Alphabet (NASDAQ:GOOGL) Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL), which is more commonly referred to as Google, recognized as one of the largest tech companies by revenue. It reported trailing revenue of $318.15 billion and holds the position of fourth most valuable company globally with a market cap of $2.17 trillion.

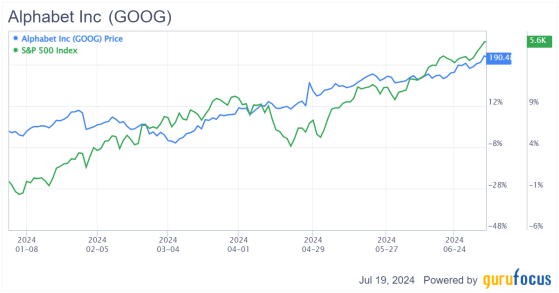

As we head into the second-quarter earnings season, the bull market continues to rise, driven largely by the Magnificent Seven. The S&P 500 has appreciated by around 17% year to date, while Alphabet has outperformed the benchmark, returning roughly 37%. Despite skeptics arguing that such appreciation is not sustainable, companies like Alphabet continue to defy these bearish predictions.

Regardless of recent performance or all-time high share prices, I believe the Google parent company is poised for further growth, with significant revenue and earnings expansion on the horizon. While market retracements and a potential future recession are possible, the largest companies continue to expand, so I think the bullish case for the company is far from over. There remains a substantial opportunity for long-term investors. While shares may experience cooling periods, I expect them to end 2024 significantly higher than they are today.

GOOG Data by GuruFocus

Despite the general bullish sentiment, some analysts have been bearish on Alphabet due to perceived weaknesses in generative artificial intelligence. They cite potential negative revenue impacts from AI overviews, search share loss to Microsoft's (NASDAQ:MSFT) Bing and advertising share loss to retail media networks. Analysts suggest that while Google's historical financial performance is strong, its competitive position may deteriorate, preventing future repetition of such numbers. These views are not without merit; for instance, Google's search market share has been declining slowly over time. Concerns about AI's negative revenue impact are also valid as AI overviews currently occupy spaces traditionally reserved for ads, potentially reducing ad clicks and revenue.

However, there are compelling reasons to believe Alphabet will thrive in the coming years. The company is a leader in AI, owns YouTube and the Play Store and has one of the world's fastest-growing cloud services businesses. Historically, the majority of its revenue has come from search, but this may change. Other segments, such as YouTube and cloud services, are growing rapidly and could drive future gains. I believe the company will sustain its upward trajectory due to its innovations and diversification, serving as major growth catalysts. The favorable market trends in AI and cloud computing, backed by the growth in digital advertising, support my bullish stance. Consequently, I consider the stock a great value today despite the risks it faces.

Market dominance in searchAlphabet's Google is best known for its overwhelming dominance in the search engine market, where it holds over 90% market share. It owns the most popular search engine globally, responsible for approximately 70% of all global inquiries and receiving over 1 billion hits monthly. Its market dominance is built on a foundation of enhanced customer satisfaction, improved user experience and relentless innovation. The company's ability to consistently stay ahead of the competition in terms of technological advancements gives it a significant competitive edge. Google's complex and highly scalable algorithms are continuously improved, making them difficult for competitors to replicate. This persistent innovation and commitment to high-quality products will likely ensure its market dominance remains unchallenged in the long run.

Source: StatCounter

Capitalizing on AI opportunitiesThe communication services company's substantial investment in artificial intelligence positions it well for future growth. The launch of OpenAI's ChatGPT has spiked demand for AI, leaving the chatbot market with immense growth potential. According to Precedence Research, the generative AI market is projected to increase from approximately $18 billion in 2023 to around $804 billion by 2033, representing a compound annual growth rate of 46.50%. While Google has faced some criticism regarding its handling of consumer-facing AI, such as inaccuracies in its Gemini AI output, recent developments have improved its reputation.

For instance, it announced AI enhancements for search, including AI-powered search summaries, which were well-received. Additionally, strong earnings releases, such as the first-quarter 2024 results, boosted investor sentiment. Despite initial setbacks, Alphabet is a leading player in the AI sector, with seven products boasting over a billion users each, a talented pool of AI engineers and numerous patents protecting its competitive edge. The Google parent's unique and superior Gemini technology positions it strategically to leverage AI's growth potential.

Source: Precedence Research

Promising growth in cloud servicesGoogle Cloud, while generating less revenue compared to Amazon's (NASDAQ:AMZN) AWS and Microsoft's Azure, shows significant promise. It is now consistently profitable and continues to grow at a healthy rate. The cloud segment is experiencing the fastest revenue growth among the company's different divisions and has recently turned the corner on profitability.

CEO Sundar Pichai noted Google announced over 1,000 new products and features in recent months, resonating with a wide range of customers. Notably, over 60% of funded generative AI startups and nearly 90% of unicorn companiess are Google Cloud customers, along with established businesses like PayPal (NASDAQ:PYPL). As AWS and Azure have become profit drivers for Amazon and Microsoft respectively, there is no reason Google Cloud cannot achieve 30% operating margins by 2027-28. If growth continues at this pace, Google Cloud could contribute close to $5 billion in operating income per quarter by that time. Despite Google's already vast size, substantial growth opportunities remain in its Cloud and AI divisions.

