Meta Platforms, Inc. (NASDAQ:META) delivered solid Q3 2024 results, depicting the company's overall robust revenue growth, ad performance, and engagement across the core platforms. The total revenue for the quarter increased by 19% year over year (YoY) and reached $40.6 billion.

This increase was mainly driven by the Family of Apps segment, which greatly contributed to Meta's advertising revenue, comprising Facebook (NASDAQ:META), Instagram, and WhatsApp. The third-quarter ad revenues reached $39.9 billion, 19% higher compared to the same period last year, on the back of better-priced ads and higher ad impressions, reflecting Meta's move to monetize the huge users with better ad targeting and AI-powered enhancements.

These improved ad-targeting features are courtesy of Meta's investments in AI, which increased ad relevance and boosted engagement. The result of this AI personalization strategy is three times more effective, which means increasing user retention and engagement: an 8% increase on Facebook and a 6% increase on Instagram. Central to this strategy was Meta AI, the company's AI assistant, which would make sure to really help tailor content and ads to user preferences while creating a more immersive experience across Meta's platforms.

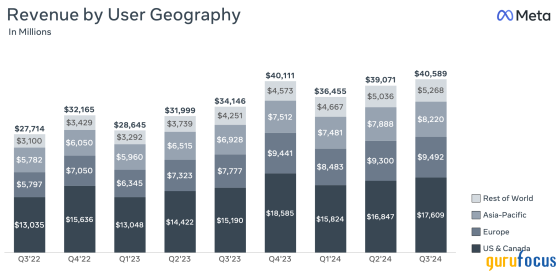

Geographically, Meta reported strong ad revenue growth in both the Asia-Pacific and European regions, with high user engagement and soaring demand for ad placements. The former enjoys an extensive mobile-first user base that is growing very fast, while the latter has shown great resilience in ad demand against economic challenges. While the U.S. and Canada remain Meta's most profitable markets, growth was relatively slow because of market maturity. This diversified growth across regions underlines Meta's capability to capture new ad revenue streams outside its core North American markets.

Source: Meta Earnings

Meta Boosts Profits with Strategic Cost Management and AI Investments Amid Metaverse Ambitions

Additionally, Meta's net income for Q3 was 35% YoY higher, a function not only of revenue growth but also increased profitability through operational efficiencies and disciplined cost management. Its margin stretched to 43% from 40% a year ago despite big continuous investments in AI and Reality Labs, Meta's metaverse-focused business segment. An increase in such a margin would say that Meta is arresting non-core costs effectively while reallocating resources to strategic growth areas.Reality Labs remains at an early stage, though it is considered a critical piece of Meta's longer-term vision of immersive digital experiences. As a result, it continues to incur significant losses. This quarter, Meta spoke about its long-term goal of developing its metaverse and VR/AR capabilities. Mark Zuckerberg mentioned that this technology would change the way digital interactions are conducted over the long term. While Reality Labs posted a significant operating loss, profitability for Meta as a whole was good enough to digest these costs and showcase the resilience of its core business.

According to marketing expert Dominick Tomanelli, Meta deploys sophisticated AI models by leveraging first-party data and serving up personalized content and targeted ads to drive user experience. Integration of AI tools allows their team to increase user connection through video content creation and recommendation systems with consumers, content creators, and advertisers alike. Another example is investment in AI infrastructure, which should, over time, further underline Meta's commitment to more advanced AI-driven personalization and engagement across all of its platforms.

Meta's $734 Fair Value: High Growth Potential

Meta's fair value of $734, according to the Discounted Cash Flow (DCF) model, reflects an optimistic view of its future growth potential, especially in AI and Reality Labs. The model assumes Meta will achieve a high 10-year EPS growth rate of 28.80%, driven by anticipated returns on its massive investments in advanced AI and immersive technology through Reality Labs. Following this growth period, the terminal growth rate slows to 4%, representing a mature phase as the company stabilizes. Revenue is projected to grow at an annual rate of 33%, while free cash flow is expected to increase by 25.30% over the next decade. These growth projections underscore confidence that Meta's AI and metaverse initiatives could significantly boost cash flows if they succeed, transforming the company's financial profile and driving earnings upward.The DCF model's outcome$734 per sharesuggests a 22.13% margin of safety compared to the current stock price of $572.04, indicating a potentially undervalued position for Meta based on these assumptions. This valuation implies that, despite high upfront costs and some near-term financial pressures, Meta's long-term growth in new, high-potential areas could justify its current premium pricing. The valuation relies on substantial future growth in earnings, revenue, and cash flow, contingent on Meta's ability to monetize its AI and the metaverse ventures. However, this optimistic fair value comes with inherent risks; if growth falls short of these high expectations, the current stock price might prove overvalued. Investors considering Meta should weigh this potential upside against the risk that ambitious growth goals may not fully materialize.

Costly AI, Metaverse Investments Amid Mounting Regulatory Risks

Meta invests in a set of risks, mainly huge capital expenditure and dependency on AI-driven ad revenue. Meta's huge capital expenditure plans are primarily in AI and Reality Labs. Meta increased its guidance for CapEx in 2024 to US$38-40 billion, which might strain cash flow and hurt profitability if these investments do not pay off big. While the focus on AI and metaverse is expected to drive growth for Meta going forward, the near term will likely be a financial burden that presses on the company's margins and free cash flow, particularly because Reality Labs continues to operate at a loss.Besides, of course, there are regulatory and geopolitical risks. Meta continues under increasing examination in the U.S. and EU regarding data privacy and AI ethics, where any such regulations would impinge on its use of data and raise compliance costs. Geopolitical tensions, especially in regions like the Asia-Pacific, which have shown phenomenal revenue growth for Meta, can disrupt operations or lead to change policies that hurt advertising demand. While prospects for growth may be bright for Meta in many ways, investors will want to consider these risks carefully in light of today's premium valuation and ambitious but expensive investment initiatives taken by the company.

Takeaway

In all, Meta's Q3 2024 earnings highlight that it can effectively balance short-term profitability with long-term growth initiatives. Solid ad revenue growth driven by AI-driven engagement and responsible cost management set Meta well on its path to achieving its ambitious strategy centered on AI and the metaverse.This content was originally published on Gurufocus.com