WTI crude oil defied expectations, shedding 3.62%, despite prevalent Middle East tensions that should typically serve to push the barrel price higher. The fossil fuel industry felt the pressure even more acutely, with energy-related stocks absorbing more significant losses than the commodity itself. The S&P energy sector plunged 6.15% over the week, weighed down by Exxon Mobil (NYSE:XOM) and Chevron (NYSE:CVX) stocks, which dropped 4.98% and 13.47% respectively, after reporting disappointing quarterly results.

Chevron, meanwhile, announced plans to buy smaller rival Hess (HES) in a $53-billion all-stock deal, while another significant industry player, Halliburton (NYSE:HAL), fell 5.96% - despite strong Q3 financial performance, with robust net income and significant international revenue growth - further highlighting the turbulence in the fossil energy market. And with the FT Wilshire 5000 Energy Index also dropping by 3.73% over the week, it’s clear that this is a global trend.

On a fund level, substantial moves were evident in iShares S&P/TSX Capped Energy Index ETF (XEG), with the fund which currently stands at $1.75 billion in assets under management, falling 2.36% over the week.

On the cleaner side of the energy spectrum, financing challenges continue to plague groups dependent on long-term project funding. High-interest rates, which have shown relentless growth over the last two years, are having a significant impact on businesses investing in long-term ventures, such as Siemens Energy (ENR). The German titan registered a devastating week-over-week decrease of 26.36% after the group said it was seeking government support following a big setback at its wind unit.

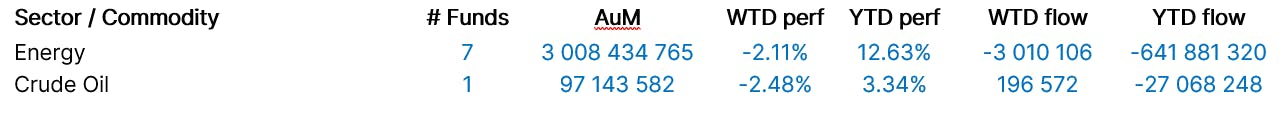

Group Data

Index Data

Funds Specific Data: XEG, NNRG

This content was originally published by our partners at the Canadian ETF Marketplace.