- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Avantis U.S. Small-Cap Value ETF (AVUV) Hits $10 Billion AUM Milestone

Among the variety of factor investing strategies available to investors, funds that emphasize a small-cap value tilt have become particularly popular, thanks in part to their decreasing fees.

Standing out in this crowded field, the Avantis U.S. Small-Cap Value ETF (AVUV) recently surpassed a significant milestone, amassing over $10 billion in assets under management (AUM).

This ETF's success can be attributed to its unique rules-based strategy, which focuses on selecting companies by size, valuing undervalued stocks, and prioritizing profitability.

These criteria have historically allowed AVUV to outperform its benchmark significantly, drawing the attention of both do-it-yourself investors and advisors who aim to beat market-cap-weighted indexes.

"AVUV hit a milestone, as did Avantis overall - we crossed $40 billion in AUM across our strategies," says Mitchell Firestein, senior portfolio manager at Avantis Investors. "These are fun milestones to cross as a team because it tells us that clients are finding value in what we do. But our focus doesn’t change – we want to do our best every day to keep earning the trust that clients have placed in us."

Here's everything you need to understand about AVUV and the reasons behind its impressive growth and performance.

What is small-cap value investing?

To fully grasp the concept behind AVUV it's essential to dive into its academic foundation, particularly the Fama-French three-factor model, which was later expanded to include five factors.

These factors are key to understanding how certain aspects of the market are targeted for potential outperformance. Here are the five factors:

- Size (Small minus Big, or SmB): Smaller companies, or small-cap stocks, tend to outperform larger companies over time, potentially due to higher risk and growth potential.

- Value (High minus Low, or HmL): Stocks with lower price-to-book ratios or other value metrics are seen as undervalued and may outperform more expensive, or "growth," stocks.

- Market Risk (Market): The overall risk associated with the stock market, indicating that stocks, in general, have higher expected returns than safer investments like Treasury bonds.

- Profitability (Robust minus Weak): Companies that are more profitable, as measured by earnings compared to their book value, tend to outperform those that are less profitable.

- Investment (Conservative minus Aggressive): Firms that invest conservatively are found to outperform those with more aggressive investment strategies.

