- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Netflix Q1 Earnings Preview: Slowing Subscriber Growth Remains Key Risk

- Reports Q1 2022 results on Tuesday, April 19, after the market close

- Revenue Expectation: $7.94 billion

- EPS Expectation: $2.92

When streaming giant Netflix (NASDAQ:NFLX) reports its latest quarterly earnings tomorrow, investors may discover the entertainment services company has been finding it hard to attract new subscribers amid stiff competition and a tough macroeconomic environment.

Due to these headwinds, analysts have trimmed their earnings estimates for the Los Gatos, California-based company whose shares have fallen more than 40% in 2022. The stock has also been among the worst performers on the NASDAQ 100 Index so far this year.

Netflix was forecast to add just 2.5 million subscribers in the first quarter that ended on Mar. 31, a number that marks the slowest start to a new year for the company in at least a decade.

There could be additional downside as well since Netflix decided to exit Russia after its invasion of Ukraine. The entertainment company has between one to two million subscribers in Russia, according to media reports.

This situation has made it clear to investors that NFLX is entering a slow-growth period after a remarkable run during the pandemic. Netflix added 18.2 million customers in 2021, down about 50% from the previous, record year.

Morgan Stanley, in a note last week, lowered its price target on the stock ahead of earnings—to $425 from $450. Its note adds:

“Long term, we believe Netflix will deliver compelling revenue and margin growth. Near term, we see risk to consensus net adds expectations. Valuation is not stretched here, but we think it is unlikely shares can outperform with falling net adds estimates.”

Barclays also lowered its price target to $380 per share from $425, saying in a note:

“Based on the average predicted value across various short and long term models, Netflix appears to be on a path to ~4mm subs, better than company guidance, but still weak in the absolute for a Q1.”

Intensifying Competition

Adding to the difficulty of subscriber growth momentum, consumers have more choices now, courtesy of some of the world’s top entertainment content providers. The Walt Disney Company (NYSE:DIS), Netflix's most formidable competitor, announced in March that it would offer a lower-priced version of its streaming service, Disney+, with advertising later this year. The new offering will begin in the US in late 2022 and expand internationally next year. The company plans to release details about price and timing at a later date.

The post-pandemic weakness and intensifying competition are the two major catalysts that have divided analysts on Netflix in recent weeks.

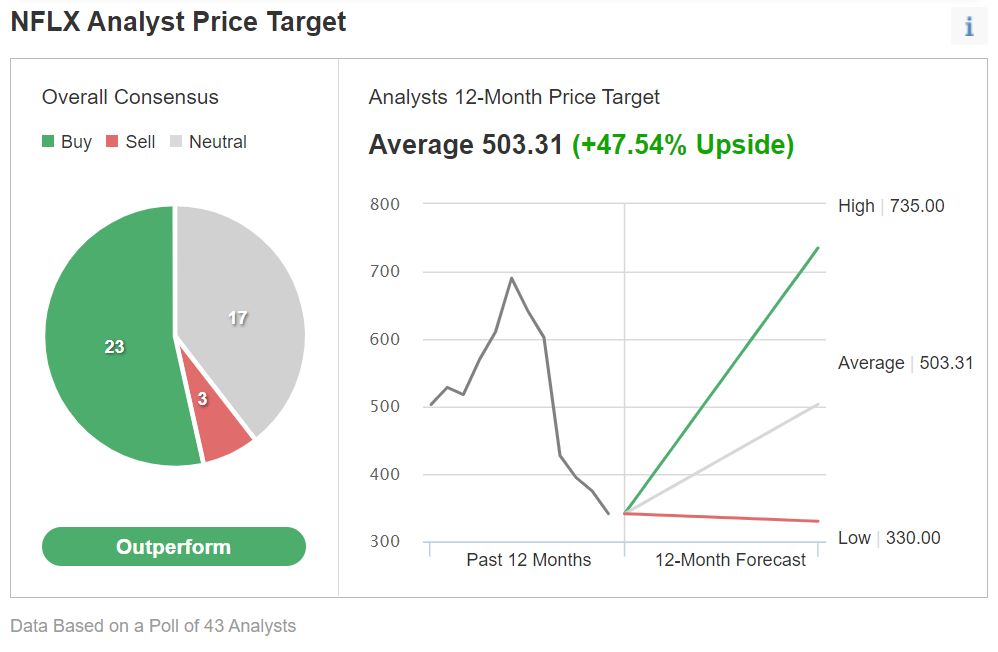

Chart: Investing.com

In an Investing.com poll of 43 analysts, though the majority of those surveyed provided an 'outperform' rating, significantly, 20 participants don't currently recommend buying the stock.

Despite this dismal short-term earnings outlook, Netflix stock offers a buying opportunity for long-term investors, given the company’s ability to attract new subscribers with best-in-class content, boosting margins and cash flow along the way. The recent share sell-off has the stock trading at a discount to its historical averages. Netflix now sells for 32 times forward earnings, less than half its five-year average.

J.P. Morgan analysts see Netflix having a strong second half of 2022. They've provided an overweight rating and a $605 price target on NFLX. That target implies 77% upside from Thursday’s closing price of $341.13.

An additional long-term development worth considering: Netflix isn’t dependent on debt to fuel its growth. After years of borrowing to fund production, the company said it no longer needs to raise outside financing to support day-to-day operations.

Bottom Line

Netflix may not provide a positive surprise tomorrow when it reports, but its stock has become an attractive buy after the recent slump. After solidifying its cash and competitive positions during the pandemic boom, the company is better positioned to return to growth.

Related Articles

TSMC has taken a hit over the past few weeks, falling about 10% YTD amid market turmoil driven by President Trump's tariff threats. I believe this drop is more about short-term...

Following the latest IM-2 mission news, Intuitive Machines Inc (NASDAQ:LUNR) stock is down 54% over the month. Presently holding at $8.95 per share, LUNR stock leveled down to an...

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.