- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Stock Splits Continue Their 2024 Comeback

Stock splits are gaining in popularity in 2024 as some companies try to make their stocks look more appealing to retail investors. With the rise of retail investors out of the COVID-19 pandemic came the need to be more appealing to this more active batch of investors. Walmart1 and Nvidia2 made it clear when they split their stocks this year, that the purpose was to be more accessible to a wide range of investors, including employees.

In Q2 2024 announced stock splits reached 100 (out of Wall Street Horizon’s universe of 11k global equities). This is the highest level of stock splits since Q2 2023 which reached 101. However, the first half of 2024 saw 168 split announcements, the highest for a first half in over ten years.

Traditional vs. Reverse Splits

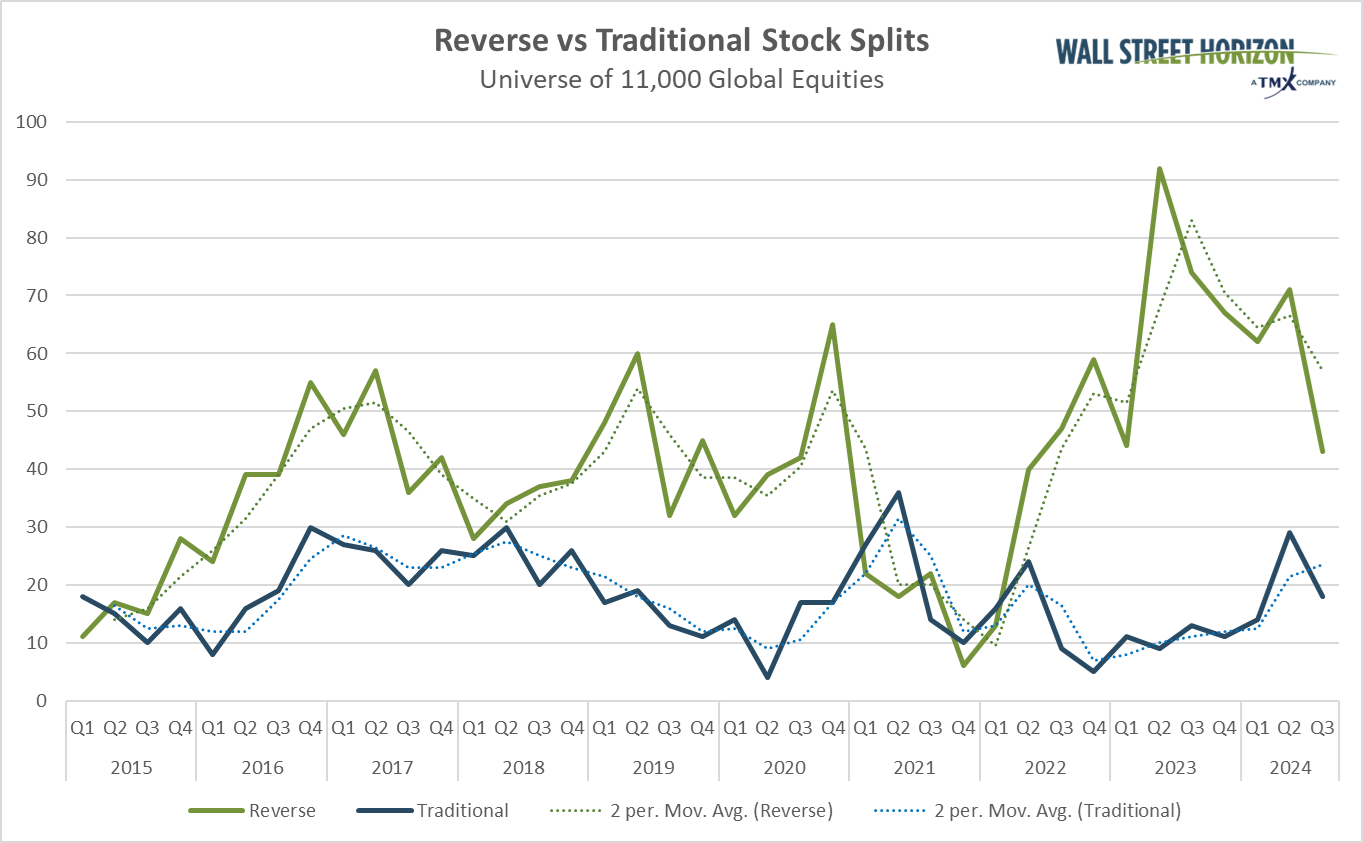

While total stock splits are up, most of that volume is driven by reverse splits which have been outpacing traditional splits for years. A reverse split takes shares from an investor and replaces them with less shares, increasing the stock price, but the market value of the company remains the same. The motivation for this is likely to remain listed on certain exchanges by boosting the share price.

While Q3 isn’t completed yet, it’s clear from the first ten weeks of data that the splits trend continues. In July 2024 there were 30 split announcements (18 reverse, 10 traditional), that’s the most July split announcements in nine years of data. As things do, splits slowed a bit in August with 27 announcements, but that was still a high count historically speaking, with an average of 22 August split announcements for the 10 years.