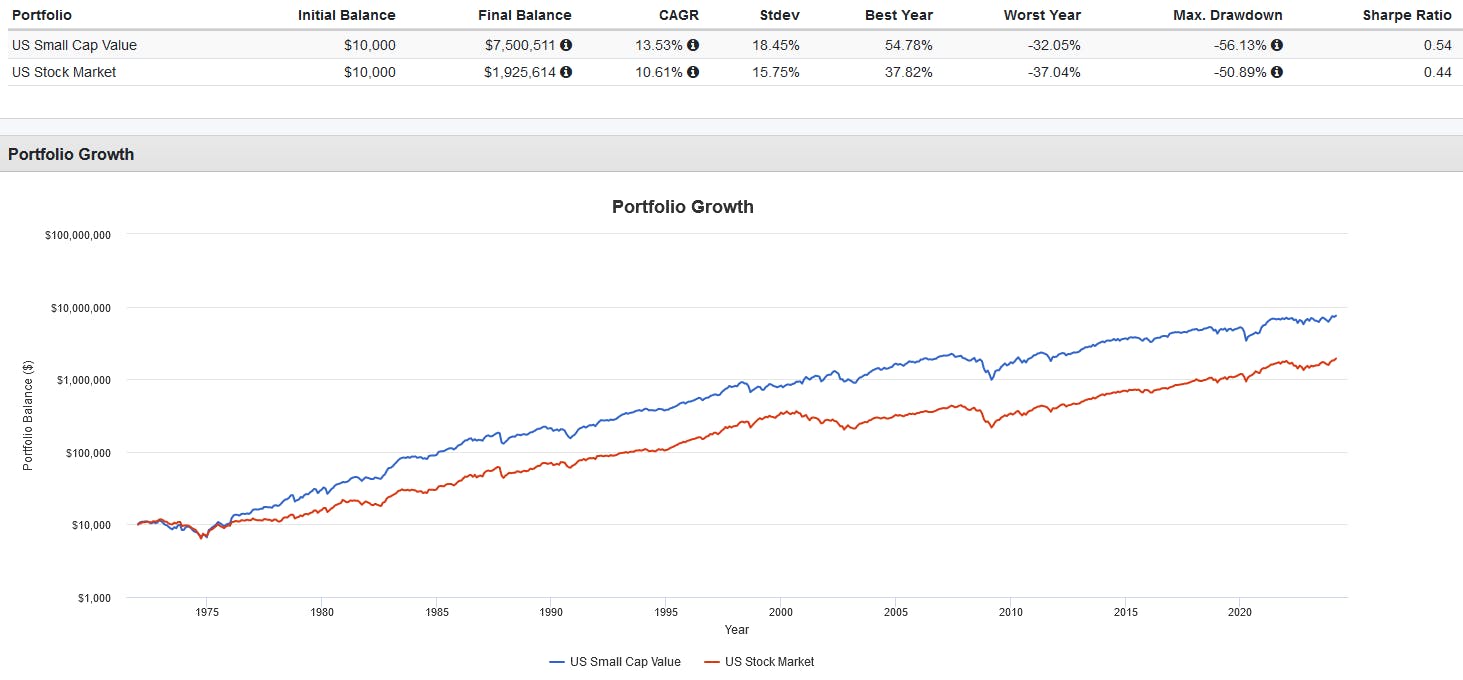

Today, factor ETFs, such as AVUV, target one or more of these factors in combination to gain an edge in the market. A popular combination is small-cap value, which historically has outperformed the total U.S. market by a significant margin, as seen below:

How does AVUV ETF work?

AVUV ETF operates by targeting stocks that exhibit higher profitability, distinct value characteristics, and smaller market capitalizations.

The ETF employs an active, rules-based methodology to evaluate small companies, focusing on adjusted book/price ratios to identify value and adjusted cash from operations to book value ratios to assess profitability.

Importantly, AVUV is not bound to the reconstitution or rebalancing schedule of an index. This allows the portfolio managers significant discretion to sell off securities that no longer align with the fund's desired characteristics for size, value, or profitability.

Despite a 0.25% expense ratio, which might initially appear high, this fee is actually quite competitive for factor ETFs, particularly when considering AVUV's performance.

