Highlights

- In Q2 2022, Xebec Adsorption Inc. reported revenue of C$ 44.5 million.

- CloudMD Software & Services Inc. added over 350 new customers to their network in Q2 2022.

- Hamilton Thorne's went up 14 per cent YoY for the quarter that ended on June 30, 2022.

Along with research, try to keep your portfolio diversified. Several investors follow a single strategy i.e., focusing on one factor. Instead, go for multiple strategies and pick up stocks from different stocks with growth potential opportunities.

Here, we explore six penny stocks and their recent performances amid a volatile market:

In Q2 2022, Xebec’s revenue was C$ 44.5 million compared to C$ 32.7 million in the year-ago quarter. The company incurred a net loss of C$ 23.4 million compared to a net gain of C$ 10.2 million for the same comparative period.

There was a decline in the net debt which was reported at C$ 37.8 million as against C$ 43.4 million on December 31, 2021.

In Q2 2022, CloudMD Software posted revenue of C$ 40.3 million, which was an increase of 157 per cent over the same period in 2021. The adjusted EBITDA plunged to C$ 3.2 million compared to a loss of C$ 0.6 million for the same comparative period.

As on June 30, 2022, the cash and cash equivalents for CloudMD Software also decreased to C$ 29.7 million versus C$ 46.88 million on March 31, 2022.

The company added over 350 new customers to their network of 7,200 clients in the reported quarter.

For the quarter that ended on June 30, 2022, Hamilton Thorne's sales went up 14 per cent year-on-year (YoY) to US$ 14.2 million compared to the same period the previous year. The gross profit of the company grew by 11 per cent to US$ 7.1 million for the same comparative period.

For the reported quarter of fiscal 2022, its net income declined to US$ 274,537 versus US$ 482,419 million a year-ago quarter. The adjusted EBITDA decreased by one per cent to US$ 2.43 million. Hamilton’s organic growth was reported to be at eight per cent.

As of June 30, 2022, the total assets for Hamilton Thorne decreased to US$ 70.29 million compared to US$ 75.06 million on December 31, 2021.

On April 1, 2022, Uranium Royalty Corp. announced its acquisition of additional one per cent gross revenue royalty interest on the Lance Uranium Project in Wyoming, USA.

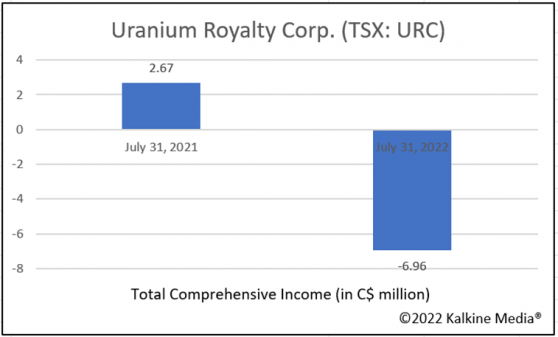

The picture below depicts the total comprehensive income of Uranium Royalty Corp. in two different time periods.

For the quarter that ended June 30, 2022, Aleafia Health's revenue rose to C$ 6.51 million compared to C$ 11.65 million a year-ago quarter. The cash and restricted cash was C$ 5.62 million versus C$ 4.85 million for the same the comparative period.

As of June 30, 2022, the total assets for Aleafia Health Inc. increased to C$ 86.37 million from C$ 85.14 million on March 31, 2022. On the other hand, the liabilities decreased to C$ 66.97 million from C$ 83.53 million for the same comparative period.

In Q2 2022, Calibre Mining's revenue increased to C$ 111.26 million from C$ 78.78 million in Q2 2021. For the same timeline, the net income also rose to C$ 15.42 million compared to C$ 11.88 million in the corresponding quarter a year ago.

Bottom Line: Before diving into penny stocks, make sure to go through the financials of the companies in a detailed manner. Check with the prospects and convert them into opportunities.

If you are a long-term investor, go for the stocks that operate against volatility and are consistent. This can lead to your balanced portfolio and help your portfolio perform better.

If you are a short-term investor, look for the stocks that are currently trending in the market and invest accordingly. You can use disposable income as well while investing in penny stocks.

Please note, the above content constitutes a very preliminary observation based on the industry and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.