Quotes

All Instrument Types

- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Investors lost 37% by missing this ONE signal 😵

Read now

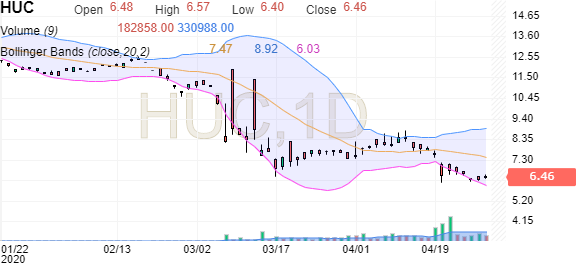

Global X Crude Oil ETF (HUC)

Add to/Remove from a Portfolio

Add to Watchlist

20.44

0.00

0.00%

07/03 - Real-time Data. Currency in CAD

- Volume: 0

- Bid/Ask: 20.22 / 20.25

- Day's Range: 20.39 - 20.60

Horizons Crude Oil

20.44

0.00

0.00%

- Technical Analysis

- Candlestick Patterns

HUC Candlestick Patterns

Dozens of bullish and bearish live candlestick chart patterns for the Horizons Crude Oil ETF and use them to predict future market behavior. The Horizons Crude Oil ETF patterns are available in a variety of time frames for both long and short term investments. Gain a trading edge with the auto pattern recognition feature and gain an insight into what the patterns mean.