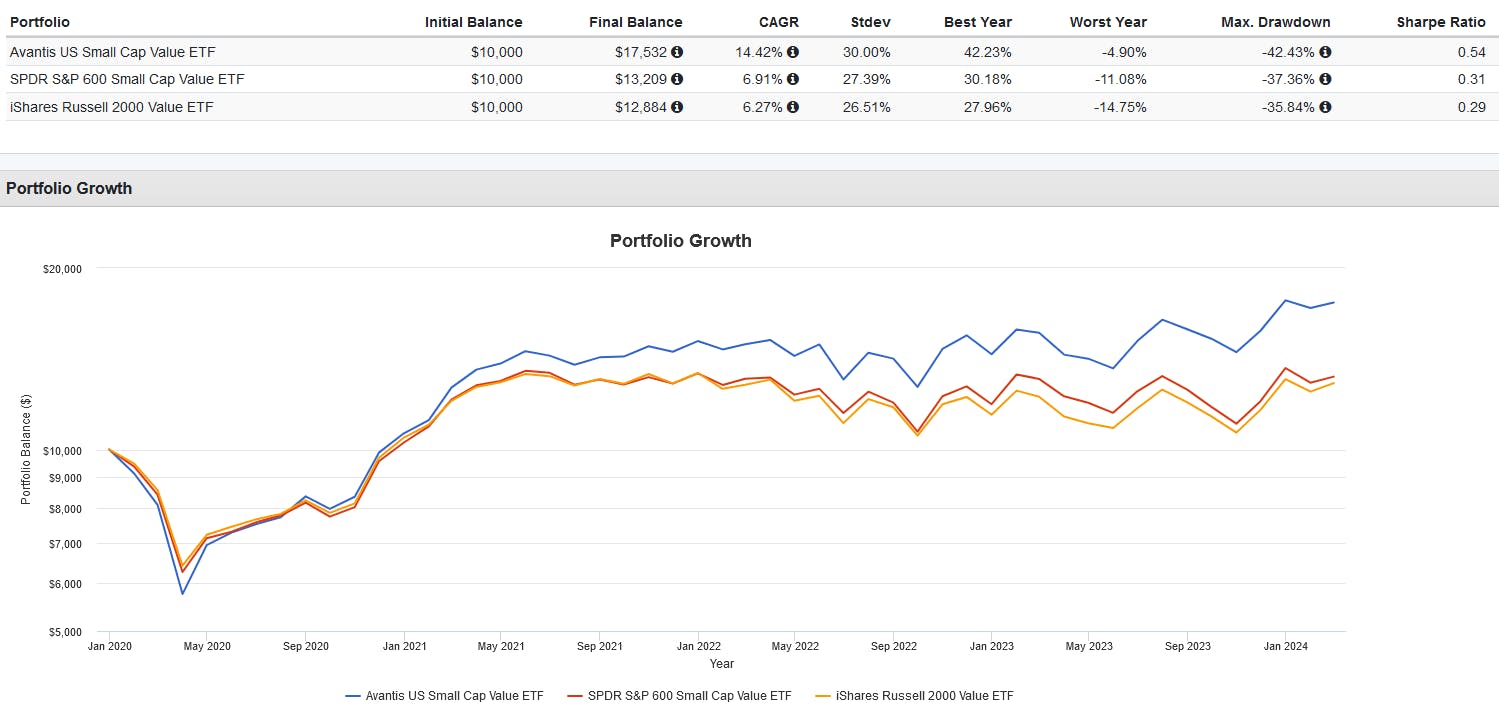

Since its inception, AVUV has strongly outperformed popular passive ETFs that track benchmarks like the S&P 600 Small-Cap Value Index and the Russell 2000 Value Index.

How does AVUV ETF work?

AVUV ETF operates by targeting stocks that exhibit higher profitability, distinct value characteristics, and smaller market capitalizations.

The ETF employs an active, rules-based methodology to evaluate small companies, focusing on adjusted book/price ratios to identify value and adjusted cash from operations to book value ratios to assess profitability.

Importantly, AVUV is not bound to the reconstitution or rebalancing schedule of an index. This allows the portfolio managers significant discretion to sell off securities that no longer align with the fund's desired characteristics for size, value, or profitability.

Despite a 0.25% expense ratio, which might initially appear high, this fee is actually quite competitive for factor ETFs, particularly when considering AVUV's performance.

Since its inception, AVUV has strongly outperformed popular passive ETFs that track benchmarks like the S&P 600 Small-Cap Value Index and the Russell 2000 Value Index.

Additionally, AVUV has shown superior loadings to the size, value, and profitability factors, demonstrating its effectiveness in capturing the intended market segments and contributing to its appeal among both DIY investors and advisors looking for an edge over market cap-weighted indexes.

"When we started Avantis, the goal was to combine the benefits of indexing with the potential for outperformance for investors - so far, things are going according to plan," Firestein says. "For the ETFs we have that have a longer than three-year track record, the average annualized excess return net of fees is 1.95% - this has been achieved at fee levels that are very competitive with passive funds."

This content was originally published by our partners at ETF Central.

Related Articles

Europe’s defense strategy is shifting fast. With former U.S. President Donald Trump demanding higher NATO spending and reducing support for Ukraine, the EU is stepping...

One of the easiest risks to minimize in investing is excessive fund fees. That’s why, when looking for ETFs, you should always try to minimize the management fee, which is the...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.