TSX has several aviation companies listed on it. Along with the traditional passenger airlines, it also has aviation equipment and air cargo. Irrespective of the stocks you pick, conduct your research and consider even the smallest factors while assessing. Not every stock may be favourable to every investor. For some investors, the selection criteria may be on dividends; for others, it may be the revenue generated by the company.Highlights

- Cargojet stock witnessed a QTD increase of 16.95 per cent.

- Air Canada showed a decline and fell by 3.21 per cent within a month.

- The YTD performance of Air Canada stock was -10.17 per cent.

As a long-term investor, reposition your portfolio from time to time depending upon the criticality of the market. The aviation sector faced a downturn during the pandemic time. Now, with increasing inflation and interest rates, the sector may again fluctuate up and down. Make sure to pick the stocks that prove to be favourable to you. Now, let us look at the two stocks mentioned with their recent financial performance.

Cargojet’s stock witnessed a QTD (quarter-to-date) increase of 16.95 per cent. In Q3 2022, the total revenues grew to C$ 232.7 million from C$ 189.5 million in Q3 2021. The adjusted EBITDA also rose to C$ 82.1 million compared to C$ 70.9 million for the same comparative period.

The net income was posted at C$ 83.4 million versus a net loss of C$ 12.9 million in 2021. Cargojet announced the dividend of C$ 0.286 per share to be distributed quarterly, followed by earnings per share of C$ 11.20. The dividend yield for the company is 0.876 per cent.

In Q3 2022, the operating revenues for the company were reported at C$ 5.322 billion versus C$ 2.103 billion in Q3 2021. The net loss for the company was reported at C$ 508 million compared to a net loss of C$ 640 million.

As of September 2022, the net debt of Air Canada increased to C$ 7,829 million versus C$ 6,953 million on December 31, 2021.

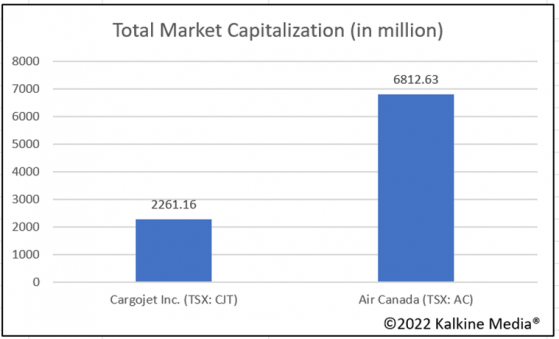

On an MTD basis and YTD basis, Air Canada stock fell by 3.21 per cent and 10.17 per cent. The graph below illustrates the total market capitalization of Air Canada and Cargojet.

Bottom Line: Currently, the economy is facing a downturn due to different macroeconomic factors. Amidst the market chaos, work with a long-term strategy. The stock market does not guarantee anything. Hence, the investors must prepare themselves to cope with prevalent risks and uncertainties. Find the right opportunities to tap on to get your desired portfolio.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.