- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

US Dollar: Rising 50bp Cut Hopes Keep Greenback Pinned With NFPs on the Horizon

- The US dollar faces pressure ahead of crucial labor market data.

- With the dollar index hovering below 101, traders are on alert for potential signs of further weakness.

- On the flip side, strong NFPs this week may drive a recovery in the greenback.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

The US dollar faces downward pressure as traders eagerly await signals regarding the Fed's next move. This week, they'll closely monitor economic data and speeches from Fed officials that could provide crucial insights.

Market participants continue to debate whether the Fed will cut interest rates by 50 basis points or 25 basis points in November. Despite the Fed's dovish signals, upcoming economic data will significantly influence its final decision.

Currently, the dollar index trades below 101. If it breaks below 100.5, we could see further weakness. However, strong employment data later this week might pave the way for a dollar recovery.

PCE Data Offers Insight into Inflation Trends

Last week, market participants closely monitored the U.S. PCE data released on the final working day. The figures met expectations, easing inflation concerns and helping to sustain risk appetite.

This anticipated outcome allowed the Fed to maintain its focus on employment while balancing its inflation targets. The upcoming employment data this week could, therefore, play a pivotal role in market pricing.

On Wednesday, traders will scrutinize private employment data in the U.S. This will lead up to Friday’s nonfarm Payrolls, unemployment rate, and average hourly earnings, all of which follow initial jobless claims on Thursday.

The Fed has made it clear that while it aims for its inflation target, it prioritizes the labor market. The results from this data set could heavily influence the central bank's rate decisions in November.

While the market currently leans toward another 50 basis point cut, this week’s employment figures could dramatically shift those expectations.

Employment Data May Shift Market Sentiment

Given that this employment data will impact the Fed’s decisions, it could also alter the market's risk appetite.

Strong employment figures might nudge the Fed toward a 25 basis point cut, while weak data could complicate matters and heighten expectations for a half-point reduction. However, any weakness in employment may also raise recession concerns.

Despite the moderate outlook, there are hopes for a soft landing for the U.S. economy based on recent data.

Yet, a severe dip in employment could quickly shift the narrative, overpowering any positive effects from the first rate cut.

Will the DXY Continue to Decline?

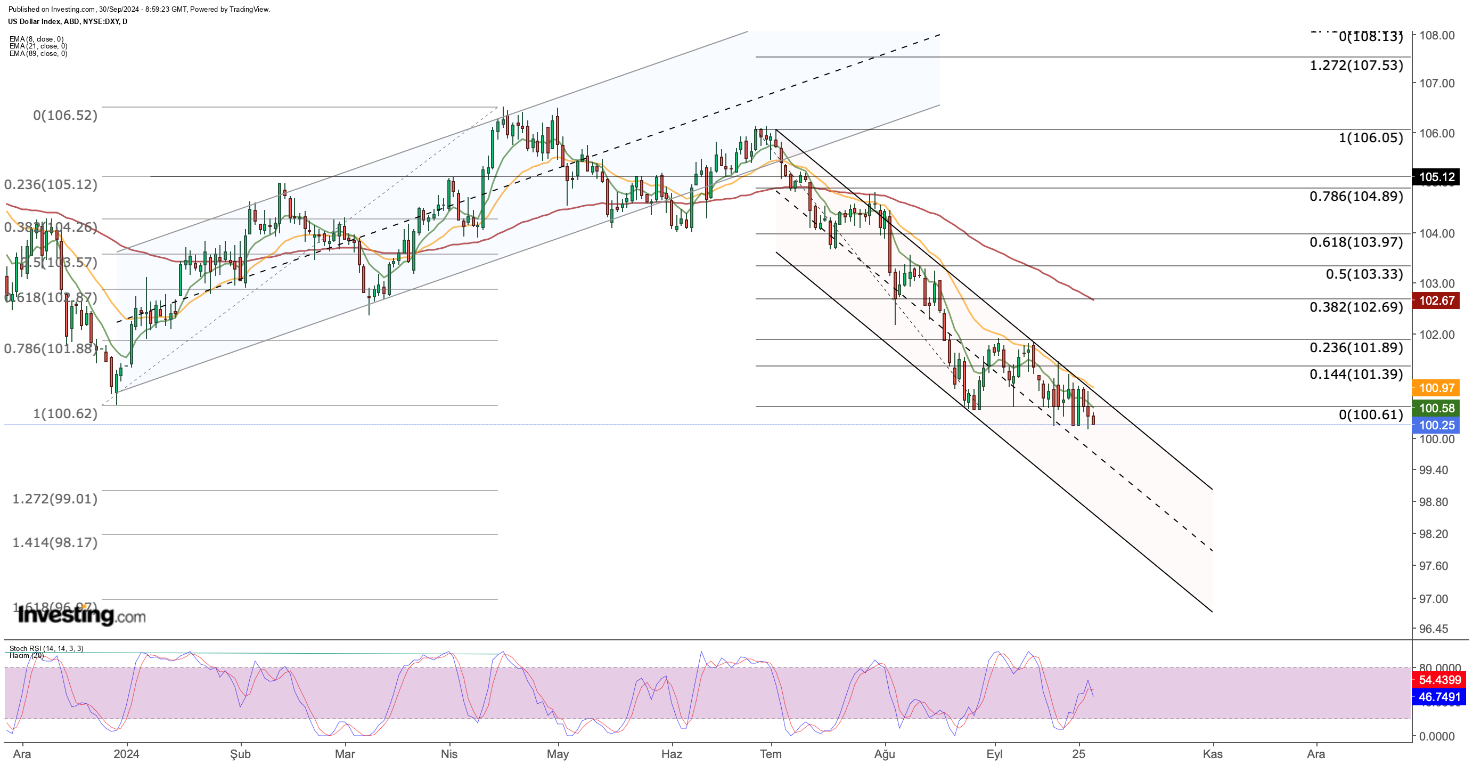

As the dollar index (DXY) approaches a week packed with crucial employment data, it starts off with a weak outlook, remaining below the 101 level.

Last week, the dollar struggled against six major currencies, facing resistance around the 101 threshold. While risk appetite remains robust, low demand for the dollar tests the index’s main support near 100.5.

DXY kicked off the week around the 100.25 level, where traders noted reaction purchases last week. If it stays below 100.5, we may see a continuation toward the 96-99 range.

A rebound in DXY could gain traction if employment data proves strong, alleviating recession fears and paving the way for the Fed to consider a smaller cut of 25 basis points.

In a scenario where dollar yields remain relatively high, increased demand for the dollar could become evident.

This uptick could push DXY toward the resistance level at 101.3, above the critical 100.5 mark. However, to confirm a recovery, the index must convincingly breach the 101 level in weekly closes.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services.

Related Articles

EUR/USD has surged at a fast pace in the past few days. Concerns about a US recession are rising. The US government's stance on tariffs remains unclear. Get the AI-powered list...

CAD The loonie softened to start the week, with a backdrop of falling US equities proving a drag for the Canadian dollar. That leaves USDCAD trading around 1.44 ahead of...

After a week when FX markets were very much dominated by events in Europe, focus this weeks shift to China. Chinese retaliatory trade measures against US agricultural goods have...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.