- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Should Canada Cut Rates?

By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

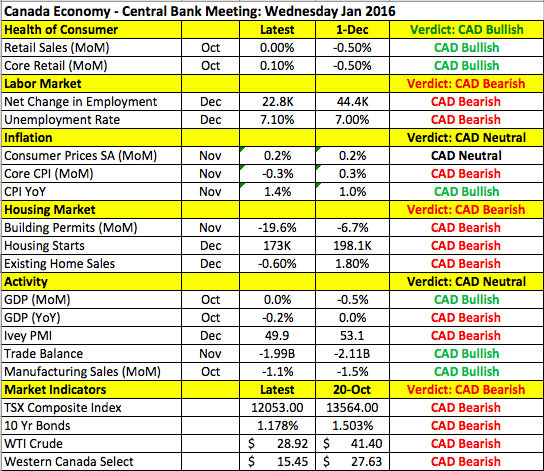

The worst-performing currency over the past 3 months is hands down the Canadian dollar. The loonie lost more 10% of its value against the greenback, half of which occurred in the short span of 2016. On Wednesday, the Bank of Canada will deliver its first monetary policy announcement of the year and its decision on interest rates will determine whether USD/CAD peaks or heads for new highs. Since the last monetary policy meeting, oil prices have fallen close to 30%. This decline has taken a big toll on manufacturing activity and translated into staggering energy-sector job losses. The Bank of Canada should lower interest rates if it wants to reverse the slide in the economy. But many argue that it could be a bullet wasted because a rate cut would have a stronger impact on the currency and the economy once -- oil prices stabilize. Furthermore, according to the table below, parts of the economy is improving. For example, retail sales and GDP stopped falling in October and the trade deficit narrowed. While stagnation is hardly cause for optimism, non-energy exports are benefiting from the lower Canadian dollar. The Bank of Canada expects the non-resource industry to pick up the slack but that may not occur for some time. Instead, it can only hope that the weaker currency will drive up inflation.

Considering that the Bank of Canada is not opposed to the idea of negative interest rates, a 25bp rate cut that takes the lending rates down to 0.5% would not be out of the question. Last month, BoC Governor Poloz said, “The bank is now confident that Canadian financial markets could also function in a negative interest rate environment.” It is important to note that he does not plan to bring rates to negative levels at this time but his comments reflect his dovish bias. Oil prices have fallen too far too fast and the situation for Canada has gone from bad to worse so a rate cut is certainly possible. The majority of economists surveyed by Bloomberg are not looking for a reduction because they believe that the central bank will want to wait for the first budget from Trudeau’s government before taking action. The new Prime Minister promised a massive fiscal stimulus program to get the economy moving and is more specifically considering an immediate $1-billion handout for the hard-hit Alberta and Saskatchewan provinces. We believe that the BoC should lower rates, but it’s a close call. Given this uncertainty, it is probably best to hold off on trading USD/CAD until after the BoC announcement.

Aside from the loonie, our focus remains on the British pound, which fell to its lowest level against the U.S. dollar since February 2009. After dropping below the 2010 low, GBP/USD easily took out the 1.4200 level, trading as low as 1.4130. While cpi rose more than expected in December, Bank of England Governor Mark Carney said point blank that “now is not yet time to raise interest rates.” The head of the BoE expressed concerns about weaker global growth and the downside risks to emerging markets. He specifically talked about moderating wages and the questions that it raises for labor slack. We are particularly interested in this point because U.K. employment numbers are scheduled for release on Wednesday. No major changes are expected for jobless claims, but wages are expected to slow significantly, which could drive GBP/USD toward 1.40. Meanwhile, it's worth recognizing that the weaker sterling is finally helping to boost inflation but at 0.2%, the BoE is still a long way from reaching its 2% target.

The New Zealand dollar has also been on our radar. For the second time this year, dairy prices fell at the Global Dairy Auction. This week, prices declined -1.4%, compared to -1.6% at the Jan. 5 auction. It's not a good start to the year for New Zealand dairy farmers - who will likely see a lower payout from Fonterra (AX:FSF). The Reserve Bank of New Zealand was reluctant to call a bottom in dairy after prices increased in the third quarter and that caution is now validated. If we don’t see a recovery in the coming month or two, the RBNZ may have to consider lowering interest rates again, especially since consumer prices fell -0.5%, matching the decline in Q4 2008, which was the largest drop since the fourth quarter of 1998.

With no U.S. economic reports released Tuesday, there was very little consistency in the dollar's performance. The greenback appreciated against the British pound, Japanese yen and Canadian dollar, but lost value versus the euro, Swiss franc, Australian and New Zealand dollars. U.S. stocks erased their earlier gains to end the day unchanged while 10-year yields moved slightly higher. We finally have some U.S. data on Wednesday with housing starts, building permits and cpi scheduled for release. Chances are that given the rise in the dollar and fall in oil prices, CPI either held steady or turned negative in December.

The euro traded slightly higher on the back of a better-than-expected ZEW survey. Despite market volatility and the problems in China, investors grew more optimistic about the current conditions in Germany. Their outlook deteriorated but less than economists anticipated. The fact that both parts of the report surprised to the upside was enough to lend support to the currency. Investors hope that between last year’s Quantitative Easing program and the weaker euro, the German economy stands some chance of recovering in the coming year.

Related Articles

The US dollar fell last week due to Trump's inconsistent trade policies and signs of a slowing economy. February's non-farm payroll data disappointed, with unemployment...

Welcome to Simply Forex - weekly forecast This content was originally published by our partners at Simply Forex.

CAD While USDCAD continues to sink in response to rolled-back US tariffs, we are still of the view that the current trade tensions are not a positive for loonie fundamentals....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.