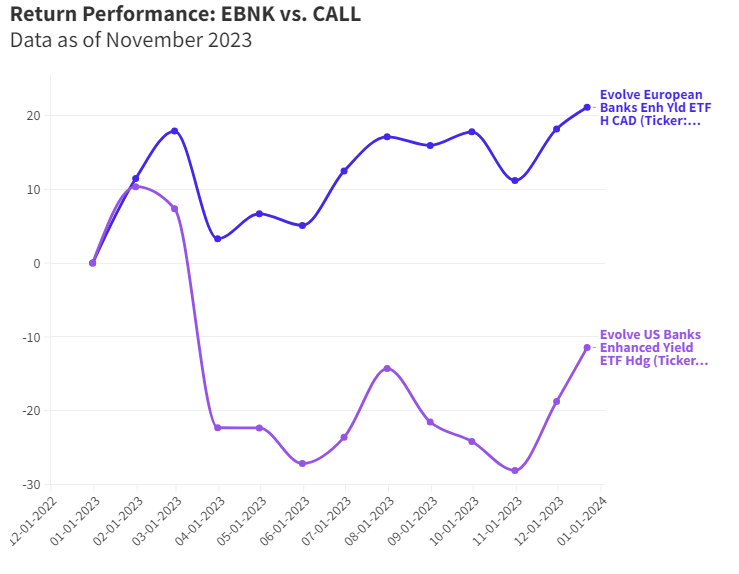

In looking at the rolling return performance of each fund over the year thus far, the volatility that has been present in the US banking sector is quite evident, whereas the performance of the European banking sector has been relatively placid. As evidenced by the chart, due to recurring bank failures in March 2023, the US banking equity sector had a precipitous decline, relative to the European banking sector. Furthermore, with elevated interest rates impacting mortgage refinancing/housing affordability and the need to increase ‘loan loss provisions’, the performance landscape of US banking equities was choppy throughout the year.

Despite facing significant challenges such as rising interest rates and stagnant growth in the European economy, European banks have shown remarkable resilience. They have started to demonstrate improved valuations, especially notable against the recent backdrop of negative interest rates that have burdened the region. This improvement is partly due to many institutions actively strengthening their balance sheets in the aftermath of the eurozone debt crisis.

Looking Forward

As outlined in the latest FOMC report, the Federal Reserve has revised its inflation forecasts downward, anticipating its preferred measure to drop to 2.4% by 2024. Accompanying this adjustment in inflation expectations is the projection that interest rates will also start to decrease. Current estimates suggest a median rate of 4.6% by the end of 2024, marking a reduction of three quarter-points from the present target range of 5.25%-5.5%Though higher borrowing costs boost interest income for the big lenders, a broad recovery in investor sentiment and lower rates are expected to be additive to banking performance. Simply put, with interest rates potentially moving lower in 2024, the tailwinds of stable to lower funding costs, borrower alleviation, and improving capital levels should be enough to propel banking stocks forward.

In Europe, the European Banking Authority has recently released its annual risk assessment of the European banking system. The report emphasizes that the tightening of monetary policy has been beneficial for banks, enabling them to boost their net interest income through higher net interest margins.. Furthermore, European Union and European Economic Area banks’ return on assets (RoA) and return on equity (RoE) were reported at their highest levels since the global financial crisis (GFC), reaching 0.7% and 11% respectively. Although this recovery has been broadly based, some banks benefited more than others depending on their business model or their asset and liability structure. Profitability might face a slowdown due to low loan demand and limited asset growth. Additionally, the potential increase in funding costs could negatively impact net interest margins.

Takeaway

Indications suggest that the US interest rate environment might start to decline in 2024, potentially ending the previously observed synchronicity in interest rate policies among developed economies, especially as the European Central Bank commits to keeping rates high despite reduced inflation. For investors, the changing economic landscape suggests a potential resurgence of the beaten-down US banking sector in the coming year. This may provide an opportunity to explore banking ETFs and assess their fit in one's portfolio. CALL offers investors exposure to the largest US banks, while also providing an opportunity for yield generation with their covered call strategy, such a solution is worth consideration as we approach an inflexion point in the US banking industry.

This content was originally published by our partners at the Canadian ETF Marketplace.