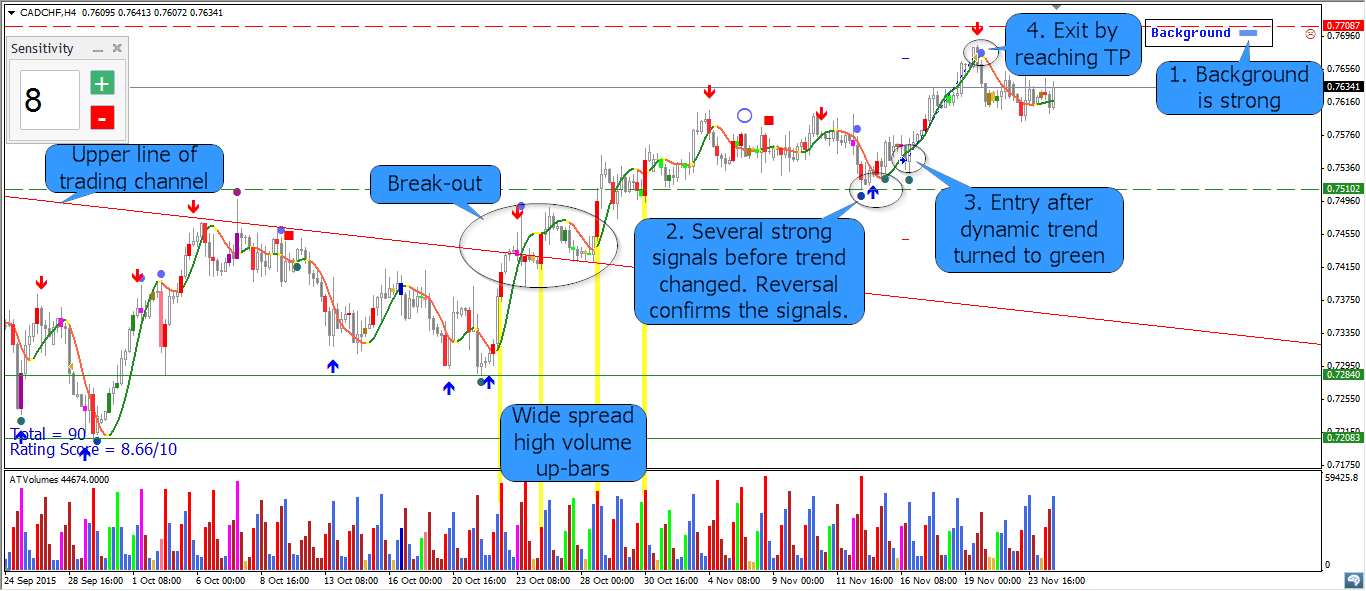

As it was noticed in CAD/CHF analysis, price was moving in a trading channel. In the above chart we see how the price has broken the upper limit of this channel. Break-out was made by high volume up-bar. Later price touched the trendline (very often once resistance is broken it becomes support) and continued to rise. There are several wide spread up-bars with high volume near the break-out. Background turned to strong and it was clear that pattern of moving in trading channel was changed. It was time to look for long trades.

- Background was strong

- Several strong signals (Demand and Minor Demand) before trend changed. Reversal also confirms these signals.

- Entry after dynamic trend turned from red to green

- Exit by reaching TP level.

Total: + 125 Pips

Right after my exit in the chart appeared weak signal and signal from Reversal indicator, price turned down.

Reversal indicator is looking for different patterns compare with VSA indicator and quite accurately detects price reversals in the chart. The best view of market can be achieved by using both indicators.