The communication services sector is composed of companies that focus on connectivity and is a favorite of long-term investors as it is resilient to market cycles and somewhat reliably predictable. The sector includes internet and phone providers. Three of these largest U.S. telecommunications companies by market cap are T-Mobile US Inc. (NASDAQ:TMUS) ($208 billion), Verizon Communications Inc. (NYSE:NYSE:VZ) ($171 billion) and AT&T Inc. (NYSE:T) ($134 billion).

The purpose of this analysis is to study these three stocks comparatively and understand which is best for which type of investor. The scales tip in favor of Verizon as its risk-reward ratio appears the most attractive of all three stocks despite an impressive multiyear run of T-Mobile and AT&T's long-standing record of high dividend payments.

An important point to keep in mind is the U.S. telecom market is mature; estimated at $443 billion in 2024, it is expected to reach $530 billion by 2029, meaning a low compound annual growth rate of 3.67% until 2029. In comparison, the total addressable market for blockchain is 40 times the value of the blockchain space in 2022 by 2030. The telecom sector is not suitable to growth investors, although some individual stocks may be growth stocks, as T-Mobile used to be.

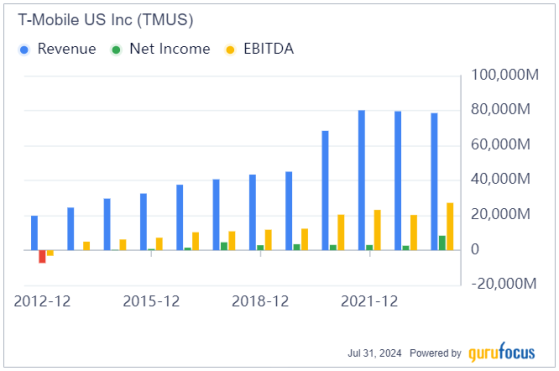

T-Mobile's fading growth will force it to become an income stockWhile T-Mobile was the natural pick for growth investors and both AT&T and Verizon were for income investors, the dynamics have shifted. T-Mobile's growth is fading year after year and will have to shift into an income stock. The valuation multiples are lower for income stocks relative to growth stocks and, therefore, the transition will likely be painful.

In the above chart, we can clearly see the financial engine that used to power T-Mobile's growth story (and stock price) has stalled in the last three consecutive years. From the third quarter of 2021 through the first quarter of this year, the revenue growth has ranged from -2.60% to 2.20%.

As a reference, in the eight-year period prior to that (2013-2020), T-Mobile grew its revenue every single year at an annual average of 17.60%. Every single quarter in that time period had positive revenue growth. The trend for T-Mobile clearly appears to have shifted within a saturated market. As mentioned, the U.S. telecom market is expected to grow only at a CAGR of 3.67% and upside potential is limited once a company has completed its scaling like T-Mobile appears to have.

The telecom sector currently trades at an average of 12 to 13 times earnings (both trailing and forward). T-Mobile is trading at 22 times trailing earnings and 19 times forward earnings. Its 1.10% dividend yield is also significantly lower than the sector's 3.53% yield.

The company's shareholders have been patient so far, hoping for a recovery in growth - but in a highly saturated market and given the inflated valuation, the risk-reward ratio is not attractive and is potentially akin to a ticking bomb. If the company fails to reverse the trend, the stock should correct by 30% to 40%, resulting in a share value of approximately $100 to $120 instead of the current $170 to $180.

Verizon to outperform AT&T thanks to the return of U.S. Treasury investorsBoth Verizon and AT&T have limited capital appreciation potential and have bond-like features. Their valuations are below the sector's with a multiple of 8.50 to 9 times for Verizon in trailing and forward earnings and 8 to 8.50 times for AT&T. These valuations support their dividend yields.

However, while both Verizon and AT&T attract shareholders that are primarily income investors, Verizon has been a more reliable dividend payer in the last several years. AT&T's 50% dividend cut in 2022 without increasing again (in comparison, Verizon's cut was 25% and dividend payments have increased since then) makes Verizon a more reliable pick for a pure income investor.

These stocks are likely to receive a boost when the Federal Reserve lowers interest rates: income investors' money should return to the sector and the preference, given the recent dividend history, is likely to favor Verizon over AT&T. The largest competitor for these stocks are, in a way, the U.S. Treasuries that pay yields close to these stocks' dividend yields. Verizon offers a 6.50% dividend yield and AT&T a 5.90% yield. In comparison, the S&P 500 average dividend yield is 1.30%.

Further, Verizon has had almost no growth in the last decade and its financials are among the steadiest in the S&P 500.

The story is a bit more worrisome on AT&T's side.

The revenue in the last three years is 50% lower from the 2019 peak and its net income even turned negative in 2022, forcing management to slash its dividend payments.

Therefore, for an income investor, Verizon is a safer choice while T-Mobile has not done its transition yet and AT&T continues to lose share to competition in a saturated market.

Risk factorsThere are risks involved for the three stocks, of course.

In the case of T-Mobile, the risk lies in the fact the company seems to be sitting between two chairs at the moment. It is not a convincing growth stock anymore with its 11 successive disappointing quarters in terms of revenue growth. It is also not a convincing income stock with its low dividend yield relative to the sector and to its two main competitors.

In the case of Verizon and AT&T, the high interest rate environment causes turbulence and headaches for income investors. The risk-free rate of U.S. Treasuries have been fluctuating between 4% and 5% in the last 12 months. The 1% to 2% premium offered by the dividend yields of Verizon and AT&T may not be sufficiently attractive to capital currently invested in Treasuries. In case interest rates stay elevated, we could witness a bear market similar to the one last year for both stocks.

Additionally, for all three stocks, the interest rate of the Fed adds additional pressure as these capital-intensive companies finance a large part of their operations with third-party debt. This could bring further pressure to an already struggling and low-growth market.

Bottom lineThe communication services sector is mature in the United States after decades of high growth. The three main playedrs are struggling to fuel their growth and find new catalysts in a mature and saturated market.

The growth story of T-Mobile increasingly appears to be fading and income investors traditionally exposed to Verizon and AT&T continue to be seduced by the risk-free alternative of U.S. Treasuries, keeping their valuations moderate. Shareholders of AT&T might also, in time, seek alternatives if revenue and dividend payments do not quickly show signs of recovery. It is in this context that an investment in Verizon within a diversified portfolio, with its 6.50% dividend yield, could be an attractive play at this point in time.

This content was originally published on Gurufocus.com

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.