- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Inflation Day: Today's Report Could Help Revive Year-End Rally Hopes

- Focus shifts to the key inflation data due today

- This data will play a pivotal role in deciding the year-end rally's fate

- Decline in shelter inflation has continued, increasing odds of a lower-than-expected number

Today could be decisive in terms of determining whether the stock market's year-end rally will materialize, as all eyes turn to the looming inflation report.

Inflation, a driving force in the markets for the past two years, directly influences rate decisions by the Fed and ECB. Powell has repeatedly said that the Fed is focused on getting inflation back toward the 2% target.

So, let's shift our focus to the market's expectations to see if we could get any closer to that target today.

Our economic calendar anticipates a nearly flat core CPI, signaling minimal change, along with a decline in both monthly and annual CPI figures.

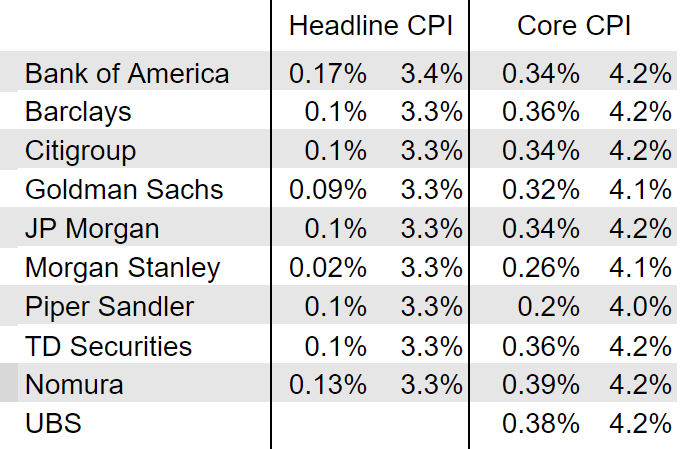

However, major investment banks offer a slightly different perspective, as illustrated below:

Source: The Internet

Specifically, while expectations for the CPI figure align, showing a decline at +0.1 percent change on a monthly basis and +3.3 percent change annually, the core figure anticipates a slightly larger annual change (averaging 0.1%).

We will find out in the next few hours if these figures are confirmed or if there is a deviation.

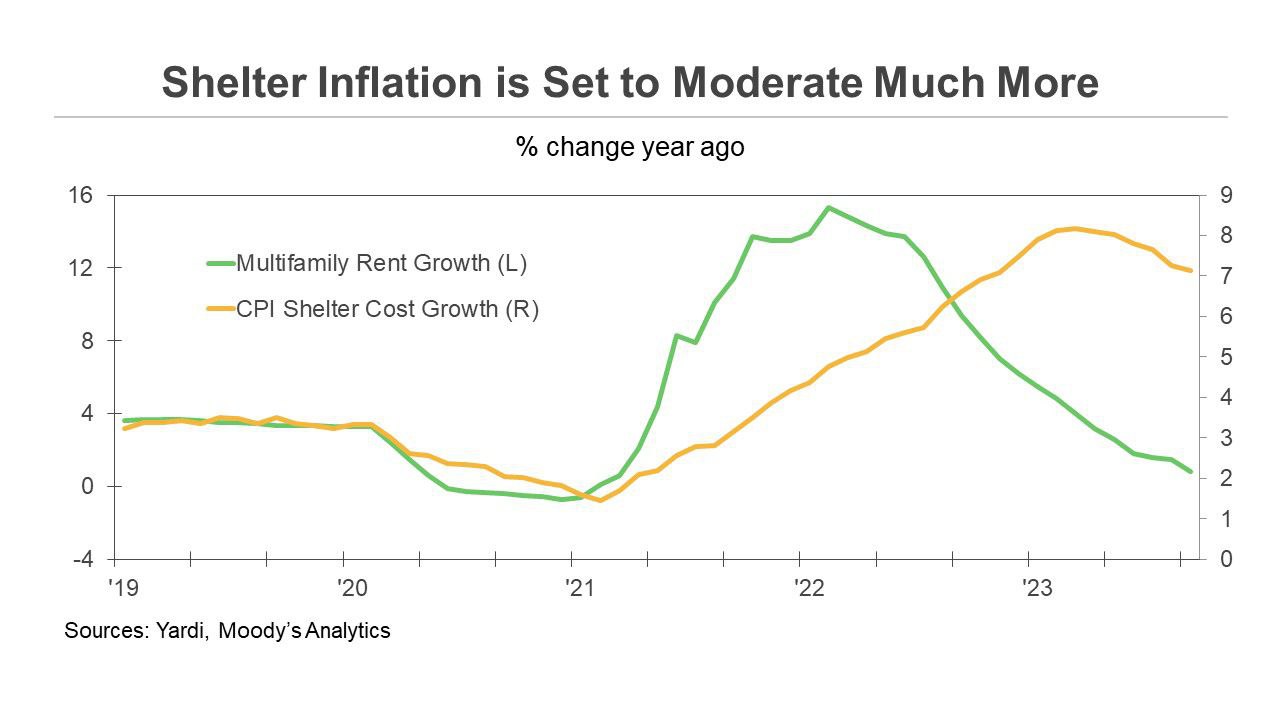

What remains certain is that one of the crucial components of the price figure, the Shelter component (comprising about one-third of the total figure), has been exhibiting signs of a slowdown for several months.

Source: Yardi

This could contribute to the overall decline. As is customary, the market's response to the report will be pivotal, likely favoring a positive reaction to a lower-than-expected figure and conversely reacting unfavorably in the opposite scenario.

Patience is key, not only after today's probable knee-jerk response but also throughout the entire week, to get a comprehensive understanding of how market participants perceive and digest the data over time.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Related Articles

DOGE is unlikely to cause a US recession, but its "move fast and break things" approach raises the risks. Narratives about the U.S. economic outlook have darkened in the past...

Discover this week’s market highlights with critical insights into weekly sell signals for the S&P 500, Nasdaq 100, and TSX 60. This video dives into key market dynamics,...

US equity futures are pointing to a higher open today. European markets have opened in the negative territory, following weaker Asian sessions. Global markets still have their...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.