- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Did Fed Kill Long Dollar Trade?

By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

Investors sold U.S. dollars after the Federal Reserve left interest rates unchanged Thursday citing uncertainty abroad and slightly softer inflation as reasons for waiting. Their decision was NOT unanimous with Jeffrey Lacker breaking from the ranks to vote in favor of a 25bp rate hike. While the Fed passed on a rate hike in September, they are still thinking about raising interest rates this year. In fact 13 of the 17 members of the FOMC expect liftoff to begin in 2015. As such we believe that there should be further weakness in the greenback before a renewed rally going into the next monetary-policy meeting.

Yellen made it clear that fundamentally their outlook has not changed and they still believe the U.S. economy is performing well even though dollar bulls were disappointed by the Fed’s decision to hold rates steady. They want to see further improvement in the labor market and hopefully inflation before raising interest rates. While the Federal Reserve boosted its forecast for 2015 growth, they lowered their projections for 2016 and 2017 growth along with their projections for the unemployment rate, inflation and Fed Funds rate. Considering that rates were held steady, it should be no surprise that the dot plot forecasts moved lower. Nonetheless Janet Yellen indicated that every meeting is a live meeting including October and a special press briefing could be organized if rates were changed. It would be surprising if the Fed only wanted to see one and not two more employment reports before raising rates. Yet the deciding factor could be the Chinese markets – the Shanghai Composite Index ended the day down 2%.

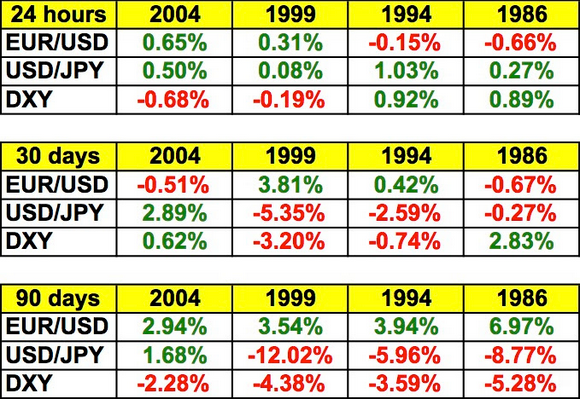

If Thursday’s FOMC announcement takes EUR/USD to 1.15 or USD/JPY to 118.25, we view those as great places to reestablish long dollar positions. Historically the U.S. dollar rises on average 6% in the 6 months before the Federal Reserve raises interest rates -- but once the tightening cycle begins, the pressure is on the dollar. In the past 30 years, there have been 4 major tightening cycles in 2004, 1999, 1994 and 1986. While USD/JPY moved higher in the first 24 hours after the Fed raised interest rates in each of those years, the moves were inconsistent if you look at how the EUR/USD and Dollar Index performed. More importantly as shown in the table below, 90 days after the first hike, the dollar dropped an average of 4% versus the euro and 6% versus the Japanese yen. While USD/JPY increased in 2004, the trade-weighted Dollar Index performed terribly that year indicating that over a 3-month period, rate hikes tend to hurt the U.S. dollar. What is particularly interesting about these moves is that the dollar weakened even though additional interest-rate increases were made during this 90-day period. The reason why the dollar tends to weaken after liftoff is because higher interest rates slow growth. However outside of the latest easing cycle, in the past 30 years 1% was the lowest level that the Federal Reserve ever took interest rates. The base is lower now so even if the Fed hikes by 25bp in 2015, borrowing costs will remain very low. Janet Yellen made it very clear that they are looking to raise rates gradually so don’t expect the Fed Funds rate to be at 3% a year from now. Also, tightening by the U.S. central bank will come at a time when other countries are easing so 3 months later we could still see the dollar trading higher than when the Fed first raises rates.

Like the Fed, the Swiss National Bank also left monetary policy unchanged on Thursday. While the Swiss franc jumped on the release, nothing in the SNB statement was positive. The central bank left interest rates at a record low of -0.75% and said the currency was significantly overvalued. This implies that they will not hesitate to intervene in the currency again. However whether they step into the market to manipulate the currency or increase stimulus depends on how serious the European Central Bank is about increasing Quantitative Easing. Many ECB officials have warned that it is a possibility if the economy worsens but their language is not strong enough to indicate that more QE is coming soon.

EUR/USD was the best-performing currency pair Thursday, rising more than 1%. With no major Eurozone economic reports released, the euro traded on the market’s appetite for U.S. dollars. With 1.1400 broken, the May 15 high of 1.1467 serves as the closest level of resistance followed by 1.15 and then the August spike high right above 1.17.

The British pound also rose strongly, shrugging off weaker retail sales numbers. Consumer spending grew 0.1% in August, which was in line with expectations but on an annualized basis, retail sales growth slowed to 3.5% from 4.1%, worse than the market’s 3.8% forecast. Excluding auto and fuel sales, spending year over year was also weaker than anticipated. However the recent performance of sterling signals that investors are looking beyond this latest report to the positive impact that Wednesday’s jump in earnings will have on consumer demand and economic activity.

The Australian and New Zealand dollars failed to benefit from U.S. dollar weakness. For New Zealand, GDP growth accelerated in the second quarter but the 0.4% increase fell short of expectations, leading to an overnight decline in the New Zealand dollar. While we have to admit that we were surprised to see New Zealand growth increase at all, the softer report reinforces the Reserve Bank’s decision to lower interest rates this month. At the time, the central bank made it clear that it would lower rates again if necessary. We are bearish kiwi but believe that the recent rebound in dairy prices eases the pressure on the RBNZ to act. However if dairy prices fall again, the central bank will not hesitate to increase stimulus again.

The Canadian dollar was unchanged going into Friday’s consumer prices report. After the Bank of Canada adopted a less dovish posture, we turned bullish Canadian dollars. Our conviction was reinforced by the recovery in oil prices and we are looking for stronger consumer-price growth because the sharp rise in the price component of IVEY PMI signals growing inflationary pressures. In the medium term, we expect USD/CAD to test 1.30.

Related Articles

CAD Despite the rally seen across European FX in recent days, the loonie has proven a notable laggard, seeing only marginal upside against the dollar. That said, we think this...

The euro EUR/USD has surged after European leaders announced big spending plans for defence and infrastructure. This comes at a time when President Trump acknowledges that tariffs...

Welcome to Simply Forex weekly forecast This content was originally published by our partners at Simply Forex.

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.