Customize

Candlestick Patterns

Time Frame

Pattern Indication

Type

Reliability

| Pattern | Timeframe | Reliability | Candles Ago | Candle Time | |

|---|---|---|---|---|---|

| Completed Patterns | |||||

| Harami Bullish | 1D | 1 | Mar 06, 2025 | ||

| Belt Hold Bearish | 1H | 4 | Mar 07, 2025 10:00 | ||

| Engulfing Bearish | 1H | 4 | Mar 07, 2025 10:00 | ||

| Belt Hold Bearish | 30 | 4 | Mar 07, 2025 10:30 | ||

| Engulfing Bearish | 30 | 4 | Mar 07, 2025 10:30 | ||

| Belt Hold Bearish | 15 | 4 | Mar 07, 2025 10:45 | ||

| Engulfing Bearish | 15 | 4 | Mar 07, 2025 10:45 | ||

| Inverted Hammer | 1D | 6 | Feb 27, 2025 | ||

| Bullish Hammer | 1D | 8 | Feb 25, 2025 | ||

| Three Inside Up | 1W | 9 | Dec 29, 2024 | ||

| Homing Pigeon | 1D | 9 | Feb 24, 2025 | ||

| Bullish doji Star | 5H | 9 | Mar 03, 2025 15:00 | ||

| Abandoned Baby Bearish | 1M | 10 | May 24 | ||

| Evening Doji Star | 1M | 10 | May 24 | ||

| Evening Star | 1M | 10 | May 24 | ||

| Harami Bullish | 1W | 10 | Dec 22, 2024 | ||

| Tri-Star Bullish | 15 | 10 | Mar 05, 2025 12:00 | ||

| Doji Star Bearish | 1M | 11 | Apr 24 | ||

| Gravestone Doji | 1M | 11 | Apr 24 | ||

| Belt Hold Bullish | 30 | 11 | Mar 05, 2025 11:00 | ||

| Tri-Star Bullish | 15 | 12 | Mar 05, 2025 11:15 | ||

| Belt Hold Bullish | 1D | 14 | Feb 13, 2025 | ||

| Abandoned Baby Bearish | 1W | 16 | Nov 10, 2024 | ||

| Evening Doji Star | 1W | 16 | Nov 10, 2024 | ||

| Three White Soldiers | 1H | 16 | Mar 04, 2025 13:00 | ||

| Bullish Hammer | 5H | 19 | Feb 25, 2025 09:00 | ||

| Bullish Hammer | 1H | 19 | Mar 04, 2025 10:00 | ||

| Belt Hold Bullish | 1D | 21 | Feb 04, 2025 | ||

| Bullish Engulfing | 1D | 21 | Feb 04, 2025 | ||

| Bullish Hammer | 1D | 23 | Jan 31, 2025 | ||

| Harami Cross | 15 | 23 | Mar 04, 2025 14:30 | ||

| Harami Bullish | 15 | 23 | Mar 04, 2025 14:30 | ||

| Belt Hold Bearish | 15 | 24 | Mar 04, 2025 14:15 | ||

| Engulfing Bearish | 15 | 24 | Mar 04, 2025 14:15 | ||

| Homing Pigeon | 1D | 26 | Jan 28, 2025 | ||

| Upside Gap Two Crows | 1M | 27 | Dec 22 | ||

| Bullish doji Star | 30 | 29 | Mar 03, 2025 13:30 | ||

| Tri-Star Bullish | 30 | 31 | Mar 03, 2025 10:30 | ||

| Harami Cross | 1M | 32 | Jul 22 | ||

| Separating Lines Bullish | 15 | 32 | Mar 04, 2025 12:15 | ||

| Belt Hold Bearish | 1D | 38 | Jan 10, 2025 | ||

| Harami Bullish | 1D | 39 | Jan 09, 2025 | ||

| Harami Cross | 1D | 39 | Jan 09, 2025 | ||

| Engulfing Bearish | 1M | 40 | Nov 21 | ||

| Inverted Hammer | 1W | 40 | May 26, 2024 | ||

| Tri-Star Bullish | 15 | 40 | Mar 03, 2025 16:00 | ||

| Bullish doji Star | 15 | 42 | Mar 03, 2025 13:45 | ||

| Harami Bullish | 1W | 43 | May 05, 2024 | ||

| Harami Cross | 1W | 43 | May 05, 2024 | ||

| Tri-Star Bearish | 30 | 43 | Feb 27, 2025 10:00 | ||

| Deliberation Bearish | 1M | 44 | Jul 21 | ||

| Doji Star Bearish | 1M | 44 | Jul 21 | ||

| Belt Hold Bullish | 5H | 45 | Feb 04, 2025 08:00 | ||

| Tri-Star Bullish | 15 | 45 | Mar 03, 2025 10:45 | ||

| Shooting Star | 1D | 46 | Dec 30, 2024 | ||

| Tri-Star Bullish | 30 | 46 | Feb 26, 2025 15:30 | ||

| Doji Star Bearish | 1M | 48 | Mar 21 | ||

| Belt Hold Bullish | 5H | 48 | Jan 31, 2025 14:00 | ||

| Advance Block Bearish | 1M | 50 | Jan 21 | ||

| Bullish doji Star | 1H | 50 | Feb 21, 2025 14:00 | ||

| Three Outside Up | 1M | 51 | Dec 20 | ||

| Tri-Star Bullish | 5H | 51 | Jan 29, 2025 12:00 | ||

| Bullish Engulfing | 1M | 52 | Nov 20 | ||

| Engulfing Bearish | 1M | 54 | Sep 20 | ||

| Upside Gap Three Methods | 1M | 54 | Sep 20 | ||

| Engulfing Bearish | 1W | 54 | Feb 18, 2024 | ||

| Tri-Star Bearish | 30 | 54 | Feb 25, 2025 10:30 | ||

| Shooting Star | 1D | 55 | Dec 11, 2024 | ||

| Tri-Star Bearish | 1H | 55 | Feb 19, 2025 15:00 | ||

| Three Outside Up | 1M | 57 | Jun 20 | ||

| Tri-Star Bearish | 15 | 57 | Feb 27, 2025 10:00 | ||

| Bullish Engulfing | 1M | 58 | May 20 | ||

| Belt Hold Bullish | 5H | 58 | Jan 27, 2025 05:00 | ||

| Tri-Star Bullish | 30 | 58 | Feb 21, 2025 15:30 | ||

| Three Black Crows | 1M | 60 | Mar 20 | ||

| Engulfing Bearish | 1M | 62 | Jan 20 | ||

| Tri-Star Bullish | 30 | 62 | Feb 21, 2025 12:30 | ||

| Homing Pigeon | 1D | 63 | Nov 28, 2024 | ||

| Harami Bullish | 1W | 64 | Dec 10, 2023 | ||

| Tri-Star Bullish | 15 | 65 | Feb 25, 2025 13:15 | ||

| Inverted Hammer | 1M | 66 | Sep 19 | ||

| Tri-Star Bearish | 15 | 68 | Feb 25, 2025 10:45 | ||

| Tri-Star Bullish | 5H | 69 | Jan 17, 2025 15:00 | ||

Add Chart to Comment

Confirm Block

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

Report this comment

I feel that this comment is:

Comment flagged

Thank You!

Your report has been sent to our moderators for review