The US housing market, believed to be bigger than the US stock market, recovered during the past decade of low interest rates and is now coming under pressure, with the Federal Reserve (Fed) raising the Fed funds rate for the fourth time to curb inflation. Amid the uncertain geopolitical environment and sticky inflation (stagflation), the Fed hiked the rate by 25 percentage points (ppt) in March 2022, by 0.75ppt in June 2022 (for the first time in almost 28 years) and again by 75 basis points (bps) in July 2022 to slow rising inflation because of the supply-chain disruptions caused by the Ukraine/Russia conflict. A high interest rate reduces the buying power of borrowers, as they need to pay more interest. Inflation remains a concern, reflected by the consumer-price index (CPI), which rose to 9.1% in June 2022 from 8.5% in May 2022 (the highest since 1981), mainly as food prices rose by 1.1% and energy costs by 7.5% in July 2022. The Fed, on 17 August 2022, commented on raising interest rates further to quell US annual inflation and that it would slow the pace of hikes “at some point”. This benchmark rate was slashed to zero at the start of the pandemic but now sits at 2.25-2.5%.

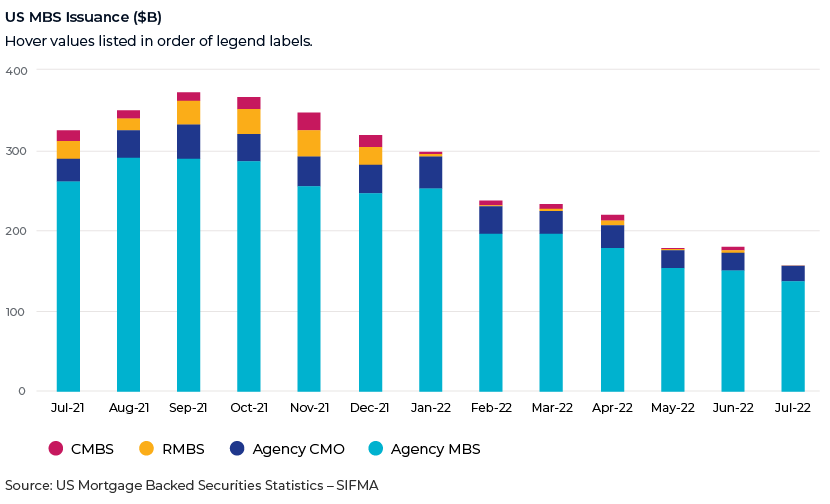

Forecasts released with the July decision show projections for a 3.25-3.5% Fed funds rate by the end of 2022, the highest since 2008. This implies several small hikes in store this year, reaching close to 4% in 2023 before declining in 2024. The Fed’s statement also confirmed its plan to reduce its balance sheet by September 2022, which includes a net reduction of USD35bn of mortgage-backed securities a month when fully phased in.

Does a Fed rate hike increase the mortgage rate?

