July numbers are in, and the Bank of Canada's consecutive rate hikes in an attempt to battle inflation which reached 3.3% in July, has clearly left a mark on the Ontario housing market. Here is the crux of it.

As you can see, from home sales and prices to new listings and property types, every aspect of the Ontario market is currently in a downturn. Although to most of us at first glance, it may look like a bleak picture, for the one paying attention, it might just be the silver lining of an opportunity they have been waiting for.

According to Manoj Karatha, Broker of Record for The Canadian Home, "What most home buyers do not understand is that when rates go up, prices go down, and when rates go down, prices go up. I understand that rates are high at the moment, and it might just be off-putting for many, but we have to acknowledge the opportunity here. Prices are coming down fast; if for example, you are a first-time home buyer, then this is a great time to make a move."

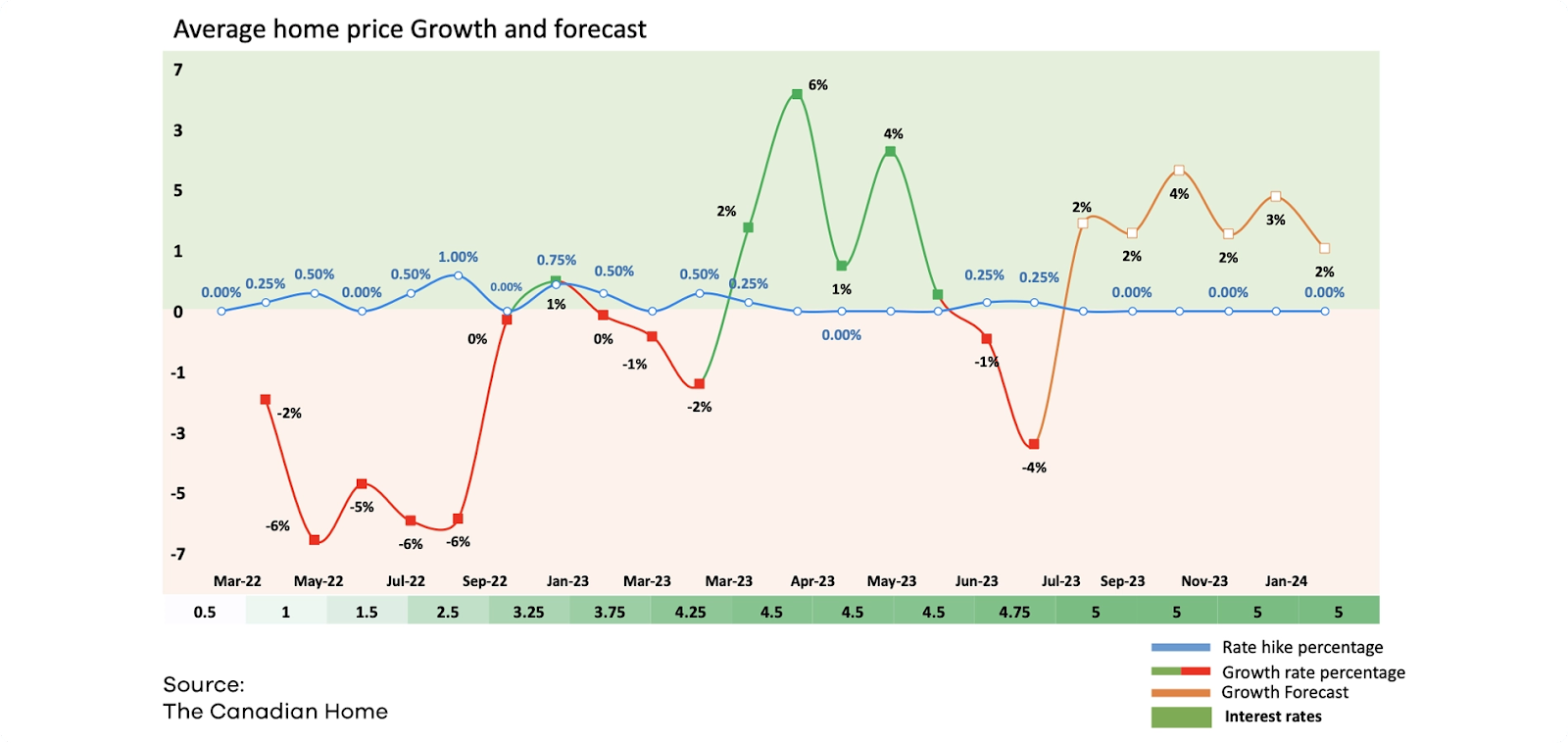

Mr. Manoj Karatha raises a valid point which is the inverse relationship between interest rates and home prices. The Bank of Canada has been tracking interest rates and home prices in Canada since 1975. The chart below shows the relationship between these two variables over time. As you can see, there is a clear inverse relationship between interest rates and home prices. When interest rates go down, home prices go up. And when interest rates go up, home prices go down. Given the recent uptick in the inflation rate to 3.3% in July, the Bank of Canada (BoC) may opt to raise interest rates once more come September. This could potentially lead to a continuation of the inverse relationship; wherein home prices are likely to experience further declines.

