- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Coca-Cola's Record Highs: Time to Pause Before the Bubble Bursts?

Coca-Cola Co.'s (NYSE:KO) stock continues to dazzle, having recently reached a record high. Over the past year, the consumer goods giant's shares have consistently hit new highs, driven by strong momentum and robust operational performances despite headwinds. However, following a momentous run last year, the stock now seems overextended and is fairly valued at current levels.

Nevertheless, the soda manufacturer appears to have defied the negative broader perception surrounding it. Many worried about lackluster quarterly results due to the worsening economic and geopolitical challenges across key markets. This can be seen in its latest quarterly results, which recorded sluggish growth in North America and volatility in the Middle East, compounded by currency and structural challenges.

The company has held up and exceeded expectations with comfortable margins across both lines. However, the stock has run too far, so any potential gains from its upcoming quarterly results are already factored in. Historically, September has consistently been the weakest trading month for the company, based on a decade's worth of data. With that in mind, let's delve deeper into Coca-Cola's story and assess why the stock is too hot to touch at this point.

Recent performance packs a punchDespite being up against formidable headwinds, Coca-Cola's recent operational performance has been remarkable. Hence, it is unsurprising the stock has surged upwards of 20.70% over the past six months alone.

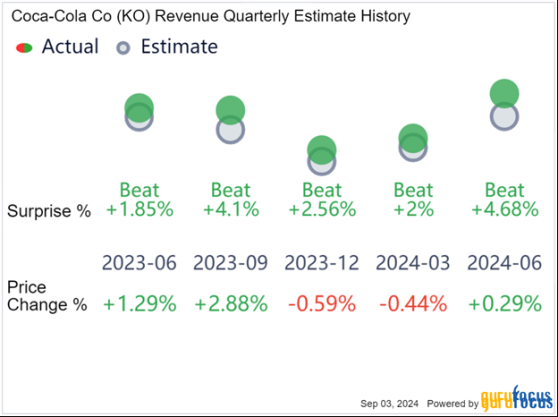

The snapshot below shows that in the past five consecutive quarters, it has sailed past top-line expectations with aplomb. The most notable surprise came from its recent showing in the second quarter, which exceeded expectations by 4.68%. Additionally, it outperformed expectations by 2% in the previous quarter, efficiently maintaining its robust momentum.

The positive trend for its earnings per share, excluding non-recurring items, is perhaps even more favorable. It outstripped estimates by a comfortable 4.22% in the second quarter and surpassed expectations by 3.30% in the previous quarter, underscoring its strong profitability position.

Coca-Cola's operational review for the first half of 2024 shows consolidated 2% growth in concentrate sales and an 11% bump in price/mix, which led to a heartening 13% increase in organic revenue. Regionally, the Europe, Middle East and Africa segments showed a significant 23% growth in price/mix, offsetting the 21% currency drop to post 23% organic revenue growth. Latin America is the pick of the regions for the soda giant, boasting a 25% increase in organic revenue, supported by a 21% improvement in price/mix.

Source: Coca-Cola second-quarter press release

However, North America's sales stagnated with 0% growth in concentrate sales, although it managed to post a 9% organic revenue bump mainly through price adjustments. Moreover, Asia Pacific and Global Ventures saw modest organic revenue growth at 5% and 1%, respectively. Bottling Investments also faced a sizeable 26% decline, mainly due to structural changes.

Despite a few shortcomings, Mr. Market reacted positively to the results, pushing the stock to new heights. A big part of that was the full-year guidance bump, alongside the diversification of its revenue streams, positioning Coca-Cola as a robust, inflation-resistant pick. The chart below illustrates how the company's revenue streams have diversified over the past decade.

In 2014, most of Coca-Cola's sales (51%) came from Bottling Investments. A decade later, the reliance on Bottling Investments has dropped substantially to around 17.20%. Additionally, North America's share has risen significantly to 36.70%, but other regions like Europe, the Middle East and Africa, Latin America and Asia Pacific have maintained their proportions, contributing to a more even distribution of revenue sources. Overall, Coca-Cola's revenue is far more diversified in 2023 compared to 2014, with a broader spread across multiple geographic areas.

