- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Canopy Growth Vs. MedReleaf: Which Stock Has Greater Upside?

MedReleaf Corp (TO:LEAF) has an edge in its production-cost profile, while Canopy Growth Corp (TO:WEED) has the clear upper hand with higher production capacity

SmallCapPower | November 17, 2017: Canadian marijuana stocks have been receiving much investor interest in recent days following the decision of Constellation Brands (NYSE:STZ) to take an ownership interest in Canopy Growth, as well as Aurora Cannabis’ takeover bid for CanniMed Therapeutics. As most marijuana investors know, the top spot in the cannabis industry belongs to the incumbent Canopy Growth Corp, which has taken advantage of its branding, early Health Canada approvals for sale and export, and a first-mover position in the market. However, the entry of new players has changed the competitive landscape, with the top players fighting for a share of the large opportunity with heavy investments in expanding their production capacity. One among those players is MedReleaf Corp., which is Canada’s first and only ISO 9001 and ICH-GMP certified producer of medical cannabis.

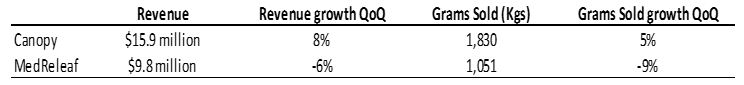

Quarter-to-Quarter Growth

For these companies, revenue growth is the most significant factor and it is quickly reflected in stock prices as quarterly reports roll out.

MedReleaf posted negative revenue growth in its most recent quarter due to the impact of volume and price restrictions imposed by the VAC policy in November 2016 and May 2017, respectively. Canopy Growth has not been affected by the VAC policy, which shows how well the Company’s management had overcome the regulatory change, posting decent growth.

Production and Supply

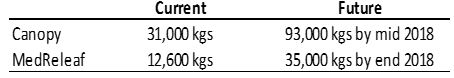

There is currently a lack of supply in the industry. Additionally, the upcoming legalization of recreational marijuana use in Canada in July 2018, will further drive demand. Both companies are ramping up their production facilities but there will be a period of time before these facilities can come online. So, it is important to understand production profiles of both companies.

With three times the current and expected production, Canopy Growth wins this metric. Canopy’s humongous capacity will play a huge role in capturing the market as, and when, recreational marijuana use gets legalized.

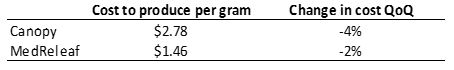

Production Cost/Gram

Cost to produce will significantly define the companies’ margin levels, so it is important to compare this metric for the recent quarter. This is a factor that will scale in importance as revenues grow.

Clearly MedReleaf wins in this metric. MedReleaf is able produce with almost 50% less cost as compared with Canopy Growth, which is a big plus for MedReleaf. Due to the very low production cost, MedReleaf is able to generate profits at the operating level and has positive EBITDA levels. On the other hand, Canopy Growth is unprofitable at the operating level.

Recent Developments

Canopy Growth recently (October 2017) announced plans to expand production capacity by about 3.0 million sq ft in British Columbia. The Company is currently licensed to produce 31,000 kgs of marijuana and related products, and aims to triple that by July 2018.

Recently, in November 2017, MedReleaf received a sales license for its second facility in Bradford, Ontario. The Company received the sales license within six months after getting the cultivation license in April 2017. This development has helped MedReleaf increase the total current licensed production and sales capacity by 80% to ~ 12,600 kg per year. And once the construction of the Bradford facility is fully completed in the summer of 2018, total licensed production and sales capacity from MedReleaf’s two facilities in Markham and Bradford will be 35,000 kg per year.

Valuation

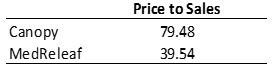

Most of the Canadian marijuana stocks are trading at higher valuations due to the future expectations and the nascent stage of the industry. Recent valuations are astronomically high given the increased investor activity in the cannabis space as the recreational legalization date in Canada is fast approaching.

In terms of price-to-sales, Canopy Growth currently trades at a 100% premium to MedReleaf. This premium can be easily justified given that Canopy Growth has better growth prospects, higher production capacity and huge international opportunity.

Conclusion

Overall, both companies have the potential to provide monstrous returns for investors heading into recreational legalization in Canada. While MedReleaf has an edge only in its production-cost profile, Canopy Growth has the clear upper hand with higher production capacity, decent growth rates and huge international opportunities. Thus, Canopy Growth is more attractive from an investment perspective and has the potential to provide much higher returns as compared with shares of MedReleaf.

Disclosure: Neither the author nor any of the principals at SmallCapPower, or their family members, own units in any of the companies mentioned above.

Related Articles

The cryptocurrency market experienced a major rally following Donald Trump’s announcement that Bitcoin, Ethereum, XRP, Solana, and Cardano will be included in a new U.S. strategic...

One of the easiest risks to minimize in investing is excessive fund fees. That’s why, when looking for ETFs, you should always try to minimize the management fee, which is the...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.