As the financial market navigated through turbulent waters this week, with the S&P 500 losing 0.95%, precious metals emerged as the unsung heroes. Gold rebounded strongly (spot price up 4.48% for the week, at $2,329.75/Oz) with wars raging in the Middle East and Ukraine. The fresh record high comes even as an unexpected expansion in U.S. manufacturing activity and an upbeat U.S. jobs report cooled hopes of earlier rate cuts, pushing Treasury yields higher.

However, it was silver that truly dazzled, showcasing a remarkable weekly performance.

Silver Soars Sharply

Despite the historically strong correlation between gold and silver prices, the recent surge in gold prices had not been mirrored by silver. This time, silver outshined the yellow metal with a 10% increase over the week, the spot price reaching $27.48/Oz, a level not seen since June 2021. This surge was fueled by a technical breakout above the key resistance level of $25/Oz. Silver has likely the potential to rally toward $30/Oz.

Copper Price Jumps to 14-Month High

On the base metal front, copper futures surged to above $4.24 per pound, lifted by strong demand for solar panels — copper is one of the most efficient conductors of electricity — increasing supply risks and fresh weakness for the greenback. Continued disruptions in major mines are still affecting the supply, with activity being hindered by logistical issues in Congo and droughts in Zambia. Recording a 5.67% jump this week, copper futures hit their highest mark since January 2023. The rally in copper prices highlights their sensitivity to geopolitical and economic changes and the crucial role of this base metal in the global economy.

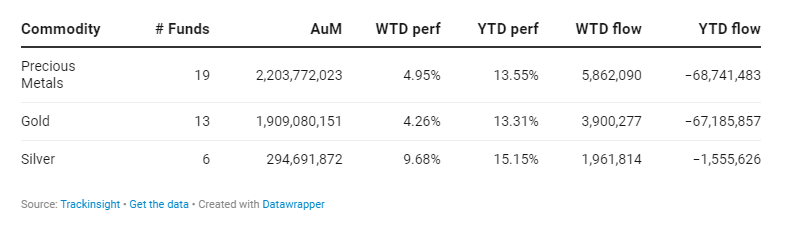

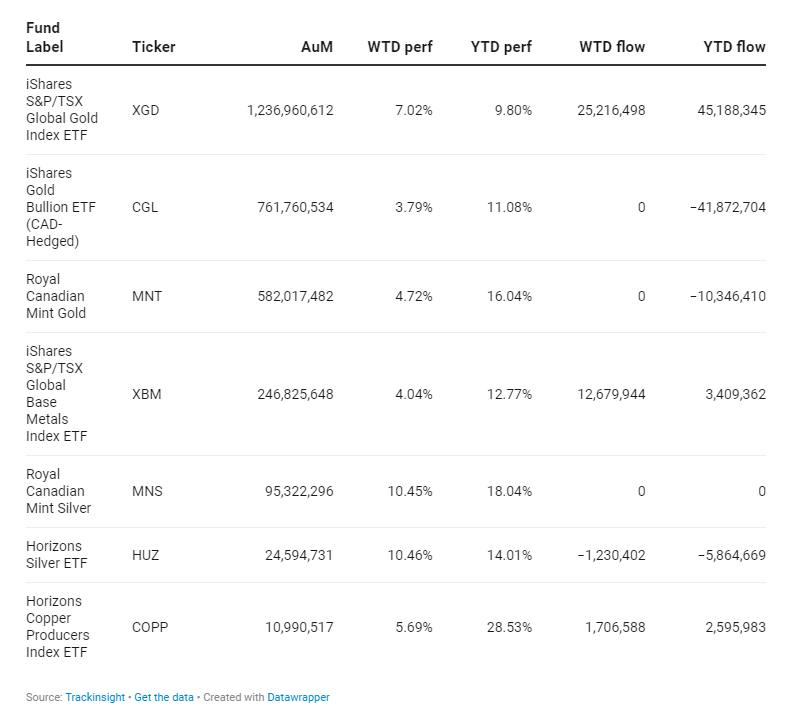

ETFs Ride the Wave

The upward trajectory of precious and industrial metals was reflected in the performance of related Exchange-Traded Funds. The Royal Canadian Mint Silver (MNS) and the Horizons Copper Producers Index ETF (TSX:COPP) experienced notable gains of 10.45% and 5.69%, respectively. These movements underscore the growing investor interest in metal-based ETFs as a hedge against inflation and an efficient way to diversify their portfolios.

Group Data