The benchmark Dutch TTF gas price experienced a notable decline over the course of last week, dipping below 30 euros, a level not witnessed since June 2021. This downward trend can be attributed to the alleviation of supply concerns as Europe enters the summer season, coupled with a reduced reliance on Russian energy sources. It is worth noting that the price had reached an unprecedented peak of 345 euros in March 2022, shortly after the Russian invasion of Ukraine in February of that year. That said, the current price is still double that of the price seen in 2020 (approximately 15 euros) when the global economy was impacted by the Covid pandemic, leading to a drastic reduction in global energy demand.

Since the beginning of 2023, favourable weather conditions and timely policy actions have helped mitigate pressure on both European and global gas markets. The decline in natural gas demand diminished the necessity for storage withdrawals in both Europe and the United States during the 2022-23 winter season, consequently storage sites are closing the heating season with inventory levels comfortably exceeding the five-year average. Reduced demand is further expected throughout the summer of 2023, potentially easing market dynamics.

Though prices have already declined by two-thirds this year, shale-gas drillers in the United States remain optimistic, speculating that the downturn eroding their cash-flow projections will be short-lived, with a subsequent rebound anticipated in 2024. Suppliers assert that production growth in the U.S. is rapidly decelerating as shale explorers curtail drilling activities. This shift could lead to a contraction in the current supply glut, which has exerted downward pressure on prices. The reduction in near-term activity would result in diminished natural gas production this year, consequently reinforcing the positive long-term outlook.

This bullish sentiment for 2024 is reflected in producers’ risk appetite. Most of them have reduced their protection against lower gas prices, with U.S. benchmark futures trading in a contango structure, indicating that gas for future delivery commands a higher price compared to the present. The performance of natural gas funds may mirror this anticipated trend, as the sector achieved gains exceeding 11% during the week.

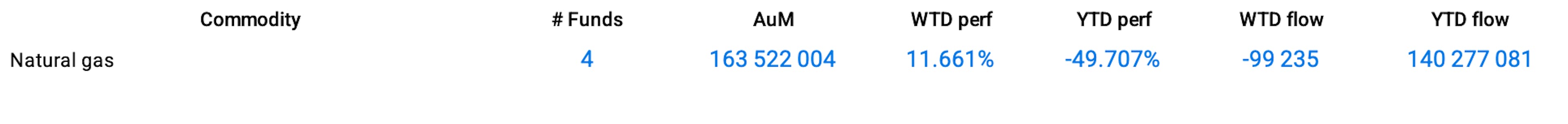

Group Data

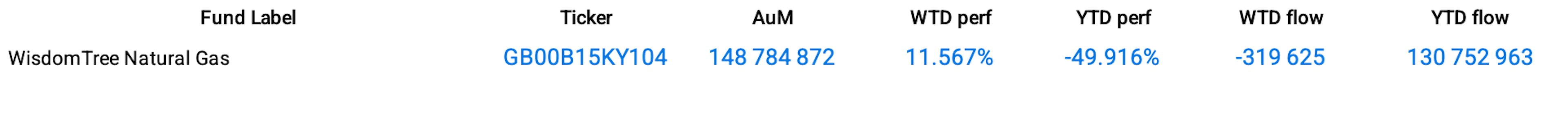

Funds Specific Data