Consistent revenue growthDespite Alphabet's massive scale, it continues to find ways to innovate and grow, maintaining impressive double-digit growth rates on an annualized basis. The company delivered exceptional first-quarter results that surpassed analysts' expectations. Its total revenue surged 15.40% year over year to $80.5 billion during the quarter. This consistent growth is a testament to Alphabet's strength across its various business segments. Notably, Google Search and other revenue climbed by 14.40% over the year-ago period to $46.2 billion. Concerns about Search being impacted by ChatGPT and Google Gemini have proven unfounded, as their presence has not cannibalized its revenue-generating ability in the slightest.

Source: Alphabet

YouTube ads revenue saw a substantial increase of 20.90% year over year to $8.10 billion, driven by higher advertising spend. Additionally, Google Cloud revenue leaped 28.40% over the year-ago period to $9.60 billion. Further, the business' rapid expansion continues, with its revenue growing by 169.61% over the past four years, reaching $35.21 billion in the trailing 12 months.

Strong earnings growth and margin expansionAlphabet's profitability continues to rise alongside its revenue. In the first quarter, the company generated $25.47 billion in operating income, marking a 46.27% increase ($8.06 billion) year over year. This resulted in an operating margin of 31.63% compared to 24.96% in the prior-year quarter. The margin improvements were primarily driven by the expansion of Google Cloud's margins, coupled with a rebound in revenue growth.

Consequently, significant expansion in Google Services' operating margins boosted the overall margin to 31.60%, the highest since the third quarter of 2021. This led to a 61% year-over-year increase in the company's GAAP earnings per share in the last quarter, further accelerating from 56% growth in the fourth quarter of 2023.

Source: Alphabet

Robust financial positionIf Alphabet's exceptional business performance and growth prospects were not enough, its financial positioning puts it over the top. As of March 31, the company had $94.9 billion in net cash, cash equivalents and marketable securities. This translates to approximately $7.57 per outstanding share. This robust financial position enables the company to continue investing in its business, fueling its growth cycle over the years.

Growth outlookWall Street projects a consensus of 7.90% for sales growth and 13.20% for earnings per share growth over the next five years. While this reflects Alphabet's maturation as a business, I believe new innovations in AI could increase the revenue growth rate by an additional 2% to 4% annually over the next five years, resulting in a strong top-line growth trajectory.

Why Alphabet remains a compelling investmentThe company's ability to sustain its growth and profitability makes it one of the best stocks to invest in for the long term. Despite potential market retracements and the inevitability of a future recession, I believe the Google parent will continue to thrive and deliver substantial returns to shareholders.

Despite Alphabet's recent surge to an all-time high, I believe the stock is still undervalued. It is currently trading at a GAAP price-earnings ratio of 28.50, which is in line with its 10-year average. Interestingly, this multiple is slightly below the S&P 500 Index's multiple of 28.70 times. Given the recent growth rebound in its core advertising business and substantial margin expansions driven by increased capex on AI innovations, Alphabet is expected to generate $7.54 in earnings per share for fiscal 2024 and grow earnings by 30.24% over the next two years through 2026.

On a forward earnings basis, Alphabet trades at the most attractive valuation among the "Magnificent Seven'' based on forward price-earnings multiples. This comparison highlights that the stock is significantly undervalued compared to its peers, such as Meta Platforms (NASDAQ:META) and Apple (NASDAQ:AAPL), despite having more projected growth.

Source: Alpha Spread

Long-term growth potentialWhile shares of Alphabet could experience short-term retracements, I believe they will continue to appreciate over the long term. Short-term fluctuations are a natural part of investing in equities, but the company's strong fundamentals and growth prospects make it a resilient investment.

Further, its board has approved an additional $70 billion in share repurchases and declared its first cash dividend of 20 cents, enhancing its capital allocation program. This additional allocation toward buybacks should provide a boost to earnings per share in the future.

DCF valuationTo confirm Alphabet's undervaluation, let's consider a discounted cash flow analysis. Assuming a revenue CAGR of about 8% over the next five years and relatively stable net income margins, the cash flows discounted at 7.90% amount to $524.30 billion. The present value of the terminal value is $2.30 trillion, resulting in a total present value of $2.80 trillion. By adding a 3% terminal growth rate, we derive an approximate $230 fair value estimate. This represents 17% upside to today's price, indicating Alphabet is a compelling investment opportunity.

Source: Alpha Spread

Source: Alpha Spread

Final thoughts

Alphabet's unparalleled market dominance, especially in its search business, and its aggressive investments in AI and cloud services position it well for sustained growth. Despite facing challenges and a potentially cooling market, the company's robust financial performance and strategic advancements make it a compelling investment. The stock's undervaluation relative to peers further underscores its potential for long-term gains, solidifying its status as a top pick for investors looking to capitalize on the ongoing tech revolution.This content was originally published on Gurufocus.com