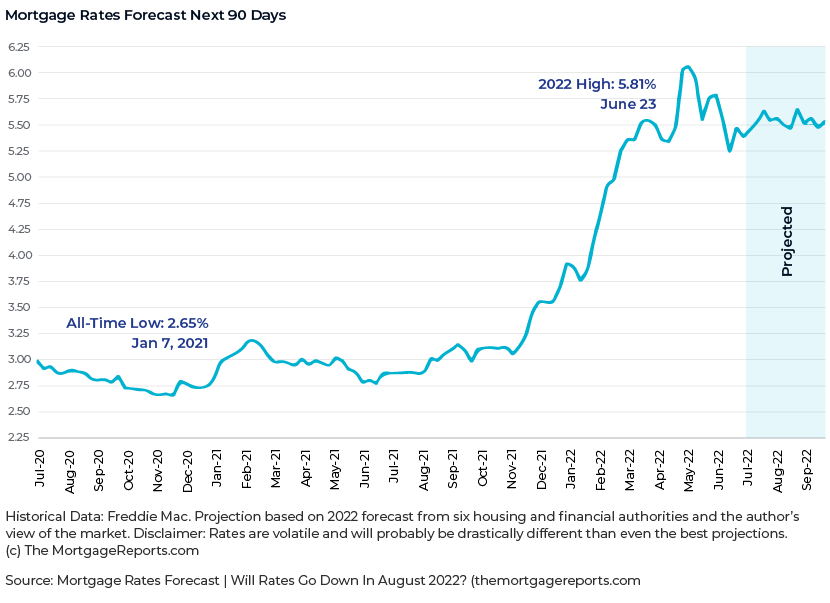

There is a popular misconception that the Fed sets mortgage rates. Fed rate hikes, along with inflation and housing inventory, do steer mortgage activity, resulting in higher rates and a reduction in demand. By raising interest rates, the Fed made mortgages more expensive, as we have seen this year, with the mortgage rate at its highest since the 2008 financial crisis. This meant existing-home sales and mortgage applications taking a hit and falling by double digits amid recession fears and rising interest rates. This was evidenced in June 2022, when an unexpectedly large increase in the Fed rate pushed the mortgage rate higher than we expected, although it seems to be declining gradually. Mortgage rates have historically moved in tandem with 10-year Treasury bond rates; however, the spread has widened by a full percentage point in recent months.

Fed funds rate hikes and changes in long-term interest rates have also moved in parallel, as evidenced from November 2015 to 2018, when a 225bps expansion in the Fed funds rate led to an interest rate of 4.9%. The average 30-year fixed interest rate jumped to 5.54% on 12 August 2022 (a 13bps increase from the previous week; a basis point is equivalent to 0.01%), and the average rate for a 15-year fixed mortgage was 4.91% (a 21bps increase from the previous week). With US interest rates (30-year) hovering around 5%, existing-home sales have fallen by more than 14% from 2021.

Household owners that take out adjustable-rate mortgages or home equity lines of credit (HELOCs) are impacted adversely, as their cost of borrowing increases with a Fed’s benchmark interest rate hike. This is mainly because interest rates on HELOCs are directly linked to the Wall Street Journal prime rate, which is the base rate on corporate loans. The prime rate rose to 5.50% on 28 July 2022 (US prime rate = The Fed funds target rate + 3). Affected homeowners should start considering the option of converting to fixed-rate loans and review details of their loan paperwork to understand how a rate increase affects their loan.

The US is seeing a housing deficit, with robust demand for rentals, and multifamily and single-family housing. Refinancing application volumes have declined over 60% on a y/y basis, with purchase application volumes slowing due to higher interest rates and property prices; volumes had declined 10-12% y/y as of mid-June 2022. However, there is a silver lining for buyers concerned about not being able to meet the seller’s price. If interest rate hikes help home prices stabilise, people would prefer switching to owning a house from renting one. The great migration to the Southern states (the “Sun Belt”) continues as American corporations and workers relocate to jurisdictions with lower taxes (e.g., Texas), warmer climates with more space, and better value for money.

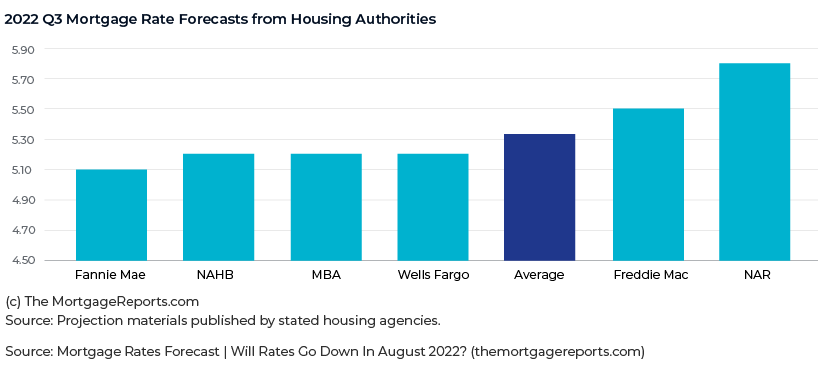

Mortgage interest rate forecast for the next 90 days: The Fed’s aggressive hike plan forecasts further mortgage rate hikes.

The Mortgage Bankers Association and the National Association of Realtors estimate the 30-year fixed-rate interest rate will settle at 5.2% by end-3Q 2022. On the other hand, Fannie Mae and Freddie Mac shared the highest prediction, forecasting the rate at 5.5% by end-September 2022.

The way forward: streamlining the workforce, with a fall in demand

Rising mortgage rates (with the biggest quarterly climb in 28 years in 1Q 2022) mean fewer qualify for a mortgage, prompting mortgage lenders and brokerages to reduce staff costs. Mortgage giants such as Wells Fargo (NYSE:WFC) & Co. and Rocket Co. have pruned staff in 2022, and online lender Better.com has been laying off about half of its workforce since December 2021. JP Morgan Chase (NYSE:JPM), one of the biggest banks in the country, has laid off/reassigned hundreds of employees from its home-lending business. Companies such as Lennar Corp (NYSE:LEN). have reduced prices and offered buyer incentives to strengthen sales in the housing market.