Gold prices touched a record high of $2,230 an ounce after data showed that U.S. inflation moderated in February, boosting bets for the Federal Reserve's June interest rate cut.

Gold's Encouraging Prospects

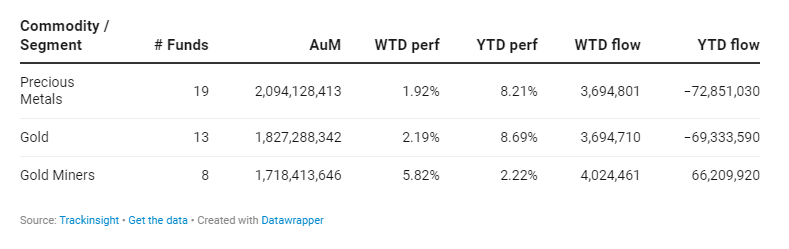

The prospect of lower interest rates, coupled with sustained gold purchasing by central banks, has created a favorable climate for gold and gold miners ETFs. For the last week of March, gold miners ETFs collectively witnessed a significant jump of 5.82%, outpacing spot gold's gain of 2.98%. This divergence highlights the sector’s remarkable performance this week despite a less stellar year-to-date (YTD) trend. Spot gold recorded a YTD gain of 8.09%, while the gold miners segment lags with a mere 2.22% rise despite a positive trend in gold prices.

Spotlight on Gold Miners ETFs

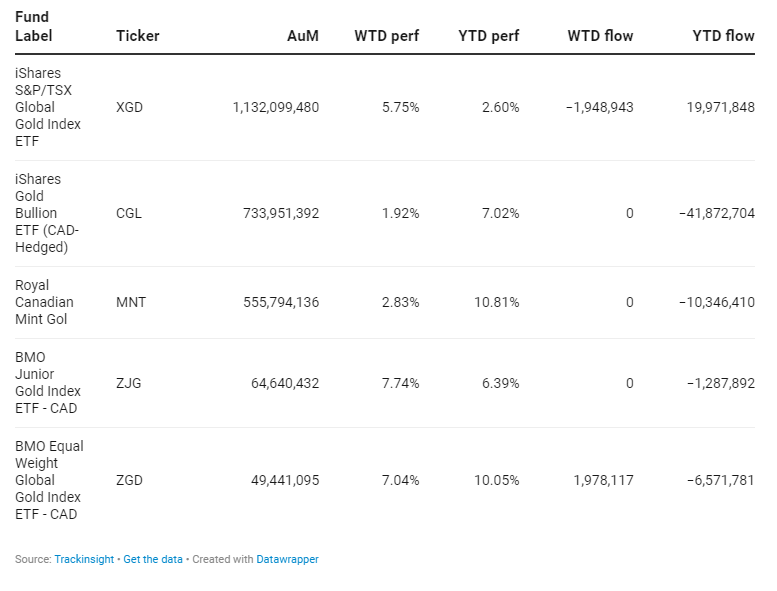

Among the gold miners ETFs, the iShares S&P/TSX Global Gold Index ETF (XGD) stood out with strong gains of 5.75% for the week. The ETF, boasting an AUM of $1.1 billion, clearly reflects the sector's recovery and optimism as a major macroeconomic shift appears to be underway.

Group Data

Funds Specific Data: XGD, CGL, MNT, ZJG, ZGD