Source: Wall Street Horizon

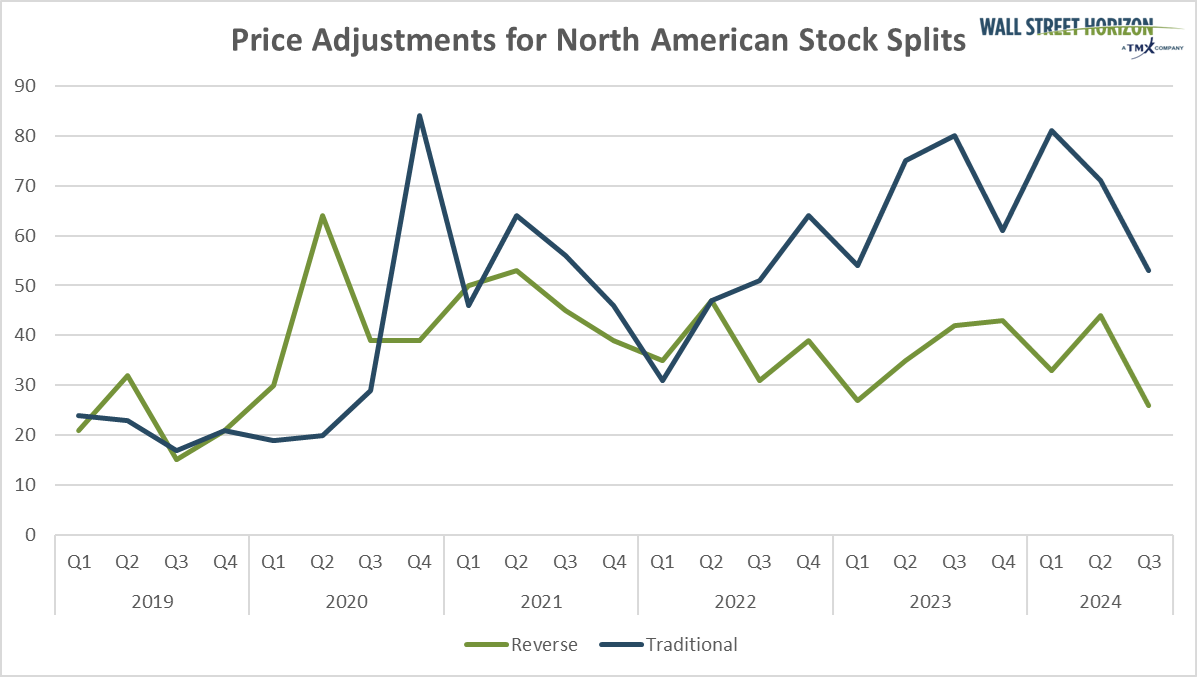

More stock splits means investment teams need to properly adjust stock prices to reflect these corporate actions properly in order to conduct time-series analysis. TMX (TSX:X)'s Price Adjustment Curve (PAC) provides price adjustments applicable down to tick-level prices or even orders, and below you can see the number of recorded adjustments for North American splits have been steadily increasing. H2 2024 recorded 229 such price adjustments, the most in five years.

Source: TMX Datalinx

Biggest Stock Split Announcements YTD

Despite reverse splits being on the rise, traditional splits tend to get the most media coverage as they are usually enacted by large caps looking to lower the price of their stock to attract new investors. Some of the more notable traditional splits in 2024 include:

Walmart (NYSE:WMT), 3-for-1, distributed February 23

Nvidia (NASDAQ:NVDA), 2-for-1, distributed March 27

Chipotle (NYSE:CMG), 2-for-1, distributed June 11

Broadcom (NASDAQ:AVGO), 50-for-1, distributed June 25

Williams-Sonoma (NYSE:WSM), 10-for-1, distributed July 12

Notable reverse splits for 2024 include:

Qiagen (NYSE:QGEN), 24.25-for-25, distributed January 30

Rent the Runway (NASDAQ:RENT, 1-for-20, distributed April 2

BuzzFeed (NASDAQ:BZFD), 1-for-4, distributed May 6

New York Community Bancorp (NYSE:NYCB), 1-for-3, distributed July 11

SITE Centers Corp (NYSE:SITC), 1-for-4, distributed August 19

The Container Store (NYSE:TCS), 1-for-15, distributed September 3

Allbirds (NASDAQ:BIRD), 1-for-20, distributed September 4

The Bottom-line

While we are only two months into Q3 the momentum in stock splits continues. As corporations attract attention by announcing splits, it may be the case that more companies are encouraged to do the same. Traditional splits tend to be bullish for a stock price, with a one-year return of 25% from the date of the split announcement according to Bank of America (NYSE:BAC). This could encourage a broader range of companies, both in different market caps and industries, to try and utilize either the traditional or reverse flavor of this corporate action.

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

TSMC has taken a hit over the past few weeks, falling about 10% YTD amid market turmoil driven by President Trump's tariff threats. I believe this drop is more about short-term...

Following the latest IM-2 mission news, Intuitive Machines Inc (NASDAQ:LUNR) stock is down 54% over the month. Presently holding at $8.95 per share, LUNR stock leveled down to an...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.