- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

US Dollar Plunges to Its Lowest Level Since April 2022

The greenback sank to its lowest level since April 2022 on Thursday, as cooling US inflation bolstered expectations that the Federal Reserve will hike interest rates just once more this year, eroding the dollar's yield advantage over its peers. Data published on Thursday reinforced the view that inflation is moderating: U.S. producer prices (PPI) inched up 0.1% in June, with the annual increase at 0.1% as well, the smallest year-on-year rise in nearly three years. The PPI data followed Wednesday's consumer price index (CPI) report, which showed U.S. core inflation slowed a lot faster than expected. It came in at 0.2% in June against market expectations of 0.3%, while headline annual CPI fell to 3%.

Yet recent data revealed a surprising decline in U.S. initial jobless claims. For the week ending July 8, the figure dropped unexpectedly by 12,000 to reach a seasonally adjusted 237,000. While market participants disregarded this news, it does imply that the labor market continues to exhibit signs of tightness.

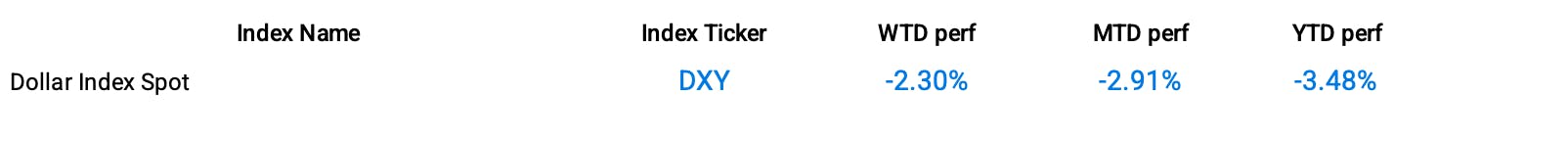

Against a basket of six currencies, the dollar index fell 2.27% week-over-week to 99.95, after dropping earlier to 99.50, a new 15-month low.

The euro rose 2.37% to $1.12, despite some deterioration in European data, after hitting a new 16-month high intraday on Friday. The greenback traded at approximately 1.31 $/£ against the British pound, marking a significant deviation from the levels observed last September (1.08 $/£) during a tumultuous period characterized by the UK government's internal turmoil. Data on Thursday revealed that the contraction of Britain's economy in May was milder than anticipated, supporting the idea the Bank of England may have room to increase interest rates without derailing growth.

Index Data

Funds Specific Data : UUP, USDU

This content was originally published by our partners at ETF Central.

Related Articles

The cryptocurrency market experienced a major rally following Donald Trump’s announcement that Bitcoin, Ethereum, XRP, Solana, and Cardano will be included in a new U.S. strategic...

One of the easiest risks to minimize in investing is excessive fund fees. That’s why, when looking for ETFs, you should always try to minimize the management fee, which is the...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.