Further, the company projects healthy organic revenue growth of 9% to 10% for the year, driven by strong operational performance and strategic pricing. It is important to note the forecast exceeds Coca-Cola's long-term growth target of 4% to 6% organic sales growth. Additionally, the company anticipates a superb comparable currency-neutral earnings per share, targeting a 13% to 15% jump this year.

Profitability continues to shineSay what you want about Coca-Cola, but its profitability metrics never cease to amaze. Backed by spectacular earnings growth and strategic pricing power, the company remains a standout in the beverage space, consistently outperforming peers.

Coca-Cola attracts a solid 8 out of 10 profitability rating from GuruFocus, reflecting its robust financial health. The company boasts a high gross margin of 60.53%, which comfortably trumps the industry average and is virtually in line with its 10-year median of 60.60%. Moreover, its operating margin of 26.32% and net margin of 22.92% underscore its ability to manage costs effectively and post vigorous profits.

Additionally, Coca-Cola's return on equity stands at 40.78%, demonstrating powerful shareholder returns, while its return on invested capital of 13.13% highlights its effective asset and capital utilization. Moreover, with a stellar 10-year track record of profitability, it boasts almost a 20% free cash flow margin, ranked 90% higher than its peers.

Moreover, the chart above shows a positive upward trend in its ROIC over the past decade, outperforming its weighted average cost of capital. The positive relationship shows the company can efficiently generate returns above its cost of capital, pointing to its efficient capital allocation and strong profitability. The steady rise in ROIC from a low point in 2017 to 2023 demonstrates Coca-Cola's resilience in maintaining its financial health.

Further, the tendency is supported by its earnings per share without NRI chart, showing a strong upward move above the trendline. After some fluctuations around 2010 and a dip around 2020, we can see the company's earnings growth has accelerated at a healthy pace, staying above the 6.64% trendline.

Upside seems priced inAs mentioned, Coca-Cola's stock has been a killer run of late, surging to record highs. However, given the double-digit run-up in price, the stock now trades upwards of 29.30 times trailing 12-month earnings. Things get even crazier if we consider it is trading more than 34.60 times its trailing 12-month free cash flow, the highest it has ever been for the company. Additionally, the PEG ratio of 3.64 is at a multiyear high, showing that while the company has impressive earnings growth, its stock is currently valued at a premium relative to that growth.

Trading at around $72.47, the stock is at a 2.10% premium to its average price target of $70.93, with estimates ranging from $65 to $78.

GuruFocus estimates suggest an even lower GF Value of $68.88, a potential downside of almost 5% from its current level. This suggests Coca-Cola could be heading for a breather, with its future growth prospects already baked into its current price.

The trend is underscored further by the Peter Lynch chart for the beverage titan. Based on current prices, the stock is remarkably overvalued compared to its historical price-earnings benchmarks. The blue line representing its stock price has consistently hovered over the Peter Lynch earnings line (price-earnings ratio equal to 15) shown in black. Additionally, the red line, which shows its price-earnings without NRI over the last 15 years (price-earnings ratio equal to 23.20) suggests that current prices exceed even this higher valuation benchmark.

The fact Coca-Cola's stock has held up over the Peter Lynch line and the median price-earnings over the past year or so suggests it is significantly overvalued, with investors paying a premium compared to historical averages.

TakeawayCoca-Cola has been on a tremendous run over the past year, recently hitting record highs on the back of its spectacular operational results despite the economic roadblocks. However, its stock offers little margin of safety, if any, with limited upside potential. The stock is trading at a premium, with a price-earnings ratio significantly over its historical benchmarks, suggesting that future growth prospects are priced in. Analyst estimates reiterate the overvaluation theme, expecting a slight downside from its current price. Therefore, it is best to stay cautious with the stock appearing overbought based on current metrics and historical numbers.

This content was originally published on Gurufocus.com

Related Articles

Most of the major asset classes rallied in February, based on a set of ETFs. The downside exceptions: US stocks and a broad measure of commodities. Otherwise, global markets...

March 3, 2025 (Maple Hill Syndicate) - In the first two months of this year, technology stocks fell more than 4% and consumer discretionary stocks fell about 5%. They were the...

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.