This data was later followed by a study conducted by BoC and CMHC, which found that a 1% decrease in interest rates was associated with a 2.5% increase in home prices, further cementing the inverse relationship between the two variables as a fact.

The point is, in the Canadian housing market, where declining housing affordability has been a concern for more than 20 years now, budget-friendly home-buying options are a rare occurrence. More often than not, buyers will be put in a position where they have to choose between high rates and affordability. All we are suggesting is that you go with the latter.

In the spirit of this message, we have compiled a list of cities that offer you good deals and also have an amazing growth rate* for potential investment.

FOR HOME BUYERS WITH A BUDGET OF OVER 1 MILLION

-

WHITBY

Current Price - 1.0M

Growth Potential - 26.67%

Whitby's population has been growing steadily in recent years, and this is expected to continue in the future. This growth is being driven by a number of factors, including the town's proximity to Toronto, its strong economy, and its attractive amenities. Perhaps that is why it has the highest growth potential out of all the cities in this list.

-

AJAX

Current price - 1.01M

Growth Potential - 26.24%

The rental market in Ajax is strong, and there is a high demand for rental housing. This is due to the town's growing population and the fact that it is a popular destination for commuters who work in Toronto. The average rent for a two-bedroom apartment in Ajax was $1,600 per month in 2022, making it an amazing city for those looking to climb the property investment ladder.

-

PICKERING

Current price - 1.0M

Growth Potential - 25%

Pickering has a strong economy with a diverse mix of businesses. This makes it a stable place to invest in property, as there is less risk of the market collapsing. The unemployment rate in Pickering was 5.0% in 2022, which is below the national average of 5.3%; combine this with the fact that the rental vacancy rate in Pickering is 1.3%, which is below the national average of 2.2%, and you have got yourself a safe and sound investment.

-

BRAMPTON

Current price - 1.05M

Growth Potential- 24.86%

Brampton has good infrastructure, including a well-developed transportation system and a number of schools and hospitals. This makes it a desirable place to live, which in turn drives up demand for property. This can be seen in the fact that this city has an average rental yield of 5.8% on of the highest in Ontario.

FOR HOMEBUYERS WITH A BUDGET LESS THAN 1 MILLION

-

LONDON

Current price - 645K

Growth Potential - 21.71%

According to a study by the London and St. Thomas Association of Realtors (LSTAR), the average home value in London has appreciated by 54.3% over the past five years. That means anyone who invested in a London property five years ago right now is sitting on a gold mine. That's how good the growth potential in this city is and why you should not ignore it.

-

ST. CATHERINES

Current price - 667K

Growth Potential - 18.11%

With a current price of just 667K, this inviting market presents a highly accessible option for potential buyers looking to invest in a thriving community. Moreover, the promising growth potential of 18.11% further underscores the attractiveness of St. Catherine's, ensuring not only a budget-friendly entry but also the possibility of substantial appreciation in the near future.

-

NIAGARA FALLS

Current price - 671K

Growth Potential - 20.57%

Where all other major cities in the country have been going through price hikes, Niagara Falls properties have been able to keep it on tight leash. You can get any property type of your choice within 530K to 700K. Add to this the city's mere one-hour drive from GTA, blending urban convenience with suburban tranquillity, and you've secured a remarkable deal.

-

BRANTFORD

Current price - 684K

Growth Potential - 16.66%

Brantford has everything you need, from great schools and neighbourhoods to affordable prices and top-notch properties. While big cities like Mississauga and Toronto are getting pricier, Brantford manages to keep its cost of living low. Moreover, Brantford is a major job center with a diverse range of industries (the unemployment rate is just 5.2%, lower than the national average of 6.2%), offering a perfect blend of affordability, opportunities, and excellent quality of life.

FOOD FOR THOUGHT

According to a recent survey by Mortgage Professionals Canada (MPC), 68% of Canadians believe that the best time to buy a home is when interest rates are lower. When we phrased this as a question to Robin Cherian, CEO of The Canadian Home, this is what he had to say.

"Homebuyers who genuinely believe that are only looking at the housing market on a surface level without digging in deep. Because when you do, you will realise that the interest rates, high or low, stay like that for only 2-3 years. Your mortgage, however, will last for 25 years, during which you will have to renew it multiple times. Do you really think you will be able to avoid a rate change for 25 years? In my experience, the best way to approach the home-buying process is to focus on things you can control rather than what you can’t. You can't control market conditions; no one can, not even BoC. But you can control what you buy, where you buy it and for how much because buying a property for 900k when you could have bought it for 700k just because you waited for rates to go down is not a good deal."

A 2021 survey by the Canadian Real Estate Association (CREA) found that 22% of Canadians who were in the market to buy a home in the past two years regretted waiting for a lower interest rate. This is up from 15% in 2020. Amidst the consecutive rate hikes and inflation rate changes, there is an important point that no one is talking about—Canada is facing a severe housing affordability crisis. The average price of a home in Canada has increased by more than 50% in the past five years, and it is now out of reach for many Canadians.

This means we are well on our way to reaching a point where interest rate changes, high or low, will have little to no effect on your affordability. That is why if you have the means to invest in property right now, then you should go for it because tomorrow might just be too late.

*Please note that all data stated relies on computations performed using internal, exclusive tools of The Canadian Home.